In 2017, words like bitcoin, cryptocurrency and blockchain flooded the mainstream lexicon. Few understood what they meant, but like a modern day gold rush, investors of all stripes flocked to prospect these digital mines.

Prior to this, cryptocurrency was only discussed in the dark alleys of the internet. Its initial function was to be an untraceable asset to pay for a plethora of illegal products and activities. Anthony Xie, HBA ’15, remembers hearing the rumours in high school. “Oh this is like used for drugs?” he recalls thinking.

His second exposure was far more nuanced. During the Ivey HBA course, ‘The dark side of capitalism,’ Associate Professor Jean-Philippe Vergne went in depth on cryptocurrency, and how it could change society.

The phenomenon struck a chord with Xie, and it changed his career trajectory.

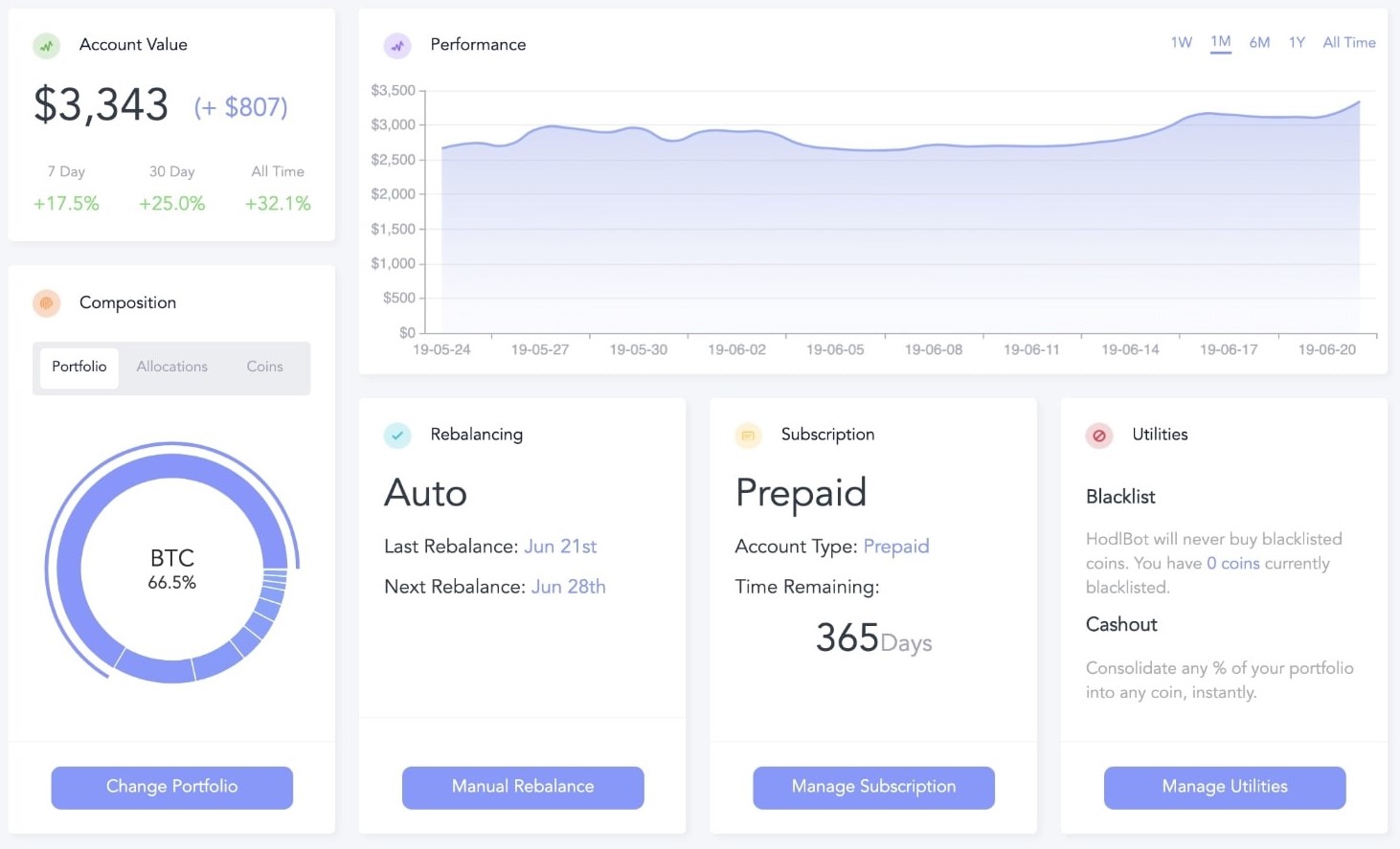

Today, Xie is a co-founder at HodlBot, an online platform that allows users to bet on the cryptocurrency market as a whole. The platform employs a strategy of “indexing,” which creates a diversified portfolio that aims to track the risk and performance of the entire cryptocurrency market.

Xie describes HodlBot as the “WealthSimple for cryptocurrency, with a little more customization” after the successful investment management service created by Michael Katchen, HBA ’11.

With HodlBot's diversified approach, Xie hopes to reduce the inherent risks in investing in a new, and volatile market; therefore, encouraging and inviting new investors, who lack the historical background or connection to cryptocurrency.

Since their launch in 2018, HodlBot has scaled up to almost 8000 users in 80 countries. Even more impressive is that the platform has overseen more than $60 million in trades with $0 in marketing.

Betting on the market

HodlBot provides passive investors four indices that include portfolios that contain the top 10, 20, 30 weighted by market cap.

“I knew from my finance background, how hard it was to beat the market,” said Xie. He points to the recent S&P Indices versus Active (SPIVA) report, which notes that over 90% of professional money managers fail to beat the index over a 15-year period.

The indices themselves are rebalanced every month, although it is possible to customize this timeline.

Due to the volatile nature of the market, coin types can fall out of favour or lose relevance very quickly. To protect users, HodlBot tries to offer starter portfolios with sufficient diversification. "If you don't know what coin will win, it may be better to just bet on the entire asset class".

The entire trading process is automated through HodlBot’s trading algorithm. Rather than depositing fiat currency, users can simply plug their exchange accounts into HodlBot’s platform to execute the trades required.

The application also allows users to create their own personalized portfolios. “Basically, we allow users to create their own exchange-traded fund (ETF) but with cryptocurrency,” said Xie.

“We are trying to own that customer relationship, commoditize exchanges, and become the platform through which people can invest in cryptocurrency.”

In the next two years, Xie is hoping to hit a $1 billion in transaction volume annually.

“The cryptocurrency investor market is growing. We are integrating with basically every single exchange out there. So, we are able to pool the liquidity, get the best order, and execution, while making it easier for users to make any portfolio they want.”

A new world of ideas

With both of his parents being entrepreneurs, Xie saw the impact, and the hard work that went into forging one’s own career.

“Going to Ivey made me want to do entrepreneurship even more, because I didn’t want to follow the traditional path of consulting and investment banking,” recalled Xie.

His interests gathered around technology, startups and finance, but he didn’t have the know-how to crack a career in tech. For Xie, it felt like a missed opportunity.

“I was angry at myself for not knowing how to code. I had classmates that either came from software engineering backgrounds, or were self-taught, and I thought I was light-years behind. It held me back.”

But Xie was able to wrestle with that feeling of regret, and gave himself a 5-year plan to learn coding.

While Xie always had a penchant for the creative, the ability to code opened up new opportunities and a new subset of ideas. “If you don’t have any industry experience or technical expertise, you are always thinking of consumer facing businesses. But with the technical knowledge, you can think of building infrastructure businesses, API layers, and, developer tools,” said Xie.

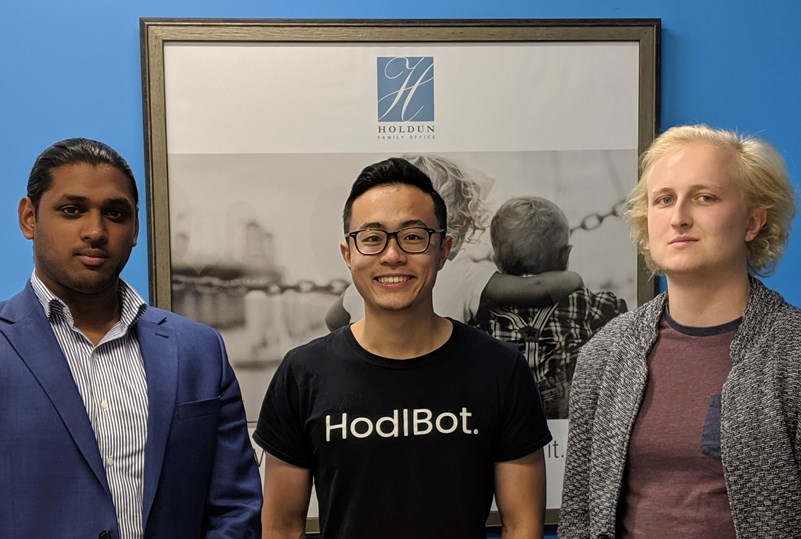

Three years into his post-HBA journey, Xie, together with co-founders, Calvin Leyon and Lucas Simpson, have built an online platform that allows thousands of users around the world to invest in the cryptocurrency market.

Not bad for a late starter.

Volatility and the future

Since the Bitcoin boom of 2017, the cryptocurrency market has had its share of ups and downs.

“I went into it knowing that it was extremely volatile. And just because it’s going up, doesn’t mean it’s not volatile,” said Xie, who is invested in the long-run usability and adoption of cryptocurrency. He fully expects the value to swing up and down over the next few years, but notes that the 15-year trend should point upwards.

He is also encouraged to see large financial institutions getting into the game. From the new tech giants like Facebook, to the established financial institutions like JP Morgan Chase.

Furthermore, established cryptocurrency firms are doing their part in educate the public.

“I like the fact that companies like Coinbase they are spending money on marketing, building awareness of cryptocurrency as an alternative investment class. It’s good news for HodlBot,” said Xie.

As the trend takes shape, Xie is convinced that HodlBot’s ability to be nimble, is what will give them an advantage to adapt to the future of cryptocurrency.

“If you want your business to be sustainable, being the first mover is not enough. If you look at robo-advisors in the U.S., large financial institutions are stealing market share even if they are late to the party. You need to figure out a way to be defensible, and create a profit moat, even as a start-up.”

Lessons from building a business

- Take feedback with a grain of salt - Much of the initial feedback Xie received for HodlBot came from a vocal minority, who were pushing more crypto-anarchists ideas. It was hard to ignore or balance out the voices, especially for first time founders. Xie didn’t want one segment to dominate the conversation, and shape the application to fit their needs vs. that of the larger community.

- Growing organically with good content - HodlBot’s growth from 0-8000 was accomplished with no marketing or sponsorship dollars. Xie understood the target audience, and with his background in writing, was able to create content to cut through the noise and keep them hooked. Their blog currently attracts 800,000 unique visitors a year.

- Technical knowledge matters - For those building technology companies, it’s really important to have a technical founder or co-founder. In Xie’s case, he taught himself how to code and aligned himself with a group of co-founders, who also brought in technical know-how to the start-up.

- “Sell before you build” - HodlBot knew where their potential market resided, and teased their ultimate product to users on Reddit and Hackernews. “We got a 1000 signups in a week for a product that didn’t exist. That gave me the confidence to actually work on the project and develop it.”

- Burden of truth higher for tech startups - For software companies, the cost of building and operating a business is so low that investors want to see massive traction before they take you seriously. “Trying to raise money with no validation, is crazy,” said Xie.