Featured Cases...

Karatu Coffee Company in Tanzania: What Strategy Next? 9B20M039_P

In 2018, the founder and owner of the Karatu Coffee Company needed to decide what to do next with his company. He was considering several options: increasing the tourism part of the business, growing the original farm, pursuing a property development project in the capital city, or simply selling out and walking away. The company, located in Tanzania, began as a coffee farm, expanded into tourism with a remote, idyllic coffee lodge, and then brought coffee and tourism together with a bustling inner-city coffee house, which also housed a boutique hotel. The final phase of expansion included the purchase of high-quality coffee equipment and highly-prized roasting facilities to capture a larger share of the coffee value chain. The owner's decision would require insights into both the coffee industry and Tanzania itself.

Ruaha Farm (T) Ltd: Engaging Local Beekeeping Communities in Tanzania 9B20M220

The chief executive officer of Ruaha Farm (T) Ltd (Ruaha Farm), in Iringa, Tanzania, established his honey business, in 2012. The company’s business model relied on the engagement and empowerment of neighbouring communities of low-income beekeepers, creating mutually beneficial relationships with local beekeeping communities in the Iringa region. The business model was unique, asset-light, and scalable. In contrast with an integrated business model in beekeeping, where a company typically owned all assets (land, beehives, processing machinery, and routes to market), Ruaha Farm not only commercialized the honey from its own farms but also reached out to all beekeepers in the region to support them in the production and collection of their honey. By 2019, amid the challenges of managing the company’s relationship with the beekeeper communities, the chief executive officer had to consider how to increase Ruaha Farm’s annual production volume from 10 to 100 tons in five years.

Project Have Hope: Managing Growth, Commitment, Time, Inventory, and Other Challenges 9B20M011

Boston-based Project Have Hope was a non-profit social enterprise promoting financial stability for 100 women in Kampala, Uganda, who had been displaced as a result of Uganda’s civil war. Established in 2006, Project Have Hope used revenue from the sale of paper bead jewellery and other products made by the women to provide training, loans, and children’s tuition. The project faced many challenges over the years, including an unplanned expansion of its beneficiaries, staffing challenges, an oversaturated bead jewellery market, rising costs, and the founder’s unsustainable workload. In 2019, Project Have Hope was at a nexus: how could the founder sustain Project Have Hope into the future?

Ghana Investment Fund Limited: Ethical Issues 9B19M124_P

The chief executive officer of RenY Corporation (RenY) based in Hong Kong, had just established the Ghana Investment Fund Limited (GIF) as a subsidiary of RenY in Ghana. GIF aimed to invest in the entrepreneurial ideas of university graduates in Ghana under a model that brought together the intellectual capital of the graduates, e-commerce, and investment capital under an umbrella of mentoring and collaboration. Access to Ghanaian government contracts to provide products and services was an important aspect of the CEO’s sustainable development plans for low income communities, but he was faced with ethical issues on the way government business was done in Ghana—to be successful in gaining some of these contracts, extra payments were required. He had to decide if his investment was going to result in nothing or if there was a way to move forward.

White Gold in Benin: Chinese Investment in China 9B18M003

In mid-June 2011, the Chinese president of the China–Benin joint venture Benin Textile Company (Compagnie Béninoise des Textiles, or CBT) was deeply worried about the supply of cotton in Benin. Since 2009, CBT had faced significant challenges in obtaining a reliable cotton supply. In 2010, the company had already placed its cotton orders, but local Beninese cotton producers were unwilling to deliver cotton at the earlier agreed-on price due to the rising market price. CBT was forced to stop production for five months and could not deliver on numerous contracts. The president of CBT was unsure whether to stay in West Africa and if so, how to improve the cotton supply situation. He had four options: maintain the status quo and hope for improvements, withdraw from West Africa, buy cotton contracts from other countries, or invest in cotton production. Which would be the best option for his company?

DeliverMeal Ivory Coast: Addressing Headquarters' Demands 9B17M048

In 2015, DeliverMeal was a Norwegian online food delivery firm, mostly present in what could be considered emerging markets such as those in Africa. Founded in 2010, the company had experienced extremely rapid international expansion. DeliverMeal followed a global strategy, and standardized processes and turnkey solutions were provided from the headquarters to the subsidiaries.

The local business development manager at DeliverMeal’s Ivory Coast subsidiary needed to make some decisions on how to react to three demands that had recently been passed down from corporate headquarters, all of which were at odds with the West African environment. How could the Ivory Coast manager meet her headquarters’ corporate expectations and still conduct successful business operations within the local cultural context?

BRAC: Shasthya Shebikas’ Role in Delivering Health Care Service to Rural Markets 9B17A065

BRAC was the largest non-governmental organization in the world, reaching out to 138 million people. It made a significant contribution to reducing poverty in Bangladesh by employing more than 117,000 community workers (Shasthya Shebikas) to improve the health and nutrition of the rural poor. The manager of BRAC's Health, Nutrition and Population program was faced with two significant challenges. First, she had to find a way to encourage more people to use BRAC’s services; more than 60 per cent of the population sought the services of unqualified health care service providers, despite the significant contribution made by Shasthya Shebikas. Second, she had to bring down the 10 to 20 per cent turnover rate of the Shasthya Shebikas.

Sun Café & Bar: A Ray of Opportunity 9B18M009

In May 2017, the owner and co-founder of the Sun Café & Bar (Sun Café) contemplated the future strategic direction of the restaurant, which offered both Nepalese and continental cuisine. Though Sun Café had shown growth since its opening in 2013, it had not achieved the revenue or brand reputation that the co-founders had hoped for. Facing mediocre financial performance within a fiercely competitive industry, the co-founders wondered where they should go from here, should they pursue new avenues for growth. They had six months before the fourth-year anniversary of the café to discuss strategic issues and come to a decision.

Sunrise Power: Charting Growth in Unexplored Areas 9B17M093

Sunrise Power, a first-generation mid-sized power and mining company in India, was considering geographical diversification in the African continent. While many African nations were rich in resources, they often lagged in economic indicators, and global companies hesitated to invest in infrastructure due to limited risk appetite. However, this left an opportunity for mid-sized firms such as Sunrise Power, so long as they could attain regulatory support and ensure high returns. Sunrise Power needed to evaluate the complexities in identifying the right market in Southern Africa. This included examining indicators like population, gross domestic product, energy demand forecasts, and electrification capacity. The firm also had to identify the critical success factors and assess the risks in the strategy planning process. Finally, it needed to design an organizational structure for its African venture so as to realize the benefits of diversification.

Joe Fresh: Ethical Sourcing 9B16M023

After more than 1,100 people lost their lives in the 2013 collapse of the Rana Plaza garment factory building in Bangladesh, executives of Joe Fresh, a Canadian fashion and lifestyle brand, had to respond. Along with numerous other Western retailers, Joe Fresh had sourced much of its merchandise from the Rana Plaza factory. The disaster evoked an emotional public reaction, ranging from sympathy to outrage. The clothing industry had become a critical part of Bangladesh’s economy, and this was not an isolated incident. How would the Rana Plaza incident affect the public perception of Joe Fresh, and what could the company do to improve that perception? More fundamentally, how could Joe Fresh balance its competitive position, obligations to shareholders, and customer demands with ethical sourcing?

Walton: Building a Global Brand Through Internationalization 9B16A001

By 2014, the Walton Group, an electrical goods manufacturer based in Bangladesh, sold its products in over 20 different countries. A decision to utilize the advantages of low labour costs in the company’s home country was made in the early 2000s, which led to an increase in value and permitted rapid international expansion. To achieve Walton’s mission of “Walton at every home,” the company established various specialized support units both inside and outside of Bangladesh. Government tax incentives in Bangladesh had boosted Walton’s cost competitiveness, but how else could Walton compete with other international brands to achieve is goals and become a household name worldwide?

Ushahidi 9B14E010

As the co-founder of a software platform called Ushahidi, Ory Orykolloh watches the unfolding catastrophic earthquake crisis in Haiti and must decide how her company’s crisis-mapping software might assist international authorities as they move into Haiti to provide help and relief. Ushahidi was developed as an open-sourced mash-up platform combining Google Maps with publicly reported (text-based) incidents of election violence during the Kenya 2007 elections, and thus, the system effectively managed to bypass government censorship. Expansion into other uses during both political crises and a variety of national/international events provided opportunities for growth. Now, with Haiti, Ushahidi’s management team must consider how its software could be used to provide assistance during a catastrophe like an earthquake.

Tata Chemicals Magadi: Confronting Poverty in Rural Africa 9B15M008

In the summer of 2013, the managing director of Tata Chemicals Magadi, Africa’s largest soda ash manufacturer and one of the oldest and largest export earners in Kenya, was wondering how he was going to respond to a growing number of challenges. As a producer of a commodity product, the company was vulnerable to escalating energy costs, oversupply and economic cycles. Global growth had been sluggish since the 2008 economic recession and competition was intense, especially since the emergence of Chinese producers. Magadi Township, where the company’s production facility was located, was one of the poorest in the country, subject to droughts and without many of the basic public services typically provided by government such as roads, health care, electricity, water and education. To address these needs, the company migrated from a top-down, paternal, ad hoc and resource-intensive approach to a bottom-up, collaborative, holistic and resource-sharing style that focused on community capacity building and self-governance. However, the issue now is how to best balance the strong need to reduce costs while remaining committed to the sustainability of the surrounding community.

A Public Relations Campaign for Rwanda 9B14A035

On February 5, 2012, the founder of McDonald Kinley Emerson, a consultancy in Toronto, Canada, was asked to give a talk about country branding. She decided to focus on the efforts of Racepoint, a U.S. marketing services agency, to reshape the image of Rwanda. As it attempted to shift perceptions of the country from war-torn and chaotic, Racepoint’s campaign attracted controversy amid allegations that wrongdoings were being glossed over in favour of a tourist- and business-friendly image. In August 2011, the publication of documents outlining the contractual agreement between Racepoint and the current Rwandan government sparked scrutiny of the government’s perceived remaking of the country’s image. Can a country overcome its reputation for genocide and violence? Should countries actively use public relations tactics to change or reinforce their reputations in the same way that corporations do?

Beer for All: SABMiller in Mozambique 9B14M026

SABMiller, the world’s second largest brewer, has developed a business model in Mozambique that represents a radical departure from the firm’s traditional approach to beer production. Despite this multinational’s well-developed global supply chains and heavily centralized processes, it has disrupted both established processes and products and has, instead, innovated to produce a cassava-based beer in an effort to serve the low-income consumers who comprise the bulk of the African economic pyramid. In a marked departure from corporate best practices, the manufacturing process begins outside of the brewery and in the vicinity of the scattered and rural cassava farming plots.

Ethiopian Airlines: Bringing Africa Together 9B14M005

Ethiopian Airlines plans to expand its African market base to become a leading airline in the continent. As part of the airline’s multi-hub strategy, the vice-president of alliances and corporate strategy and his team must identify a suitable hub location and decide on the appropriate mode and level of ownership. Success in the first hub is essential as it will both validate the viability of the multi-hub strategy and set the tone for the establishment of subsequent hubs throughout the continent. The vice-president and his team need to resolve three issues: location of the first hub, entry mode and ownership level.

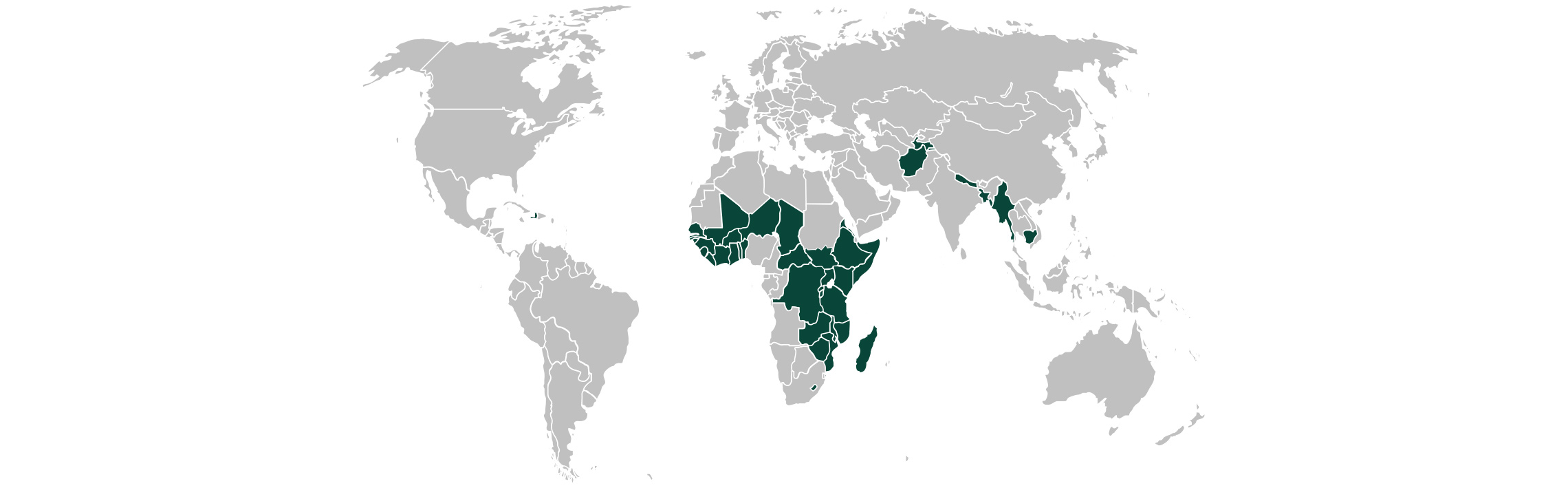

Ivey Publishing Cases Involving the 39 Countries

The poorest countries in the world have received far too little attention by business school case writers. Even in Ivey Publishing's current collection of over 5,400 cases, there are only 140 cases which reference any of the 39 Countries.

|

Country |

Number of Relevant Cases |

|---|---|

|

All countries |

1 |

|

Afghanistan |

3 |

|

Bangladesh |

10 |

|

Benin |

2 |

|

Burkina Faso |

2 |

|

Burundi |

1 |

|

Cambodia |

1 |

|

Central Africa |

1 |

|

Chad |

2 |

|

Comoros |

0 |

|

Cote D'Ivoire |

2 |

|

Democratic Republic of Congo |

3 |

|

Eritrea |

0 |

|

Ethiopia |

6 |

|

Gambia |

0 |

|

Ghana |

17 |

|

Guinea |

0 |

|

Guinea-Bissau |

1 |

|

Haiti |

6 |

|

Kenya |

30 |

|

Lesotho |

0 |

|

Liberia |

0 |

|

Madagascar |

0 |

|

Malawi |

2 |

|

Mali |

1 |

|

Mozambique |

2 |

|

Myanmar |

3 |

|

Nepal |

6 |

|

Niger |

1 |

|

Rwanda |

6 |

|

Sao Tome and Principe |

1 |

|

Senegal |

2 |

|

Sierra Leone |

1 |

|

Somalia |

1 |

|

Tajikistan |

0 |

|

Tanzania |

17 |

|

Togo |

0 |

|

Uganda |

6 |

|

Zambia |

3 |

|

Zimbabwe |

0 |

As of November 4, 2021

9B20M158_P - 11 pages

Where Have You Been?: An Exercise To Assess Your Exposure To The Rest Of The World’s Peoples (2020)

Paul W. Beamish

This annually updated exercise assesses one’s exposure to the rest of the world’s peoples. A series of worksheets require the respondents to check off the number and names of countries they have visited whether for business, family or tourism reasons, and the corresponding percentage of world population which each country represents. The summary of a group’s collective exposure to the world’s people will inevitably be the recognition that together they have seen much, even if individually some have seen little. The teaching note provides assignments and discussion questions which look at: why there is such a high variability in individual profiles; the implications of each profile for one’s business career; and, what it would take for the respondent to change his/her profile.

For marketers, it underscores the need to gather greater base knowledge about opportunities in 211 countries spread across 8 regions: Africa; North America and Caribbean; South America; Western Europe; Eastern Europe; Central Asia and Indian Subcontinent; Middle East; Asia Pacific.

9B19M012 - 15 pages

Roshan and M-Paisa: The Promise of Mobile Money in Afghanistan

Farah Kurji, Ning Su

In 2008, Roshan, Afghanistan’s leading telecommunications provider, launched M-Paisa, its mobile money transfer service, which allowed Afghans to use their mobile phones to transfer funds, receive and repay microfinance loans, make purchases, and disburse and receive salaries. The company was committed to building a financial ecosystem for transparent, safe, convenient, and secure services, which would also contribute to the long-term development of Afghanistan’s society. Utilizing technology from Vodafone Group Plc, which had been successful in Kenya, Roshan enjoyed several successful pilots, but it still faced a myriad of issues as it sought to scale the service amid a challenging operational environment. In 2011, three years after its launch, the M-Paisa service had yet to make a profit. Roshan’s chief executive officer and chief operating officer wondered what more they could do to turn M-Paisa around and, ideally, make an even more significant social impact.

9B14M057 – 13 pages

Military Arsenal Systems: Preparing to Lead a Team (A)

Lyn Purdy, Ken Mark

In March 2010, a newly promoted engineering area manager at Military Arsenal Systems, a Vancouver-based defence contractor, has just become team leader for a key program at the firm. His biggest challenge is how to lead his team, given that he is dealing with a range of personalities and the fact that he was a peer before he became their leader. How can he prove himself to be an effective leader not only to his team but to senior management? Can he rally the team quickly enough to meet the stringent deadlines for supplying the sophisticated armoured vehicles contracted by the U.S. Army for its mission in Afghanistan? See supplement 9B14M058.

9B12C009 – 18 pages

Defence Research and Development Canada – Toronto (A): The Organizational Alignment Program

Gerard Seijts, Helen Wojcinski

The world had changed as a result of the terrorist attacks on September 11, 2001. Canada was engaged in the Afghanistan War, and the first casualties were being felt. It was November 28, 2005, as Rene LaRose, the director general of Defense Research and Development Canada (DRDC) Toronto, sat in his office preparing for an all-staff briefing the following day. He knew that for his research institute to remain relevant and be a major contributor to the emerging needs of the Canadian Forces and national security in this rapidly changing landscape, a major transformation of his centre was required. The Canadian Forces was undergoing its own metamorphosis under its new Chief of Defense Staff, General Rick Hillier, and DRDC Toronto needed to be in synch with this development. LaRose had spent several years trying to convey the message that profound changes at DRDC Toronto were needed — changes that were as much cultural as they were structural. The sense of urgency was now acute with Canada at war, and DRDC Toronto was poised to embark on a major organizational alignment program.

9B17A065 - 14 pages

BRAC: Shasthya Shebikas’ Role in Delivering Health Care Service to Rural Markets

Sanal Kumar Velayudhan, Sayeda Shabukta Malik, Kaosar Afsana

BRAC was the largest non-governmental organization in the world, reaching out to 138 million people. It made a significant contribution to reducing poverty in Bangladesh by employing more than 117,000 community workers (Shasthya Shebikas) to improve the health and nutrition of the rural poor. The manager of BRAC's Health, Nutrition and Population program was faced with two significant challenges. First, she had to find a way to encourage more people to use BRAC’s services; more than 60 per cent of the population sought the services of unqualified health care service providers, despite the significant contribution made by Shasthya Shebikas. Second, she had to bring down the 10 to 20 per cent turnover rate of the Shasthya Shebikas.

9B17M097 - 15 pages

bKash: Financial Technology Innovation for Emerging Markets

Ishtiaq P Mahmood, Marleen Dieleman, Narmin Tartila

The founder of bKash Limited (bKash), a successful mobile financial services (MFS) model pioneered in Bangladesh, built the company from scratch, targeting services at the lower socioeconomic segment of society and eventually acquiring 26 million customers. bKash has had a positive impact on the lives of countless poor people and has gained worldwide recognition for its innovative business model. The model required close collaboration with telecommunications operators, banks, non-governmental organizations, and regulators. In particular, the Bangladesh central bank supported the venture, allowing experimentation in MFS to address poverty through financial inclusion. By the end of 2016, the founder was concerned about future regulations and looking to strengthen the foundation of his disruptive business to make it more robust. How could the company continue to grow while maintaining its financial inclusion objective?

9B17M074 - 12 pages

Indus OS: Revolution Through Incremental Innovation

Arpita Agnihotri, Saurabh Bhattacharya

Founded in May 2008 in India, Indus OS (previously known as Firstouch) understood the latent language needs of 90 per cent of Indian consumers, a need that prevented users from switching from their basic-feature phones to smartphones. Through incremental innovation of the open Android system, Indus OS launched the world’s first smartphone operating system that had the ability to function in 12 of India’s regional languages. Through strategic partnerships formed in 2015 with some of the leading smartphone manufacturers in India, by May 2016 Indus OS had become the second most popular operating system in the Indian market, following Google’s Android and leading Apple’s iOS. Moreover, Indus OS had firm strategic growth plans, not only for India but also for international markets like China and Bangladesh. The remaining critical issue was whether Indus OS could sustain its advantage over rivals or whether it was likely to be acquired by a large multinational corporation, a fate common to other successful start-ups in India.

9B16M023 – 11 pages

Joe Fresh: Ethical Sourcing

Jaana Woiceshyn, Norman Althouse, Nigel Goodwin

After more than 1,100 people lost their lives in the 2013 collapse of the Rana Plaza garment factory building in Bangladesh, executives of Joe Fresh, a Canadian fashion and lifestyle brand, had to respond. Along with numerous other Western retailers, Joe Fresh had sourced much of its merchandise from the Rana Plaza factory. The disaster evoked an emotional public reaction, ranging from sympathy to outrage. The clothing industry had become a critical part of Bangladesh’s economy, and this was not an isolated incident. How would the Rana Plaza incident affect the public perception of Joe Fresh, and what could the company do to improve that perception? More fundamentally, how could Joe Fresh balance its competitive position, obligations to shareholders, and customer demands with ethical sourcing?

9B16A001 – 15 pages

Walton: Building a Global Brand Through Internationalization

Mohammad B. Rana, Mohammad Tarikul Islam, Nikhilesh Dholakia

By 2014, the Walton Group, an electrical goods manufacturer based in Bangladesh, sold its products in over 20 different countries. A decision to utilize the advantages of low labour costs in the company’s home country was made in the early 2000s, which led to an increase in value and permitted rapid international expansion. To achieve Walton’s mission of “Walton at every home,” the company established various specialized support units both inside and outside of Bangladesh. Government tax incentives in Bangladesh had boosted Walton’s cost competitiveness, but how else could Walton compete with other international brands to achieve is goals and become a household name worldwide?

9B15M062 – 12 pages

The Children's Place, Inc.: Challenges in a Post-Rana Plaza World

Ram Subramanian

The Children’s Place was a New Jersey-based specialty retailer of apparel and accessories for children up to age 12. Starting in fiscal 2013, the company was moving from a clearance-centre model, where it sold a variety of national brands, to a made-for-outlet model that emphasized its own brands. This was necessitated by intense price competition in its market. The new strategy involved developing, coordinating and controlling its own global apparel value chain. When the Rana Plaza building in Dhaka, Bangladesh collapsed on April 24, 2013, killing and injuring a large number of workers, products destined for The Children’s Place were found in the debris. The adverse publicity that ensued meant that the company’s top management had to re-evaluate its strategy. What should be their response?

9B09M052 – 23 pages

Baring Private Equity Partners India Limited: Banking Services for the Poor in Bangladesh

Ram Kumar Kakani, Munish Thakur

From the 1970s onward, after the emergence of microfinance, lending for the poor started shifting from informal sources (e.g. moneylenders) to formal sources. The Grameen Bank (Grameen) led this change, primarily due to its chief executive officer (CEO) and his innovative microcredit model. On the basis of the CEO's rich understanding of on-the-ground realities, he began to experiment and modify the business model for microfinance, which, in the past few years in Bangladesh, was largely dominated by a few big players. As a result of some very interesting and insightful experiments that had been conducted, the microfinance landscape was changing the way banking services were modeled for the poor, not only in Bangladesh but throughout the world. The case profiles a situation wherein Baring Private Equity Partners India, one of the largest private equity players in emerging markets, was looking to invest in the high-growth, profitable microfinance industry of South Asia. This case is oriented toward helping students understand the credit needs of the poor and their perspective on money management, hunger, investment and savings. Students should be made to appreciate how an innovative business model can be developed through a deeper understanding of the local context combined with conceptual thinking. The case strongly vouches for the development of sustainable solutions that require both financial viability and sensitivity to the conditions of the poor. The most important point to be highlighted about the microfinance landscape is that the entrepreneurship model is changing from being socially focused to being business focused. Earlier, most players entered the microfinance arena as a not-for-profit venture; however, many for-profit organizations have now entered this sector.

9B13N012 - 9 pages

Contrasting China's Yunan Model with Bangladesh's Yunus Model for Microfinance

Yuping Du, Randall O. Chang, Meng Wu, Chun Li

In 2008, about the time when the Yunus Model of microfinancing was under attack in its home country of Bangladesh, the Yunan Model was begun in rural China. The original model suffered from inefficiencies, high interest rates and allegations of improprieties against the founder, Nobel Prize winner Muhammad Yunus. By contrast, the Yunan Model relied on social capital and mechanism design theory to enlist the rural population, financial institutions and government in a cooperative effort to increase the financial stability and entrepreneurship level of one of the poorest areas of the country. Could "microfinance with Chinese characteristics" offer a plan to reduce poverty across China?

9B13M071 – 4 pages

Loblaw Inc. and Rana Plaza

Michael Sider

A business professor who teaches sustainability must decide whether to sell his shares in the Canadian company, Loblaw Inc., after learning that the company produced garments for its clothing line in a Bangladeshi garment factory that collapsed, killing 1,127 workers.

9B04A030 – 17 pages

Eastern Bank Limited (A) 9B04A030

Terry H. Deutscher, Kaiser Islam

Eastern Bank Limited has taken over the Bangladesh operations of the Bank of Credit and Commerce International after its collapse. The new chief executive officer of Eastern Bank must make decisions about which corporate banking clients to target, how to develop and position the Eastern Bank brand, what products to emphasize, in what price structure and whether to centralize or decentralize the bank's operations. The supplement Eastern Bank Limited (B), product 9B04A031 updates the situation. This case provides a good vehicle for discussing relationship management in a complex service analysis of market segments and the present and future profitability, so that the marketing strategy decisions are customer driven.

Zhangfeng Fei, Xiaokang Zhao, Kejing Zhang, Alex Beamish

In mid-June 2011, the Chinese president of the China–Benin joint venture Benin Textile Company (Compagnie Béninoise des Textiles, or CBT) was deeply worried about the supply of cotton in Benin. Since 2009, CBT had faced significant challenges in obtaining a reliable cotton supply. In 2010, the company had already placed its cotton orders, but local Beninese cotton producers were unwilling to deliver cotton at the earlier agreed-on price due to the rising market price. CBT was forced to stop production for five months and could not deliver on numerous contracts. The president of CBT was unsure whether to stay in West Africa and if so, how to improve the cotton supply situation. He had four options: maintain the status quo and hope for improvements, withdraw from West Africa, buy cotton contracts from other countries, or invest in cotton production. Which would be the best option for his company?

9B07M025 – 17 pages

City Water Tanzania (A): Water Partnerships for Dar es Salaam

Oana Branzei, Kevin McKague

This case examines how the Tanzania government intends to address a pressing deterioration in the infrastructure and services of Dar es Salaam's Water and Sewage Authority. The decision process unfolds in the spring of 2002, on the heels of the Cochabamba uprising in Bolivia and an increasing dispute over the involvement of the International Finance Corporation and the World Bank in other water development projects in Ghana, Mauritania and South Africa. At that time, the World Bank was already sponsoring similar projects in Angola, Benin, Guinea-Bissau, Niger, Rwanda Sao Tome and Senegal, despite some vocal local opposition. This multi-part case series is ideally suited for core or elective courses in strategy and sustainability to illustrate the types of ongoing tensions and divergent decision angles that influence the formation and performance of public-private partnerships and managing in a global context. It also provides a rich and graphic account of the special threats and opportunities in the water sector - a wealth of complementary teaching resources can also stimulate larger debates by juxtaposing the case decision with a broader crisis of confidence in for-profit solutions to water and sewage provision in Africa and in Latin America.

9B20M079 - 14 pages

Technologies Ecofixe: Green Wastewater Treatment for Africa

Roxanne Lavoie-Drapeau, Gwyneth Edwards

In September 2018, Marisol Labrecque, president of Technologies Ecofixe Inc. (Technologies Ecofixe), was heading to Ain Taoujdate, Morocco, in order to supervise the installation of the company’s second ECOFIXE system in Africa. Technologies Ecofixe was a small, socially responsible Québécois company that had developed and commercialized a cost-effective system for the treatment of wastewaters in aerated ponds. With her eye on Africa’s ever-expanding market, Labrecque considered entering the French-speaking countries of Senegal, Ivory Coast, and Burkina Faso. However, given her limited resources, Labrecque knew that she would have to choose. Which country should Technologies Ecofixe enter next?

9B14C018 – 17 pages

Sewa (A): Ela Bhatt

Sonia Mehotra, Oana Branzei

In February 2014, a McKinsey Global Institute report proposed tracking an empowerment line that could enable India’s citizens to get out of poverty by providing the resources they needed to build better lives. This prompted Ela Bhatt, founder of the India-based Self-Employed Women’s Association, to take stock of her initiative to empower women working in India's informal sector. Since 1972, her organization has been widely acclaimed as a global first mover and active champion of grassroots development. Quickly approaching two million members in India and six neighbouring countries, and inspiring similar efforts in South Africa, Ghana, Mali and Burkina Faso, it exemplifies a unique form of positively deviant organizing by speaking to the centrality of human beings at work. Given resources, support and encouragement, its many members have used their own human agency even in the direst of circumstances to better their lives in ways most meaningful to them, for instance, by creating childcare, health care, banking, farming and education cooperatives. However, as she reaches retirement and contemplates the future, Bhatt wonders if the new generation of Indian leaders will take up the Gandhian socially minded path or follow the commercial careers opening up in the country’s multinational sector.

9B14M131 – 11 pages

LifeNet International's Transformation of African Healthcare via Social Franchising

Ilan Alon, Raul Carril

LifeNet International was a social conversion franchise concept aiming to provide basic, quality and sustainable healthcare to poor and underserved populations in sub-Saharan Africa. The founder and president had relied on the assistance of others to help bring about his idea of affordable healthcare. In 2012, the executive director for LifeNet International’s operations in Burundi, began focussing on developing the company in Burundi. She was excited to see LifeNet International’s presence expanding into Uganda. Her vision for LifeNet International, however, was much bigger. She envisioned LifeNet International as a sustainable organization that could provide quality healthcare and medicine to millions of people around the world.

If it planned to expand internationally and bring healthcare to more of the world’s population, LifeNet International needed a solution to tie its services together to further scale, replicate and measure its social impact. How could LifeNet International bring its social conversion franchising model to other African nations and internationally? Would LifeNet International’s model work logistically, financially and culturally? What adaptations would LifeNet need to make and what legal challenges would it face in the process of expansion? Furthermore, what structures would LifeNet need to put in place to manage the complexity of its growing network of partner clinics and operations?

9B18M196 - 6 pages

Sunton Manufacturing in Cambodia: Exit or Remain?

Zhangfeng Fei, Paul W. Beamish

In January 2017, the founder of Sunton Manufacturing in Wuxi, Jiangsu Province, China, boarded a flight to Cambodia. He had to tackle the performance issue of the company’s garment manufacturing joint venture (JV) there—after two years in operation, it had run out of cash. After meeting with his JV partner, he concluded that the existing JV in Sihanoukville was beyond repair. He now needed to decide whether to exit Cambodia or to remain there, albeit in a different city and with a new partner. A new factory would require further investment. If he quit Cambodia, could his company survive and develop in the future?

9B20M182_P - 11 pages

SafeMotos: Scaling up Innovations in African Ride Hailing

Darren Meister, Ramasastry Chandrasekhar

In April 2018, the two co-founders of SafeMotos, a motorcycle taxi service in Rwanda, in Central Africa, were examining their expansion plan. Their start-up had not yet become profitable, but they were already making plans to expand into the neighbouring Democratic Republic of the Congo. They were also driven by the larger goals of replicating their tried and tested growth model in other cities on the African continent and moving quickly into the underserved city transportation markets of Asia and the Far East. As they reviewed their four-year experience of working in Africa, they were facing a singular question: What should be the roadmap for scaling up their ride hailing service?

9B18C031 - 5 pages

Griffiths Energy International: The Board's Dilemma (A)

Gerard Seijts, Dawn Oosterhoff

In 2012, Griffiths Energy International Inc. had secured the land leases needed to begin drilling for oil in Chad and was preparing for an IPO. During the due diligence, the company’s lawyers found consulting contracts that appeared to be payments to a public official to gain a business advantage. While bribing officials was not uncommon in Chad, it was a criminal offence in Canada. The company’s senior executive team was new, and the founder and former chairman, who might have been able to explain the contracts, had died in a boating accident. The directors needed to decide what to do: continue with the IPO and deal with disclosure if the matter did surface at some point later or report the findings to the authorities now and bear the consequences.

9B18C032 - 6 pages

Griffiths Energy International: The Board's Dilemma (B)

Gerard Seijts, Dawn Oosterhoff

Supplement for product 9B18C031.

9B20M079 - 14 pages

Technologies Ecofixe: Green Wastewater Treatment for Africa

Roxanne Lavoie-Drapeau, Gwyneth Edwards

In September 2018, Marisol Labrecque, president of Technologies Ecofixe Inc. (Technologies Ecofixe), was heading to Ain Taoujdate, Morocco, in order to supervise the installation of the company’s second ECOFIXE system in Africa. Technologies Ecofixe was a small, socially responsible Québécois company that had developed and commercialized a cost-effective system for the treatment of wastewaters in aerated ponds. With her eye on Africa’s ever-expanding market, Labrecque considered entering the French-speaking countries of Senegal, Ivory Coast, and Burkina Faso. However, given her limited resources, Labrecque knew that she would have to choose. Which country should Technologies Ecofixe enter next?

9B17M048 - 6 pages

DeliverMeal Ivory Coast: Addressing Headquarters' Demands

Benoit Decreton, Phillip C. Nell, Alison E. Holm

The local business development manager at DeliverMeal’s Ivory Coast subsidiary needed to make some decisions on how to react to three demands that had recently been passed down from corporate headquarters, all of which were at odds with the West African environment. How could the Ivory Coast manager meet her headquarters’ corporate expectations and still conduct successful business operations within the local cultural context?

9B20M182_P - 11 pages

SafeMotos: Scaling up Innovations in African Ride Hailing

Darren Meister, Ramasastry Chandrasekhar

In April 2018, the two co-founders of SafeMotos, a motorcycle taxi service in Rwanda, in Central Africa, were examining their expansion plan. Their start-up had not yet become profitable, but they were already making plans to expand into the neighbouring Democratic Republic of the Congo. They were also driven by the larger goals of replicating their tried and tested growth model in other cities on the African continent and moving quickly into the underserved city transportation markets of Asia and the Far East. As they reviewed their four-year experience of working in Africa, they were facing a singular question: What should be the roadmap for scaling up their ride hailing service?

9B20M139_P - 12 pages

Fair Trade Jewellery Co.: Establishing an Ethical Global Value Chain

Anthony Goerzen, Luke Fiske

In August 2019, Fair Trade Jewellery Co., a mid-size jewellery retailer based in Toronto, Canada, was wondering how to ensure that its customers received responsibly sourced gold and diamond jewellery. The company had already devoted considerable amounts of time, energy, and expense to develop a responsible supply chain. Its activities toward that goal had included various initiatives beyond jewellery retail, such as providing inventory financing for artisanal miners in the Democratic Republic of Congo. After discovering that a key US partner along the supply chain may have not been following a clear chain-of-custody system in its refinery, the company was unsure how to proceed. Responsibly sourced gold was potentially being contaminated by other gold at the refinery, which led Fair Trade Jewellery Co. to consider opening its own local small-scale refinery. However, that initiative could mean considerable strategic risk and financial burden for the company. It could also have potential effects on its employees, who relied on the company for their livelihood. Did the company’s ethical mission require vertically integrating to such a considerable extent?

9B18M031 - 17 pages

Banro Corporation: Recapitalization for Sustainability In the Congo’s Gold Mining

Wiboon Kittilaksanawong, Kabi Olivier Katabaruka

9B20M185 - 6 pages

Chiban Leather: Designing The Next Chapter

Nicole R.D. Haggerty, Jennifer Dobrowolski, Jasmyn Dossa, Michelina Aguanno, Jessica Orchin

In May 2019, Chiban Leather, a socially conscious leather manufacturing firm based in Addis Ababa, Ethiopia, was undergoing an expansion and the company’s chief executive officer was contemplating its strategic future. She wanted to take advantage of opportunities in the Ethiopian leather industry and expand her client base to include 10 primary wholesalers. She was proud of the social impact the company had achieved so far, and she hoped to be able to focus more on this by expanding the company’s production process. She was also considering other options, including developing Chiban Leather as a retail brand, focusing on trade shows, and pursuing alternative exposure through diversified products and subscription boxes. She wondered if this was the right time to establish the brand and sell directly to clients. She also had to consider whether this option would align with her current goals and strategy.

9B14M005 –14 pages

Ethiopian Airlines: Bringing Africa Together

Paul W. Beamish, Yamlaksira Getachew

Ethiopian Airlines plans to expand its African market base to become a leading airline in the continent. As part of the airline’s multi-hub strategy, the vice-president of alliances and corporate strategy and his team must identify a suitable hub location and decide on the appropriate mode and level of ownership. Success in the first hub is essential as it will both validate the viability of the multi-hub strategy and set the tone for the establishment of subsequent hubs throughout the continent. The vice-president and his team need to resolve three issues: location of the first hub, entry mode and ownership level.

9B18M076 - 5 pages

Liyu Ethiopia Tours: Growth and Expansion Options

Nicole R.D. Haggerty, Andrew Patton, Desmond Chan, Joseph Hoekstra

In late May 2014, the founder of Liyu Ethiopia Tours was considering his options to grow the company. The small but reputable tour company had become successful in Addis Ababa, Ethiopia in only seven months. The founder, who faced the challenge of continuing to grow the business on a limited budget, was considering several strategic decisions: should he increase the company’s online presence by using the services of Google AdWords or TripAdvisor; expand local and national partnerships with hotels or with tour companies in neighbouring countries; or participate in a major trade show, with the hope of developing international partnerships. The founder wondered how to align his company’s goals with its capabilities.

9B18M102 - 6 pages

Feed Green Ethiopia Exports: Stabilizing Product Quality and Price

Nicole R.D. Haggerty, Carmen Leung, Jensen Liu, Katherine Tan

In mid-2015, the managing director of Feed Green Ethiopia Exports PLC (FGE), one of Ethiopia's leading export companies, faced a pivotal decision. FGE specialized in herbs and spices, and the price of one of FGE's major products, paprika, had skyrocketed in the past six months. As a result, FGE had sustained a massive loss. This problem had taken a toll on FGE's profitability, and the company's future was on the line. The managing director needed to mitigate this problem and prevent it from occurring again. He saw three alternatives: FGE could maintain the status quo, operate its own farm in one of two locations, or purchase its spices directly from local farmers. Maintaining the price and quality of the products and providing excellent customer service were the company's main priorities, regardless of which option it chose.

9B17C040 - 4 pages

Leadership Problems at Ganzeb Microfinance Institution

Nicole R.D. Haggerty, Wubeshet Bekalu, Emmag MacDonald, Darren Hall, Ahsan Syed

Ganzeb Microfinance Institution (Ganzeb) was formed as an extension of an indigenous non-governmental organization, and provides loans to rural Ethiopians to fund their business ventures. The microfinance industry is heavily regulated by the Ethiopian government, and the political landscape is not very stable. Since its inception in 2000, Ganzeb has been run by the same chief executive officer. The company flourished until 2006, when its financial performance declined as a result of an increasing number of defaulting loans from clients. Many other organizational problems have also emerged, which are quickly degrading the institution’s work. Now, in late 2008, the chair of the board of directors is faced with threats from the National Bank of Ethiopia: he must fix the problems or lose Ganzeb’s licence to operate. The board chair is being asked to meet with the bank to talk about the situation and the proposed solutions. He must figure out how to fix the problems of high turnover among staff, poor financial performance, and a lack of communication between the different levels of the organization.

9B17M083 - 4 pages

Femu Advertising: The Expansion Opportunity

Cathy Chen, Eric Morse

In May 2016, a business student from Addis Ababa, Ethiopia, was considering expanding his print advertising business, which he had been operating out of his home for the past five years. He was about to graduate from the School of Commerce at Addis Ababa University, and he needed to put together an action plan for his company’s potential expansion. His options were: (1) continue operating his business as is; (2) invest in an office location and move the business out of his home; and (3) invest in new machines that would allow him to bring banner printing operations in-house. Now it was time to consider the pros and cons of these options and prepare an action plan, including how to obtain the financing for fixed asset investments.

9B21M035 - 12 pages

Ecobank Ghana: Change Management in an Acquisition

Helena M. Addae, Kwesi Amponsah-Tawiah

Ecobank Ghana had branches in every region of Ghana and wanted to expand its client base to include more small and medium enterprises. At the end of 2011, Ecobank Transnational Incorporated, Ecobank Ghana’s parent company, acquired the Trust Bank Ghana Limited, a bank that primarily serviced small businesses, which it planned to merge with Ecobank Ghana through a share swap. Integrating the two banks would involve merging different organizational cultures and operational technologies. The employee appointed as the manager responsible for ensuring a seamless integration of the two banks needed a plan to integrate the staff, standardize the operational systems, and establish a converged culture. How should he prioritize the changes, and what challenges should he anticipate from the merger?

9B19M124_P - 9 pages

Ghana Investment Fund Limited: Ethical Issues

Darrold Cordes, Won-Yong Oh

The chief executive officer of RenY Corporation (RenY) based in Hong Kong, had just established the Ghana Investment Fund Limited (GIF) as a subsidiary of RenY in Ghana. GIF aimed to invest in the entrepreneurial ideas of university graduates in Ghana under a model that brought together the intellectual capital of the graduates, e-commerce, and investment capital under an umbrella of mentoring and collaboration. Access to Ghanaian government contracts to provide products and services was an important aspect of the CEO’s sustainable development plans for low income communities, but he was faced with ethical issues on the way government business was done in Ghana—to be successful in gaining some of these contracts, extra payments were required. He had to decide if his investment was going to result in nothing or if there was a way to move forward.

9B15M080 – 13 pages

UT Financial Services: Looking for the Next Mountain to Conquer

Anthony Ebow Spio, Anthony Essel-Anderson

An entrepreneur and co-founder of a private, non-deposit-taking, non-bank financial firm in Africa took his company public following a decade of phenomenal growth and strong performance. Established in an era when the traditional financial institutions would not grant credit to small and medium enterprises, the company successfully pioneered a wide variety of unique services in the non-bank financial services industry. Capitalizing on the failure of formal institutions to meet the needs of the informal sector, the entrepreneur had achieved organic growth by providing short-term loans and complementary services to customers in the neglected segment of the financial services market. The image of a high-performing company, coupled with the successful initial public offering surpassing all expectations, put tremendous pressure on the company to continue to grow the enterprise and deliver superior performance. To obtain substantial funds from the investing public, the onus is on the entrepreneur to select and pursue an appropriate strategy to keep the enterprise on a growth trajectory.

9B14C018 – 17 pages

Sewa (A): Ela Bhatt

Sonia Mehotra, Oana Branzei

In February 2014, a McKinsey Global Institute report proposed tracking an empowerment line that could enable India’s citizens to get out of poverty by providing the resources they needed to build better lives. This prompted Ela Bhatt, founder of the India-based Self-Employed Women’s Association, to take stock of her initiative to empower women working in India's informal sector. Since 1972, her organization has been widely acclaimed as a global first mover and active champion of grassroots development. Quickly approaching two million members in India and six neighbouring countries, and inspiring similar efforts in South Africa, Ghana, Mali and Burkina Faso, it exemplifies a unique form of positively deviant organizing by speaking to the centrality of human beings at work. Given resources, support and encouragement, its many members have used their own human agency even in the direst of circumstances to better their lives in ways most meaningful to them, for instance, by creating childcare, health care, banking, farming and education cooperatives. However, as she reaches retirement and contemplates the future, Bhatt wonders if the new generation of Indian leaders will take up the Gandhian socially minded path or follow the commercial careers opening up in the country’s multinational sector.

9B05B006 – 4 pages

Exporting to Ghana

David J. Sharp, Ken Mark

A loan assessment officer at Export Development Canada is evaluating a proposed deal involving the export of refurbished machines used in the forestry industry. He must decide whether Export Development Corporation should extend loans to a foreign firm that is interested in purchasing from a Canadian supplier. Issues include international business risk and the role of an export development agency in facilitating a country's exports.

9B13D009 – 6 pages

Bella Springs

Nicole R.D. Haggerty, Francis Ayensu, Jesse Brame, Chris Lau, Gerry Li

The founder of a water purification, packaging and distribution company in Ghana, Africa, faces some operational issues. Demand has increased for the company's water sachets, but the founder needs to develop strategies to increase the firm's current operational capacities to meet this demand. He and the operations manager need to determine how the company can position itself as a successful high-growth company in a developing and sometimes uncertain Ghanaian economy.

9B13M076 – 13 pages

Hello Healthcare: Taking a Cooperative Business into Africa

Albert Wocke

A retired Swiss banker has decided to bring primary healthcare to Africa by using a cooperative business model that brings together complementary firms. The model has proven successful in the United Arab Emirates, Zambia and Ghana. He now faces the decision of whether to expand into new African countries, and if so, which countries to enter, how to select partners and how to recruit country managers. The case also illustrates the challenges and misconceptions of doing business in Africa.

9B07M025 – 17 pages

City Water Tanzania (A): Water Partnerships for Dar es Salaam

Oana Branzei, Kevin McKague

This case examines how the Tanzania government intends to address a pressing deterioration in the infrastructure and services of Dar es Salaam's Water and Sewage Authority. The decision process unfolds in the spring of 2002, on the heels of the Cochabamba uprising in Bolivia and an increasing dispute over the involvement of the International Finance Corporation and the World Bank in other water development projects in Ghana, Mauritania and South Africa. At that time, the World Bank was already sponsoring similar projects in Angola, Benin, Guinea-Bissau, Niger, Rwanda Sao Tome and Senegal, despite some vocal local opposition. This multi-part case series is ideally suited for core or elective courses in strategy and sustainability to illustrate the types of ongoing tensions and divergent decision angles that influence the formation and performance of public-private partnerships and managing in a global context. It also provides a rich and graphic account of the special threats and opportunities in the water sector - a wealth of complementary teaching resources can also stimulate larger debates by juxtaposing the case decision with a broader crisis of confidence in for-profit solutions to water and sewage provision in Africa and in Latin America.

9B14M041 – 5 pages

Scuby’s Enterprises: Starting a Business in Ghana

Francis Ayensu, Nicole R.D. Haggerty, Julianna Faircloth, Helen Fisher, David MacNicol

In October 2011, a young entrepreneur in Ghana faced a critical moment. Given his degree in marketing from the Ghana Institute of Management and Public Administration and his past work experience running a retail clothing store, he was confident he could branch out and start his own photocopying service in his hometown of Koforidua, where there was a distinct undersupply of photocopying services. The proposed store would be located near All Nations University, whose students and faculty would provide a stable demand for his offerings. Now he must perform a breakeven analysis and return on investment calculation to assess whether he should go forward with the venture.

9B14M042 – 9 pages

EA Financial Services

Francis Ayensu, Nicole R.D. Haggerty, Logan Burnett, Stephanie Lachance-Coward, Taylor Klimosko

EA Financial Services is a microfinance institution in Koforidua, Ghana. In its seven months of operation, it has done well to establish a client base, but it now lacks sufficient capital to meet the growing demand for new loans. Although having a growing client base is a positive sign, the lack of capital is a significant burden — the company has had to begin turning down loan requests. The owner knows that potential clients will likely deal with one of his many competitors if he cannot provide financial services for them. He wonders if he should first explore obtaining additional operational capital or concentrate on improving current operations. Several alternatives to addressing these issues have presented themselves. What is his best course of action?

9B18M125 - 6 pages

Leisure Gardens: Expanding a Tourism Business in Ghana

Nicole R.D. Haggerty, Jenny Min, Gena Zheng, Christine Ward

The owner of Leisure Gardens, a restaurant and accommodation business in a small town in Ghana, faced problems with his business. Approximately 40 per cent of his restaurant customers were paying on credit and not paying on time, causing cash flow problems. His sole employee was unreliable, often absent when the restaurant was busy. This two-part problem hindered the restaurant's success and owner’s ability to expand the business. Moreover, the owner faced external pressures from competitors in the restaurant market. The owner was considering three options to sustainably reduce bad-debt accounts and ensure profitability in the future: implementing an employee contract, changing the payment options, and expanding the business to generate more revenue. Which option would be the best course of action for the future of Leisure Gardens?

9B18M049 - 5 pages

Burro: Tools for a Better Life in Ghana

Nicole R.D. Haggerty, Francis Ayensu, Amy Lin, Caleb Chan, Michelle Yick

Burro was a growing start-up in Ghana with a mission to provide “tools for a better life” to Ghanaians by distributing products that addressed local needs. In February 2015, after seven years of operation, the company had finally become profitable. Demand for Burro’s sustainable products was growing quickly in the booming Ghanaian market. The country manager wanted to determine a strategy for growth to maximize the success of Burro's future.

9B18D018 - 5 pages

Fastjet: Strategy and Expansion

Nicole R.D. Haggerty, James Spillane, Jocelyn Carabott, Cheryl Mok, Nicole Wiebe

In 2012, Fastjet acquired Fly540, a low-cost airline with operations in Tanzania, Kenya, Angola, and Ghana, and began operating as a low-cost carrier with the goal to become the most successful pan-African low-cost airline. Since starting operations, Fastjet had grown tremendously, achieving strong market acceptance and a reputation for reliability and punctuality. Although yield per passenger had increased over its first two years, Fastjet had continued to report operating losses due to its poorly performing operations in Kenya, Angola, and Ghana. In September 2014, Fastjet had the opportunity to expand into other African regions, and the company’s chief executive officer needed to consider his options to successfully grow the company’s operations.

9B18M097 - 7 pages

iSpace: Expanding a Start-Up Hub for West African Entrepreneurs

Nicole R.D. Haggerty, Darkwah Joseph Asante, Emma Hogeterp, Ali Beres, Hui Fang

iSpace, a start-up hub that focused on women in technology, was founded in 2013 in Ghana’s capital, Accra, and provided space, technology, and funding to 62 entrepreneurs. In May 2017, the co-founder wanted to expand the business to maximize social impact by empowering a greater number of entrepreneurs who lacked technical skills, emotional support, and access to funding. iSpace had four strategies to choose from to meet its goal: create new programs to attract more entrepreneurs in Accra, establish a presence on university campuses, expand into other regions or countries, and collaborate with government programs. In addition, the company needed a plan to address the financial and human resources constraints it would face in executing an expansion strategy.

9B18C014 - 5 pages

The Linda Dor: Building a Culture of Customer Satisfaction

Nicole R.D. Haggerty, Mark Boadu, Allie Zuccon, Zoe Woods

The general manager of operations and interim general manager of human resources at Linda Dor Restaurant and Rest Stop (Linda Dor) was facing challenges recruiting, training, and retaining staff at the lower levels of the organization. These customer-facing positions, which include wait staff, cashiers, and runners, are responsible for delivering the high level of customer service enshrined in Linda Dor Enterprises’ corporate values. Providing a positive customer experience is becoming increasingly important for Linda Dor because the company is expanding into the hotel industry and needs to ensure that its reputation for high-quality customer service is untarnished. How could Linda Dor improve employee retention and build a strong corporate culture?

9B18A052 - 13 pages

Wendy's: A Plan for International Expansion

Fabrizio Di Muro

In the summer of 2018 in the United States, Wendy’s faced an important decision related to its international markets. The company had a small international presence; of its 6,537 restaurants worldwide, only 637 restaurants were located in international markets. The company was faced with a saturated and stagnating U.S. market and fierce competition from a number of fast food rivals, including McDonald’s Corporation, Burger King Corporation, and Carl’s Jr. Restaurants LLC, and the surest path to growth seemed to be an expansion into foreign markets, where fast food was still growing. Wendy’s chief executive officer needed to determine which international market(s) to target and how many restaurants to open in each international market.

9B18N007 - 3 pages

SIC Insurance Company Limited: Corporate Governance

Joshua Yindenaba Abor, Elikplimi Komla Agbloyor, Agyapomaa Gyeke-Dako, Lydia Adzobu

In March 2013, SIC Insurance Company Limited (SIC), a Ghanaian insurance company, appointed its first female chief executive officer, Doris Awo Nkani. Under her tenure, SIC issued a credit guarantee bond to ITAL Construct International in favour of Ivory Finance for a six-month period. However, ITAL Construct International defaulted on the loan, and Ivory Finance called on SIC to redeem its credit guarantee bond. Due to the failure of SIC and ITAL Construct International to honour their obligations, Ivory Finance proceeded to court in November 2013. Over a year later, in November 2014, the parties agreed on an amount to be paid to Ivory Finance through a consent judgment. This event culminated in the board considering in February 2015 whether to retain or fire its chief executive officer. How had this situation occurred? Should the board of directors have taken action earlier? How could the company ensure that a similar situation would not recur in the future?

9B07M025 – 17 pages

City Water Tanzania (A): Water Partnerships for Dar es Salaam

Oana Branzei, Kevin McKague

This case examines how the Tanzania government intends to address a pressing deterioration in the infrastructure and services of Dar es Salaam's Water and Sewage Authority. The decision process unfolds in the spring of 2002, on the heels of the Cochabamba uprising in Bolivia and an increasing dispute over the involvement of the International Finance Corporation and the World Bank in other water development projects in Ghana, Mauritania and South Africa. At that time, the World Bank was already sponsoring similar projects in Angola, Benin, Guinea-Bissau, Niger, Rwanda Sao Tome and Senegal, despite some vocal local opposition. This multi-part case series is ideally suited for core or elective courses in strategy and sustainability to illustrate the types of ongoing tensions and divergent decision angles that influence the formation and performance of public-private partnerships and managing in a global context. It also provides a rich and graphic account of the special threats and opportunities in the water sector - a wealth of complementary teaching resources can also stimulate larger debates by juxtaposing the case decision with a broader crisis of confidence in for-profit solutions to water and sewage provision in Africa and in Latin America.

9B17M046 - 12 pages

Haiti: Energizing Socio-Economic Reform

Gwyneth Edwards, Rene Jean-Jumeau

The minister of Haiti’s Department of Energy Security needed to prepare a presentation for the country’s prime minister that proposed a solution for transforming Haiti’s energy infrastructure. Haiti wanted to attract foreign direct investment that would spur socio-economic reform; however, the opportunities depended on a solid energy infrastructure providing reliable electricity to businesses, which Haiti did not have. Also, the residents of Haiti were in dire need of a low-cost, reliable energy solution that would allow them to move away from biomass and petroleum products, which were expensive and bad for the environment. How should the minister structure his proposal? What criteria would be required to support a strategy that considered the energy value chain, types of public-private partnerships, and need for socio-economic reform?

9B14E010 – 9 pages

Ushahidi

Nicole R.D. Haggerty, Alex Jepson

As the co-founder of a software platform called Ushahidi, Ory Orykolloh watches the unfolding catastrophic earthquake crisis in Haiti and must decide how her company’s crisis-mapping software might assist international authorities as they move into Haiti to provide help and relief. Ushahidi was developed as an open-sourced mash-up platform combining Google Maps with publicly reported (text-based) incidents of election violence during the Kenya 2007 elections, and thus, the system effectively managed to bypass government censorship. Expansion into other uses during both political crises and a variety of national/international events provided opportunities for growth. Now, with Haiti, Ushahidi’s management team must consider how its software could be used to provide assistance during a catastrophe like an earthquake.

9B01C035 – 10 pages

Kate Archer in Haiti (A)

Joerg Dietz, Kate Archer

Helped the Aged Canada, a non-profit organization, has hired Kate Archer to manage their prosthetic clinic in Haiti. After her arrival in Haiti she learns that its key employee does not meet her performance expectations. Communicating with the employee, a deaf-mute, however, was very difficult and required the use of another employee as translator. She must communicate her performance expectations to the employee. The supplement to this case, Kate Archer In Haiti (B), product number 9B01C036 describes how Kate develops a contract and finalizes the agreement with the employee.

9B12A037 – 17 pages

Foundation for International Development Assistance/Productive Cooperatives Haiti: Increasing Organizational Capacity

Colleen Sharen

Since the 2010 earthquake, the executive director of the Foundation for International Development Assistance (FIDA) had been managing exploding demand for economic development from Haitians, the international development community and from individual Canadians. While there was a lot of money available for earthquake relief and micro-finance, far less was available for sustainable long-term economic development. FIDA needed an additional $2 million over the next three years to support projects that had been approved by both FIDA and its Haitian partner, productive cooperatives Haiti (pcH). FIDA needed to find investors who understood and supported the unique vision, principles and methods of FIDA/pcH.

9B13M040 – 11 pages

KayTek: Manufacturing Housing and Livelihoods in Haiti

David Wood, Taylor Sekhon

After a massive earthquake destroyed many buildings in Haiti, reconstruction has become a source of opportunity and competition for non-governmental organizations, international business and local companies. The Haitian chairman and CEO of a very successful, multi-million dollar information technology company wants to provide affordable quality housing, especially for the disadvantaged poor, using steel frame technology from his start-up, KayTek. What he has not yet determined is how to get his product to market. He has three options: to keep sales and construction in-house, to outsource, or to franchise in order to create opportunities for young Haitian engineers to become entrepreneurs. Each option has costs, in terms not only of finances and time but also of control of brand quality and accessibility.

9B12B015 – 8 pages

Café Xaragua

Mary Heisz, Robert Lehnert

While on a visit to Haiti, a student entrepreneur realized the potential for economic development in a country that was rich in certain resources and virtually unexplored by the private sector. The entrepreneur decided on coffee as a business opportunity and he and his three partners imported their first burlap sack. By November 2011 the product was for sale - a premium coffee from Southeastern Haiti with a brand focused on assisting the redevelopment and sustainability of the Haitian coffee industry. After the product met success, the entrepreneur and his partners were ready to make an additional investment. They believed that a café focused on their own brand of Haitian coffee would be a great way to generate sales and further develop their product offering before pursuing a grocery-store strategy. However, they also knew that such an investment would be risky.

W25058 - 3 pages

The Farming Dilemma

Nicole Haggerty, Ryley Mehta, Angela Du, Teddy Kassa, Melissa Shang, Maanit Patel

In early 2019, Chrystopher Jesse, a student at Jomo Kenyatta University of Agriculture and Technology in Nakuru, Kenya, inherited a 10-acre piece of land outside the city. With his degree in procurement nearing its completion and a competitive job market awaiting him after graduation, Jesse now faced the decision of whether to sell the land or use it to begin operations as a small-scale farmer. This venture, if successful, had the potential to represent a portion or all of Jesse’s full-time income over the long term.

As part of his overall decision, Jesse needed to consider two key options: Assuming he chose to start the farm, Jesse needed to decide whether to plant potatoes or carrots. After deciding which crop to plant, he would then have to decide whether to irrigate the land or not.

9B20M034 - 6 pages

Kamoriongo Poultry Co-operative Project

Nicole R.D. Haggerty, Charles Lagat, Tony Ma, Zain Kalsi

The Kamoriongo Poultry Co-operative consisted of 10 families who were involved in poultry farming in Nandi County, in the North Rift Valley of Kenya. The purpose of the co-operative was to pool savings to help individual families pay for tuition when their children came of age. Because of heavy rains during the region’s rainy season, many of the co-operative’s chickens were contracting waterborne illnesses that made them incapable of producing eggs. In order to keep up with demand from the wholesaler who bought from them once a week, the farmers had to find a way to keep their chickens healthy and to produce enough eggs to increase profits. In 2018, to combat this problem, the co-operative was considering purchasing either a new hen shelter or a commercial incubator. With a continuing decrease in egg production, the farmers needed to evaluate each alternative, determine how to finance these investments, and prepare both short- and long-term plans for sustaining their business.

9B19E014 - 8 pages

eLengo: Building Business Models to Address Macro-Opportunities (A)

Nicole R.D. Haggerty, Trevor Wright

By the end of 2018, a recent business program graduate had found that his first social enterprise had been a success, and he wanted to start his next venture in the Kenyan agricultural market. He identified three challenges in this area—climate change, lack of market access, and ineffective education systems—and he wanted to try to address one of these with a new business. Case A explores how he needed to perform a market assessment to understand the opportunities and constraints of the Kenyan market, identify the resources and processes that would be available to him when starting the business, and form strategies for performing customer research.

9B19M012_P - 15 pages

Roshan and M-Paisa: The Promise of Mobile Money in Afghanistan

Farah Kurji, Ning Su

In 2008, Roshan, Afghanistan’s leading telecommunications provider, launched M-Paisa, its mobile money transfer service, which allowed Afghans to use their mobile phones to transfer funds, receive and repay microfinance loans, make purchases, and disburse and receive salaries. The company was committed to building a financial ecosystem for transparent, safe, convenient, and secure services, which would also contribute to the long-term development of Afghanistan’s society. Utilizing technology from Vodafone Group Plc, which had been successful in Kenya, Roshan enjoyed several successful pilots, but it still faced a myriad of issues as it sought to scale the service amid a challenging operational environment. In 2011, three years after its launch, the M-Paisa service had yet to make a profit. Roshan’s chief executive officer and chief operating officer wondered what more they could do to turn M-Paisa around and, ideally, make an even more significant social impact.

W25060 - 7 pages

Hastening Growth at Swift Mobility

Nicole Haggerty, Ryley Mehta, Angela Du, Teddy Kassa, Melissa Shang, Maanit Patel

In 2018, the founder of Swift Mobility in Nakuru, Kenya, Africa was considering her options for the future of her company, which was a Safaricom Plc dealership. The founder was reflecting on how much her business had progressed in the past ten years and wondering if this was the right time to expand or invest in the company’s future. She had just spoken with the property owner of a potential new store in Mombasa, Kenya, but was also considering other options. In addition to potentially expanding to a new location, the founder could choose to invest further to grow her current operation, or sell the business and exit the highly competitive telecommunications industry in favour of a more moderate lifestyle. Which option would be her best path forward?

9B14M043 - 5 pages

Lilgaa Property Management: Property Investing in Eldoret, Kenya

Nicole R.D. Haggerty, Charles Lagat, Loice Maru, Daniel Korman, Ivan Liu, Sherry Xie

In 2013, a successful entrepreneur in Eldoret, Kenya was considering her options. In 2007, after a history of operating several small businesses, only one of which failed, she founded Lilgaa Property Management Ltd., a real estate and property management business. She had focused her energies on the real estate industry in spite of its many challenges, which included corruption and lack of regulation, enforcement and trust. In 2013 she needed to decide how to grow her business, specifically, whether she could buy a building in Eldoret and rent it out or buy a plot of land on the outskirts of town and build a hotel; if the latter, would it cater to the middle or upper class? She had to assess the various elements of the business, political and social environments and consider the potential risks that could affect the outcome of her investment.

9B19M019 - 6 pages

Uber Africa: Making Cash and Alternative Payments Work in Kenya through Contextual Leadership

Caren Scheepers, Anastacia Mamabolo

On September 30, 2017, the general manager (GM) of Uber Technologies Inc. (Uber) for sub-Saharan Africa, arrived in Nairobi, Kenya, and paid for his Uber service with cash. This functionality of the Uber app represented a new business model for Uber. The GM had to convince global management of the business case for offering cash payment options in Africa; he did so by conducting experiments and showing data that indicated rider numbers had tripled with adoption of the cash payment option. Uber’s driver-partners were concerned about safety when they transported passengers who paid by cash, both because credit card payments offered Uber rider identification and because the driver-partners were concerned about driving around with large amounts of cash. In spite of their concerns, the rationale for introducing a cash payment option was relevant, and it had to be considered carefully in the context of African locations with high crime rates. The GM considered various initiatives for utilizing data from their technology platform to safeguard their riders and drivers. They needed to address local needs in Africa while adhering to global Uber standards.

9B18D018 - 5 pages

Fastjet: Strategy and Expansion

Nicole R.D. Haggerty, James Spillane, Jocelyn Carabott, Cheryl Mok, Nicole Wiebe

In 2012, Fastjet acquired Fly540, a low-cost airline with operations in Tanzania, Kenya, Angola, and Ghana, and began operating as a low-cost carrier with the goal to become the most successful pan-African low-cost airline. Since starting operations, Fastjet had grown tremendously, achieving strong market acceptance and a reputation for reliability and punctuality. Although yield per passenger had increased over its first two years, Fastjet had continued to report operating losses due to its poorly performing operations in Kenya, Angola, and Ghana. In September 2014, Fastjet had the opportunity to expand into other African regions, and the company’s chief executive officer needed to consider his options to successfully grow the company’s operations.

9B15A012 – 7 pages

Enhancing Competitive Strategy at Darling Kenya

Pamela Odhiambo, Nicole R.D. Haggerty, Ali Kanji, Brandon Swartz