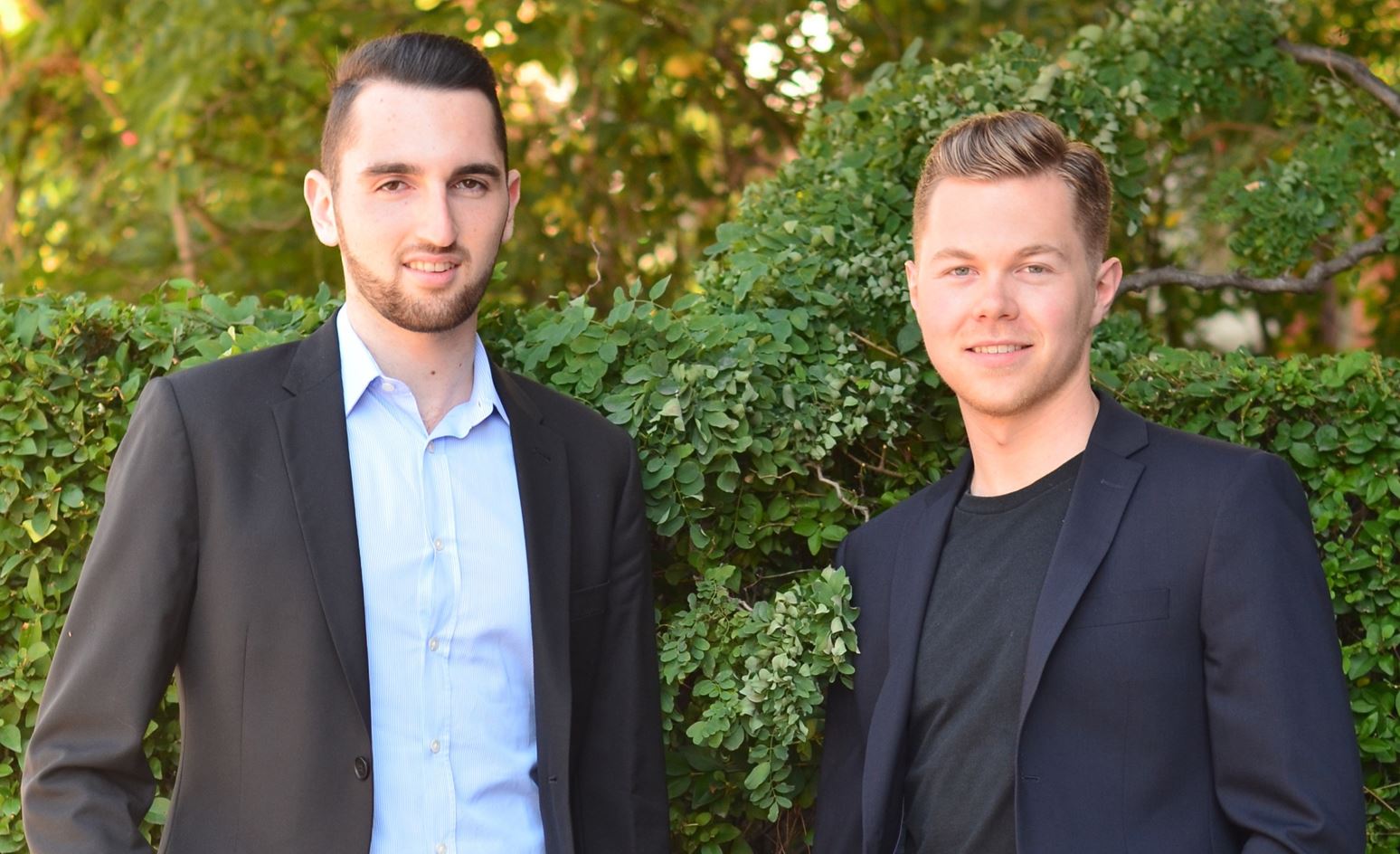

Entrepreneurship is often about finding solutions and addressing gaps in the market. Some solutions are more complex than others and Ivey HBAs Cato Pastoll and Brandon Vlaar can testify to that. They could have been making the next hip mobile app, instead they are challenging Canada’s big banks and financial system.

Lending Loop is a peer-to-peer lending platform that allows users to invest with as little as $50 in small businesses across Canada. It sounds like a simple, yet great way for anyone to invest locally and support Canadian small businesses. While similar lending platforms are common in many Western economies, Canada isn’t one of them. The problem is twofold, with small and medium sized businesses having difficulty accessing affordable financing through major financial institutions and those individuals willing to invest having no means to do so unless they are accredited investors; who generally have individual annual incomes north of $200,000.

In the days and months leading up to Lending Loop’s launch, Pastoll and Vlaar weren’t sure if they would be able to get it off the ground. Despite a large amount of technical and compliance wrangling, Lending Loop officially went online in October, 2015. Through the platform, small businesses can apply online for loans up to half a million. Approved requests are listed on the site’s marketplace where they can attract individuals looking to partner together with other individuals to effectively crowdfund investment opportunities.

Great minds think alike

Pastoll and Vlaar had a few early excursions into entrepreneurship at school. Vlaar imported and sold skateboarding decks from the U.S. and built a virtual gaming farm where upgraded characters were sold off to gamers on eBay. Pastoll successfully ran a convenience store at school, where buying supplies through wholesale distributors allowed him to tack on generous margins.

Arriving at Ivey, Vlaar signed up to join the entrepreneurial program, the New Venture Project (NVP). “I took it very seriously with my group. We had the goal to start a business, not just coming up with a business plan,” said Vlaar. During NVP, Vlaar and his team created an app named Tokynn that allowed users to send gifts and other goods to each other. Importantly, it gave him the confidence he needed to start something right out of school.

Pastoll took a different route but connected with Vlaar through a mutual friend to take part in the 2014 Vancouver CaseIT competition. They hit it off immediately, so much so that they decided to test out some ideas for a new venture. During a visit to the UK, Pastoll came across Funding Circle, a peer-to-peer lending service which allows savers to lend money directly to small and medium sized businesses. Having discussed the idea with Vlaar, they decided to research its viability in Canada during the tail-end of their HBA.

In April of 2014, they registered Lending Loop and went onto work in other industries, which certainly helped - not only with finances - in building networks and resources that would be key to pulling off their venture. Vlaar connected with Paul Hayman, HBA ’81, who he met during Hayman’s stint as an Executive Entrepreneur-in-Residence at Ivey. He helped with a number of Hayman’s ventures, evaluating new opportunities, conducting research and due diligence. He was involved with new venture research and even helped with the early development of Hayman’s latest venture, FiveWalls.ca.

Pastoll landed a job at a software consultancy firm that needed help through a management transition. The job brought him in close proximity with the programmers and technical experts that would be vital to launching their venture. With regular work by day and plotting Lending Loop by night, there was no work/life balance for either of them; still, they say it was the most productive time of their lives.

Breaking new ground

All those extra hours were essential in launching Lending Loop, which was far more complicated than anything they had undertaken before.

“Right from the get go, we immediately realized that there would be regulatory challenges operating this type of business model,” said Pastoll. They started working with lawyers with expertise in securities law and spent both time and money to fit Lending Loop into Canada’s legal framework. The crux of the problem was whether this type of offering would be considered a “security” or not.

“We don’t think it should technically be considered a security because if I lend you money directly that’s not a security,” reiterated Pastoll.

“Some days we didn’t know if we could ever get this off the ground and other days we didn’t know if we could recruit people,” said Vlaar. They spent a long time recruiting their first few employees as they wanted to make sure they got the right people. What Vlaar terms as the general aspects of running a business, like learning to delegate, are challenges they are continuing to master with help from mentors and advisors.

Key learnings for young entrepreneurs

Pastoll and Vlaar had a few words for their fellow Ivey students: “Try to get something off the ground. Always have a side project, whether it’s a blog or an app. There’s a lot of students who have that entrepreneurial spirit but that don’t have the self-confidence to try something. Once they have that, they’ll have the ability to go out and start a real company,” said Vlaar.

“Dream big but act small. Have that vision for what you want to create… but do small things to get you there,” said Pastoll. “For us we’re obviously in the financial markets now and trying to take on the big five banks in Canada, which sounds crazy to say – but it’s just making sure you do the little things along the way to get you there.”