Calculating scope 3 emissions is challenging. Building relationships among your suppliers and customers can help.

If you work for a company, you’ve probably noticed rising pressure to report on your greenhouse gas emissions. Investors and regulators are pushing companies to disclose data on their environmental performance, especially greenhouse gas emissions.

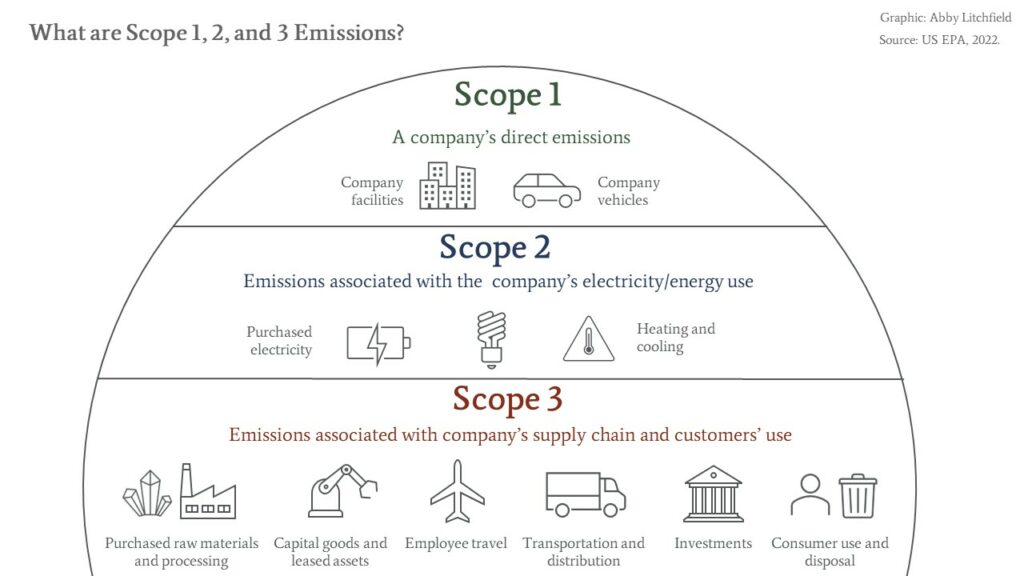

And stakeholders don’t just want emissions data from your own facilities (called direct emissions, or scope 1 emissions); they also want to know emissions from your electricity consumption (scope 2 emissions) and from your suppliers and customers (scope 3 emissions.)

There’s a good reason for this. On average, emissions from a company’s supply chain and customers are 11.4 times higher than direct emissions. If we want to tackle climate change, we have to get a handle on supply chain – or scope 3 – emissions.

Scope 3 Emissions are Hard to Measure

The Greenhouse Gas (GHG) Protocol is an international standard to help companies report on emissions, including scope 3 emissions. The standard is used by more than 90% of Fortune 500 companies in the United States and nearly 20,000 companies globally.

But there’s a problem. Even though the GHG Protocol provides guidance, Scope 3 emissions are still hard to measure and report. The reason? Suppliers need to cooperate.

If all companies simply reported their own scope 1 and 2 emissions, it would be easier for any company to calculate its scope 3 emissions. A given company could just look at reports from their suppliers and customers, and add them up. Unfortunately, not all companies report – and that’s especially true of smaller companies at lower levels of a supply chain.

When some companies don’t publish emissions data, adjacent companies can’t get reliable scope 3 emissions data. They end up relying on questionable models, or using data from a small sample of suppliers. As a result, research shows that scope 3 measurements are usually highly inaccurate.

Relationships Improve Scope 3 Emissions Reporting

So, how do you get your suppliers to share emissions data, if they aren’t doing so already?

You ask.

But it’s a big ask. Firstly, it’s a lot of work for suppliers to collect emissions data. They must create new data collection and management systems and assign staff to do the work. Secondly, the transparency may make companies feel vulnerable. A supplier may fear that disclosing emissions will damage their reputation (even though research provides initial evidence that carbon reporting can improve a firm’s market value).

To get suppliers to report, companies often apply negative pressure. That means threats to take their business elsewhere, or penalties for suppliers that don’t comply. “Many supply chain professionals believe that using coercive power is the only way to get companies to disclose,” says Dr. Jury Gualandris, NBS’s director and a professor at Ivey Business School.

But positive relationships are also a powerful way to motivate other companies.

That can mean cultivating a positive relationship with your direct suppliers, for example by setting joint goals and offering training to their staff.

But fascinating new research shows that it’s not just the relationship with your own suppliers that counts. It’s also the relationships your suppliers have with one another.

Build Relationships Between Suppliers for Scope 3 Reporting

New research by Gualandris and colleagues Annachiara Longoni (ESADE Business School), Davide Luzzini (EADA Business School), and Mark Pagell (University College Dublin) looked at how supplier-to-supplier relationships affect total sustainability disclosure across a supply chain.

This is the first study to ever look at the association between supply chain structure and reporting across a 4-tier supply chain. Researchers studied 187 manufacturing supply chains, including 4803 different companies, with 20504 sales contracts between them.

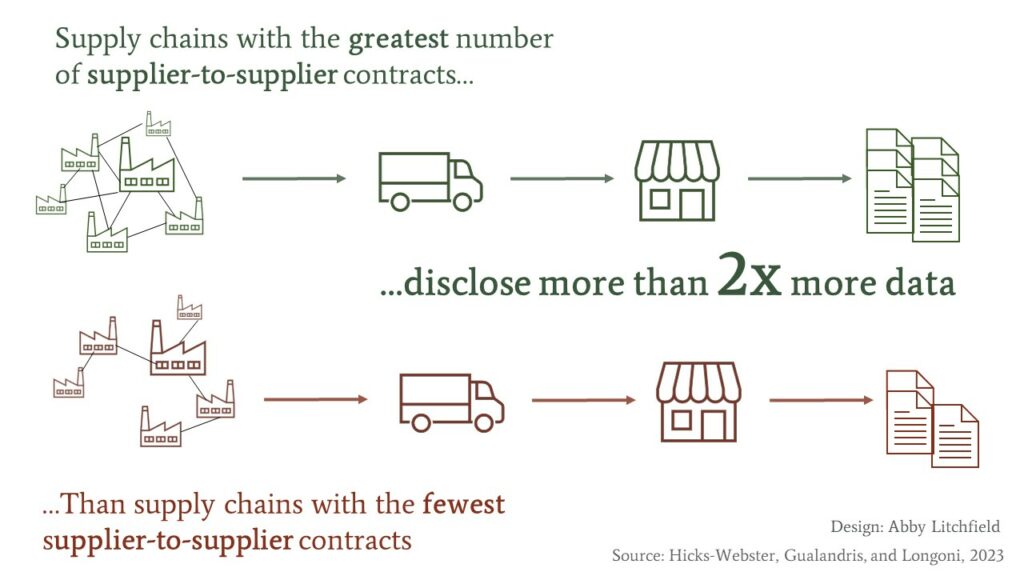

When they compared supply chains to one another, they found that when suppliers in the same supply chain have many contracts with one another, the amount of reporting those companies do goes up – a lot.

Supply chains with the greatest number supplier-to-supplier contracts disclose two times more data than supply chains with the fewest supplier-to-supplier contracts (even once you control for other variables.)

The most important message of this research, Gualandris says: “Build supply chains as communities! Provide opportunities for suppliers and customers to get to know each other, and even work with each other.”

Why positive relationships among suppliers change behaviour

Have you ever heard the saying: “You are the average of the people you spend time around”? It goes for supply chains, too. Companies that do business together start to form a sense of community, including shared ways of thinking and acting – called ‘social norms.’

Why? Because when you do business with another company, you communicate with them more regularly. Increased communication, in turn, lets ideas and practices spread. Communication also enables surveillance (positively) and enforcement. Companies know which of their peers aren’t following the group’s social norms (such as emissions reporting), and they can apply pressure.

4 Ways to Improve Scope 3 Reporting through Community Building

The same research suggests 4 strategies companies can use to build supplier-to-supplier relationships that enable scope 3 reporting.

1. Map your supply chain

To support supply chain relationships, start by knowing who your suppliers and customers are. Your procurement staff will already know your tier 1 suppliers – they’re the companies that sell directly to you. But you’ll have to do some digging to understand your tier 2 and 3 suppliers (the companies that supply your suppliers).

Big companies can find supply chain data using paid databases, such as Bloomberg SPLC, FactSet Supply Chain Relationships, and Mergent Supply Chain. These databases will tell you who your suppliers are (even tier 2 and 3 suppliers) and whether relationships currently exist between those companies.

Small companies may not be represented in these databases. The good news? If your supply chain is composed mostly of small companies, chances are there is already some sense of community. You may be able to gather a list of suppliers and sub-suppliers fairly easily through conversations.

Once you have a list of your suppliers and sub-suppliers, you can use software programs, like Gephi or UCINET, to create visual maps.

If this process feels overwhelming, you can also reach out to university research centres and consultancies for help.

2. Help suppliers and customers build relationships with each other

How do people build new relationships, or deepen existing ones? Whether it’s dating or supply chains, being in the same place at the same time is still most effective.

Existing supplier events, like Modex or ProMat, can be great opportunities to bring suppliers together. Consider organizing a networking event for your own suppliers while everyone is already co-located.

Can’t leverage an existing event? That’s OK. You can create other virtual or in-person opportunities to help your suppliers connect and find opportunities to do business together.

(Pro tip: Even if you don’t have a supply chain map, you can still start building relationships between the suppliers you do know!)

3. Encourage connection across ‘clusters’

Simply having ‘a lot’ of relationships between suppliers isn’t enough. It matters how those relationships are organized.

“Clusters” are groups of suppliers that work together to provide a product – for example, a cluster of companies might produce a single component in an electronic supply chain. (Mapping your supply chain will help you identify clusters.)

Clusters pose a challenge for scope 3 reporting because they limit the efficiency with which a new reporting practice can spread across an entire supply chain.

Suppliers in the same cluster will have good communication and shared norms, making it easier to move everyone in that cluster towards your reporting vision. But those same companies won’t have much incentive to communicate with other clusters, so you’ll have to manage each cluster independently.

(Remember in high school, when (painfully) the athletic kids formed a group, and the theatre kids formed a group, but the groups really didn’t co-mingle? It’s like that.)

So, as you’re building a sense of community in your supply chain, be mindful of building relationships between suppliers from different clusters.

4. Evaluate new suppliers

When selecting new suppliers, evaluate them for transparency and collaboration potential. Try to select companies that:

- Are already transparent with their own emissions data.

- Are willing and able to collaborate with your existing customers and suppliers. (Do they have the technical capabilities to provide what other companies need? Could they buy their own inputs from within your supply chain?)

Relationships Improve All Sustainability Reporting

This article focuses on scope 3 carbon emissions, because NBS readers say scope 3 is a real challenge for them. But the research findings actually apply to reporting on all sustainability topics.

That’s a big deal. Many countries are starting to require sustainability reporting at the supply chain level. For example, in 2022, the EU passed new regulation requiring companies to report on the human rights performance of their suppliers.

Build Supply Chains as Communities!

Anything that involves managing human relationships is bound to be a bit complex. But it’s worth it. Human relationships are the foundation of any collaboration, including reporting. Think of your suppliers and customers as a community – and foster healthy relationships between community members.

Research suggests the payoff is there. Supply chains with strong inter-company relationships disclose twice as much data as supply chains that lack those relationships.

So, what are you waiting for?

Add a Comment

This site uses User Verification plugin to reduce spam. See how your comment data is processed.This site uses User Verification plugin to reduce spam. See how your comment data is processed.