Many have heard of bitcoin, but few understand its various aspects… That’s why we have carefully prepared this 60 minute bitcoin basics. No prior knowledge required! Just read, watch the videos, and in one hour, you’ll know what bitcoin is all about.

The bitcoin paper

Bitcoin was first described in a 9-page research paper posted online in 2008 under the pseudonym Satoshi Nakamoto. The paper, titled Bitcoin: A peer-to-peer electronic cash system, covers a broad variety of topics, such as financial economics (transaction costs, trusted third-parties, money supply), network engineering (distributed decision making, data routing, cyberattacks), and cryptography, a branch of mathematics interested in establishing secure communications to facilitate peer-to-peer, open, and borderless transactions between users.

How many people do you know who have expertise in financial economics and network engineering and cryptography? Probably none, and that’s because these knowledge domains do not typically intersect (e.g., there is no university degree out there that covers all three). And this is the primary reason why, until today, bitcoin has remained difficult to understand for most of us. If you’re feeling lost, you are not the only one! That’s why we created this bitcoin crash course.

If you want to learn more about particular aspects of bitcoin, you can click the hyperlinks throughout the text and consult the supplementary materials listed at the end of each section. This is of course optional. You can get a solid overview of bitcoin in one hour without doing any of this.

The bitcoin software

The 2008 bitcoin paper essentially describes a software system enabling people to conduct secure peer-to-peer online transactions without relying on banks or payment companies. While bitcoin did start as a paper in 2008, by 2009, Satoshi Nakamoto had already published 30,000 lines of software code to make the paper’s ideas come true.

Satoshi Nakamoto (whose real identity is still unknown) has then progressively withdrawn from the project, and since 2011, it is an international team of developers who regularly upgrade the bitcoin software used by all the stakeholders in the ecosystem.

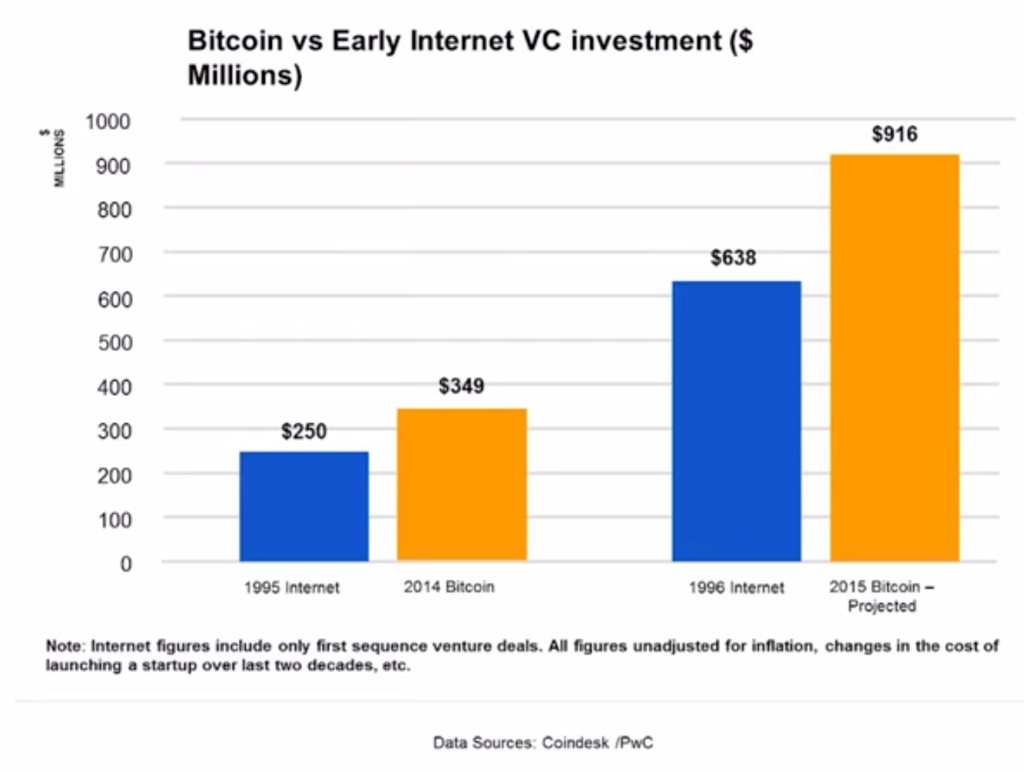

Early investment in bitcoin is comparable to early investment in the Internet

Impact

Bitcoin fundamentally transformed the way value can be stored and exchanged. On its own, the bitcoin software created an economy worth over $130 billion as of December 2019. With early VC investments comparable to that of the Internet, hundreds of millions of dollars have continued to be invested in start-up firms that build their products or services on bitcoin.

Bitcoin and its underlying blockchain technology have also become a focal point for the financial technology (FinTech) industry, which broadly entices financial institutions, governments, and central banks across the world.

Bitcoin in historical perspective

It should be noted that Nakamoto’s 2008 paper did not come out of the blue. While bitcoin is the first decentralized cryptocurrency ever implemented, several aspects of the bitcoin project have their roots in research conducted in the 1980s-90s. Several companies attempted to create e-currency systems in the 1990s—none of them in a decentralized way—and all of them failed.

Interestingly, Nakamoto recognized earlier influences by leaving a note on bitcoin’s Wikipedia page explaining that

“bitcoin is an implementation of Wei Dai’s b-money proposal on Cypherpunks in 1998 and Nick Szabo’s Bitgold proposal”

Cypherpunks are best described as an online social movement regrouping, since the late 1980s, several hundreds of libertarians and anarchists advocating for the widespread use of cryptography to protect individuals’ privacy and liberty against government and corporate interference. Like bitcoin, Julian Assange’s Wikileaks also has its roots in the cypherpunk movement.

Interestingly, back in 1999, libertarian economist and Nobel laureate Milton Friedman predicted the emergence of an online, “reliable e-cash” free from government interference. This is one of those rare moments in history where a social scientist actually makes an accurate prediction about some significant aspect of the future!

Bitcoin as a payment system

Bitcoin is to blockchain, what email is to the Internet. To date, the most basic and prominent application of bitcoin has been its use as a secure decentralized payment system. The video on the left explains how this works (watch it before you read on).

By removing the need for a trusted third-party, bitcoin makes it possible to send international payments without relying on banks (e.g. HSBC), credit card companies (e.g. Visa), or payment processing firms (e.g. Western Union).

But here’s the thing: nothing prevents the technology underlying bitcoin from being used in applications other than payments. In other words, bitcoin can potentially eliminate third-parties from (or “dis-intermediate”) other sectors of the economy. To understand how, we need to get a good grasp of the bitcoin technology.

Bitcoin technology and what it can do

It is that time in the bitcoin crash course when we need to take a look at the basic features of bitcoin technology, and based on that outline potential applications beyond payments. Please view the video to the right.

We now begin to understand how bitcoin works under the hood, and how its features offer a distinctive take on the notions of trust and ownership, with potentially far-reaching implications. Bitcoin essentially relies on five interrelated technological building blocks:

- The blockchain, a decentralized public ledger that maintains a transaction history and represents a “single source of truth” shared by all the network users. The bitcoin blockchain is append-only (i.e. past transactions cannot be modified), permissionless (i.e. anyone can join), and transparent (i.e. anyone can examine the entire transaction history). Note that blockchain technology can be used for other applications, independently of the bitcoin currency.

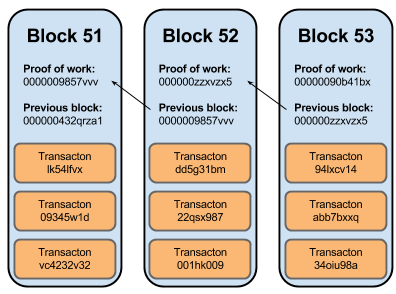

- Cryptographic hashing is a mathematical calculation used to secure, compress, store and retrieve data in the blockchain. In particular, it is used to create hash pointers that connect each block to the previous one, all the way back to the first block ever generated in 2009 by Nakamoto. Thus, altering a pointer would require altering all the pointers found in subsequent blocks. But since creating each pointer requires massive amounts of computing power, it is virtually impossible to modify old blocks (and that makes the blockchain “append-only”).

- A peer-to-peer network that connects all the bitcoin users and relies on a shared protocol. It allows anyone to broadcast new transactions to the rest of the network and have them verified, executed, and added to the blockchain. Though not hierarchical, the bitcoin network has different types of users. An important type of “power users” are miners, who are in charge of verifying the validity of transactions. Miners do so by lending their computing power to the bitcoin network in exchange for a monetary reward paid out in bitcoin currency. To get a chance at the reward, miners must include a “proof of work” into new blocks as evidence of their contribution to the overall network security.

Miners group transactions into blocks added to the blockchain. Each block is 1MB on average, and includes a “proof of work” and a “hash pointer” linking the previous block

- Digital signatures are a cryptographic way of proving ownership of digital tokens (the bitcoin currency) to the rest of the network. Miners verify each broadcasted transaction by checking its digital signature and making sure it corresponds to the actual owner of the bitcoin. And this happens without the bitcoin owner having to reveal its secret password (the “private key”), as explained in the video to the right.

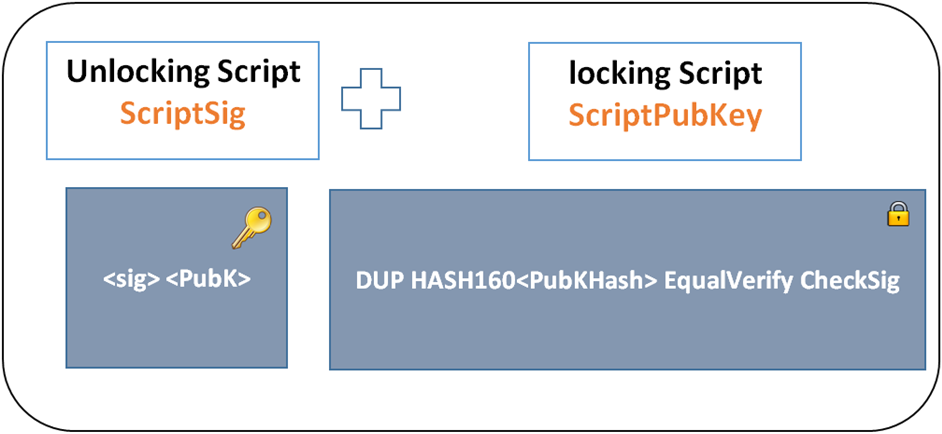

- Bitcoin Script Scripts are instructions given to a computer. Bitcoin has its own scripting language that allows for programming complex transactions separately for each unit of bitcoin. Around 200 scripting functions are available in bitcoin. A basic transaction sending bitcoin from one account to another only uses 2 scripting functions (1%), one pointing to the recipient’s address (or public key) and one verifying the digital signature of the sender. Most applications of bitcoin (beyond basic payments) described in the previous video tutorial would rely on a broader variety of scripts. Most of bitcoin Script’s potential has remained untapped until this day.

Bitcoin’s two most basic scripts: ‘ScriptPubKey’ locks bitcoin into the recipient’s wallet, and ‘ScriptSig’ unlocks the funds by checking the digital signature

Now, let’s see how these five technological building blocks interact to create basic bitcoin payments. The video shown on the right is a little bit technical, and it’s fine if you don’t get every detail the first time. It will still shed additional light on how bitcoin really works, so try to watch it till the end!

So what’s new here?

So far, this bitcoin crash course has shed light on two crucial aspects of bitcoin. First, bitcoin is a network of computers that relies on cryptography, a peer-to-peer protocol, and a scripting language to maintain a shared, transparent, permissionless, append-only, decentralized ledger of transactions. Second, bitcoin allows for transacting digital assets (possibly tied to real-world assets) without trusted third-parties. The bitcoin “currency” can potentially represent anything that people consider valuable. Because of all these features, bitcoin is considered the world’s first decentralized cryptocurrency.

Not every feature of bitcoin represents an innovation though. Cryptography, peer-to-peer networking, or digital signatures existed long before bitcoin. So what’s new?

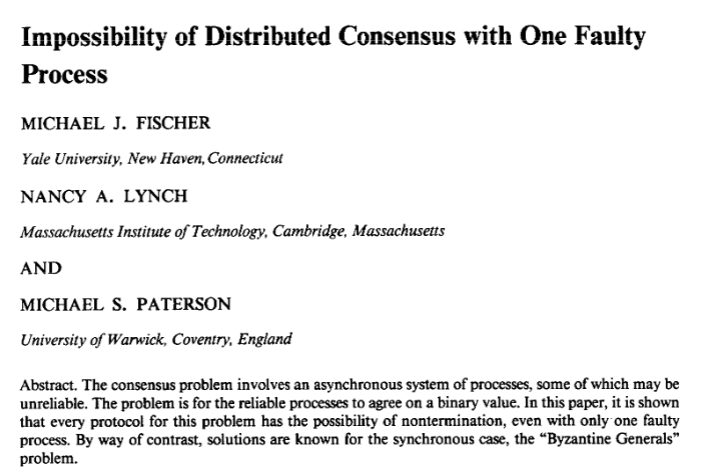

Distributed consensus and trustless transactions

The Fisher-Lynch-Paterson theorem proves the impossibility of achieving consensus about what is “true” in a decentralized (or distributed) network wherein some users are dishonest. Bitcoin offers a practical solution to this theoretical problem.

To bypass this theoretical problem, bitcoin does two things. First, it provides financial incentives for network users to tell the truth—that’s why miners are rewarded in bitcoin for their “proof of work.” Second, it compromises on the timing of the consensus by accepting a latency of 10 minutes on average to process a transaction, and of 60 minutes for the recipient to become close to 100% sure that it can never be reversed or canceled. These are the costs of achieving distributed consensus in a network with no central authority, and wherein some users are dishonest. Put differently, since bitcoin works without having to trust every user in the network, bitcoin is said to enable trustless transactions.

Digital scarcity and ownership tracking

Taken together, bitcoin’s properties create the possibility of generating digital scarcity in a secure, decentralized environment. This is quite a big deal because, in a digital world made of 1’s and 0’s, anything can easily be copied. In fact, computer design is premised on the ability to easily copy and transfer digital files. But things that can be copied without constraints are, by definition, not rare, and this affects their value—usually negatively. One of the primary reasons why bitcoin has value is because it is scarce,and that scarcity is protected by design. Besides, the bitcoin blockchain enables tracking who owns what at any point in time. The music industry lost billions in revenues when music files became easily replicable in the digital world (that is, when they ceased to be scarce). Imagine what a technology like bitcoin could have changed in this context! An essential property of bitcoin enabling digital scarcity is that it prevents “double-spending”—that is, copying a bitcoin digitally so it can be spent twice. View the video to the left to see how bitcoin prevents “double-spending”.

The bitcoin ecosystem

Bitcoin is not a corporation. It does not have shareholders, managers, or even employees. Bitcoin is not exactly an industry either, though the innovations it’s bringing about are giving birth to one (or several). The bitcoin ecosystem is best described as a community. Let’s take a look at the primary stakeholders involved in this community.

Bitcoin users

Bitcoin users are individuals who use bitcoin to make payments or simply hold bitcoin as a speculative store of value, hoping to make a profit. There are many discussions about whether speculators are a good or bad thing for the community as a whole, but they are beyond the scope of this bitcoin crash course. For now, let’s see how one can use bitcoin to make payments (view the video on the right).

Since bitcoin's creation in 2009, we have seen ups and downs in the journey of bitcoin adoption. The general trend appears to be optimistic, considering the time it takes for a revolutionary technology relying on network effects to reach the critical mass for everyday adoption. This is to say, the general public will have to feel comfortable using bitcoin for daily transactions like how we use cash issued by the central banks today. Governments have been investigating different possibilities, and overall, more and more governments are taking a positive stance on bitcoin (e.g., Japan, Singapore and India). As with any cutting-edge innovations, it takes the flexibility for emerging use cases to take shape and be clearly seen.

Interestingly, the previous video also shows that, while it is possible to use bitcoin without involving any third party, in practice, many users do rely on third-party service providers to buy, sell, store, or exchange bitcoin. Bitcoin has created an industry encompassing sub-sectors such as wallet providers, exchanges, payments and mining. An important source of funding has been from the venture capital firms.

Venture capitalists

Venture capital (VC) firms invest millions in early-stage bitcoin startups, take huge risks, and play a crucial role in shaping the bitcoin community’s trajectory. Since 2015, many have noticed that the bulk of VC investment has shifted from pure-play bitcoin startups to blockchain technology startups—that is, startups not necessarily relying on the bitcoin currency, but instead on potential applications of the underlying blockchain technology.

The Bitcoin industry—Third-party service providers

There are many different types of third-party providers in the ecosystem. They are typically private, for-profit firms funded by VCs. For the sake of conciseness, this bitcoin crash course focuses on four that are particularly important in bitcoin’s early years:

- Bitcoin wallets: Many companies offer wallet storage solution with upgraded security or convenience. Some sell hardware wallets to allow for offline storage of bitcoin holdings, which decreases the risk of cyber attacks. View the video to the right to learn how a basic wallet bitcoin works.

- Bitcoin exchanges: Exchanges are private companies that allow bitcoin users to buy bitcoin (e.g. with U.S. dollars), sell bitcoin, and exchange bitcoin for other cryptocurrencies (e.g. Litecoin).

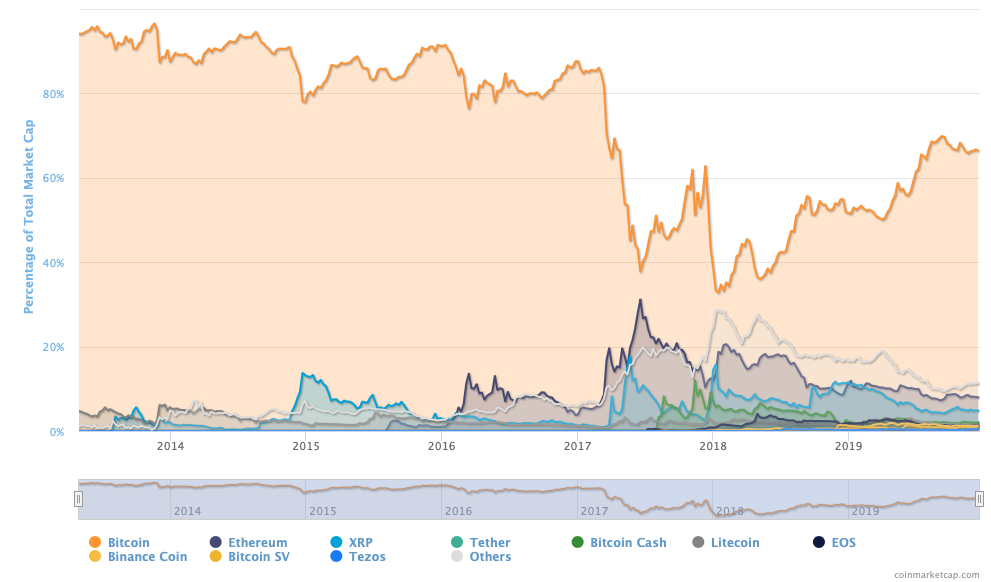

Note: Following a period when only a handful of cryptocurrencies existed ('09-mid '13), developers have created hundreds of cryptocurrencies representing alternatives to bitcoin (called “altcoins”). In terms of market value, bitcoin has shifted from a dominant position assuming more than 90% of the total cryptocurrency ecosystem, to a lower market share of 65%. Cryptocurrencies such as Ethereum which focuses on the ability to support smart contracts, and Monero which features better privacy provide novel solutions to address the old intermediary problems.

- Bitcoin payment processors: These companies offer services to help merchants accept and process payments in bitcoin. They typically charge a small fee and offer merchants the possibility of never having to hold bitcoin. To do that, they convert the payer’s bitcoin into local currency (e.g. U.S. dollar) before they reach the merchant’s wallet.

Bitcoin market share over time.

Bitcoin miners: Bitcoin mining is a computing power intensive process that is more effectively performed by specialist equipment. In addition, miners pool their computing power together to increase the probabilities of winning the rewards. Mining companies thus were established to fulfill these two categories of demand: mining hardware and mining pools. Cloud mining has also emerged as another option, whereby anyone can pay for the service provider to mine and earn rewards.

If you’ve reached this point in our bitcoin crash course, the video on the right should be easy for you to understand.

There are two general concerns the community has about mining pools. First, pooling leads to a concentration of computing (or “hashing”) power in the network as well as in specific geographic areas, thereby making bitcoin less decentralized, and possibly less secure. Today, most bitcoin are mined in China (check this for more on how a mining facility looks like). Second, as the mining reward halves every four years, it is unclear what miners’ incentives to verify transactions will be when the reward they get for their “proof of work” decreases in the future. The most recent halving event took place in July 2016, by which the reward went down from 25 to 12.5 bitcoin per block. Next halving is estimated to take place around June, 2020.

Nakamoto believed that transaction fees would progressively replace block rewards, that is, bitcoin users would have to pay miners (fee <1%) to have them verify transactions and add them to the blockchain. The problem is, mining is costly (in hardware, electricity, and rent) and thus only profitable when the bitcoin price is high enough to cover these costs. This is the operational risk miners have to take.

Bitcoin core developers

Bitcoin core developers are real people who give their time to maintain bitcoin’s “core” software (e.g. fix bugs), improve it, and help the network to scale. What do they do exactly and how can one join the team? Listen to a core developer talk about his job in the video on the right.

Now, you may be wondering… How many core developers are there? Less than fifty developers in the world are in charge of major developments. That’s quite a responsibility…but how do they get paid for their work? Well, they don’t (at least not directly), because bitcoin is not a corporation, and its developers are not employees. Currently, bitcoin developers are funded through a “Sponsorship Programme” through which funds are raised to support bitcoin development. .

Disagreements can emerge in the bitcoin community. For instance, since 2015, the bitcoin community has had heated debates on how to scale the bitcoin network going forward. Some disagreements result in part of the community launching their own alternative, non-compatible version of the software, leading to the creation of a new cryptocurrency (an event called "hard fork" which results in a "forkcoin").

Merchants accepting bitcoin

Merchants have several incentives to start accepting bitcoin. First, the bitcoin user demographics are quite attractive—they tend to be tech-savvy people in the higher income brackets. Second, settling bitcoin payments at the point of sale is mobile-friendly, transaction fees are between 1 and 2.5 percent lower than those charged by Visa or Mastercard, and there are no charge-backs. Third, settlement takes seconds (including internationally) when using the services of a bitcoin payment processor, which is faster than credit card payments.

Regulators

Is bitcoin regulated? Yes and no. As long as bitcoin payments remain private, no specific regulation applies (in most countries). However, tax offices have provided guidelines on how to declare capital gains realized in bitcoin. But as soon as third-party businesses are involved (which is most of the time), bitcoin is actually heavily regulated and a number of enforcement agencies are involved. Some would argue that bitcoin regulation in the U.S. is actually a “nightmare”. View the video on the right to see how this works.

National regulators have been experimenting in their approach to bitcoin. For example, in late 2015, the New York State Department of Financial Services (NYSDFS) started to issue BitLicense to businesses conducting activities related to virtual currencies. In 2017, Japan further approved the acceptance of bitcoin in retail as a legal currency, and eliminated consumption tax on bitcoin transactions. The Japanese government is officially supporting the use bitcoin as a payment. Currently, Japan accounts for about 20% of global fiat/BTC trading volume.

On the other hand, in the US, the Security and Exchange Commission (SEC) has rejected multiple applications for bitcoin exchange-traded funds (ETF). While the Chinese government is cracking down on bitcoin exchanges, but it is heavily investing in blockchain as a technology. Overall, entrepreneurs are trying to gain legitimacy with regulators in this regard, and some countries have shown to be more flexible than others.

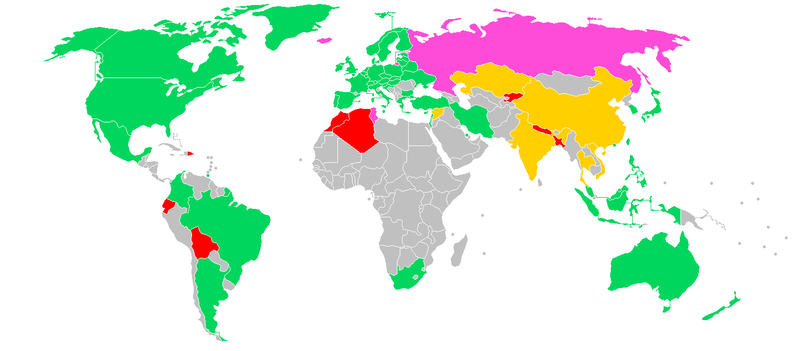

Supplementary material: Bitcoin regulation in selected jurisdictions

Legal Status of bitcoin (As of December 2019). Red indicates where bitcoin is banned, Green indicates legal, and orange and purple indicate ambiguous regulation.

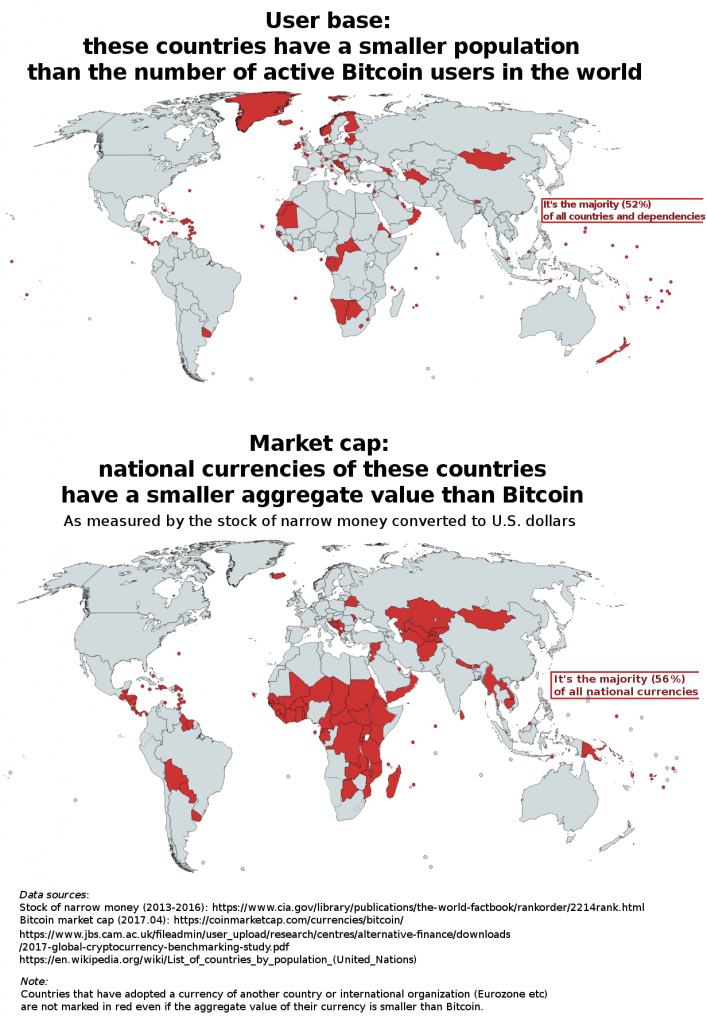

Source: https://www.cryptocoinsnews.com/bitcoin-now-larger-fiat-currencies-europe-americas-market-cap/

The current state of bitcoin:

Bitcoin has reached several important milestones so far. For instance, bitcoin is now larger than quite a few fiat currencies in market cap (e.g., in Bolivia, Paraguay, Thailand, Sudan and more) as well as user base (e.g., in Norway and Finland). Bitcoin has also gained wide awareness and acceptance among retail and (some) institutional investors.

In 2019 bitcoin completed its 400 millionth transaction. As of July 2019, bitcoin is processing 360,000 transactions every day. In the same year bitcoin also crossed its cumulative transaction fees of 1 billion USD.

Wrapping up the bitcoin crash course:

The future of bitcoin

Like any major technology adoption (consider the Internet as an example), mainstream bitcoin adoption requires the true value of the technology to be unpacked at the right time. Some believe that the bitcoin blockchain is where the revolution lies and is bound to thrive despite the ambiguity in governance and regulations.

On the other hand, financial institutions have been exploring private blockchains which are not transparent, permissionless, or append-only, so they don’t really need incentivized miners, because in this context distributed consensus can be achieved by other means. Private blockchains, thus, are very different from the bitcoin blockchain, and far less innovative.

Some say the future lies somewhere in between. R3, the consortium consisting of major global banks, predicted that the future of central banks could be either open and permissionless blockchains or closed and permissioned distributed ledgers. Moreover, some have shifted their focus to blockchain software platforms that have the ability to handle self-executing smart contracts built on distributed consensus.

Supply and demand for bitcoin, as well as the ongoing development of the bitcoin technology and ecosystem, will drive the price of bitcoin going forward. Still, as the most basic blockchain implementation, bitcoin adoption shall serve as a key indicator for the overall readiness of the blockchain infrastructure that sets the stage for mainstream adoption.

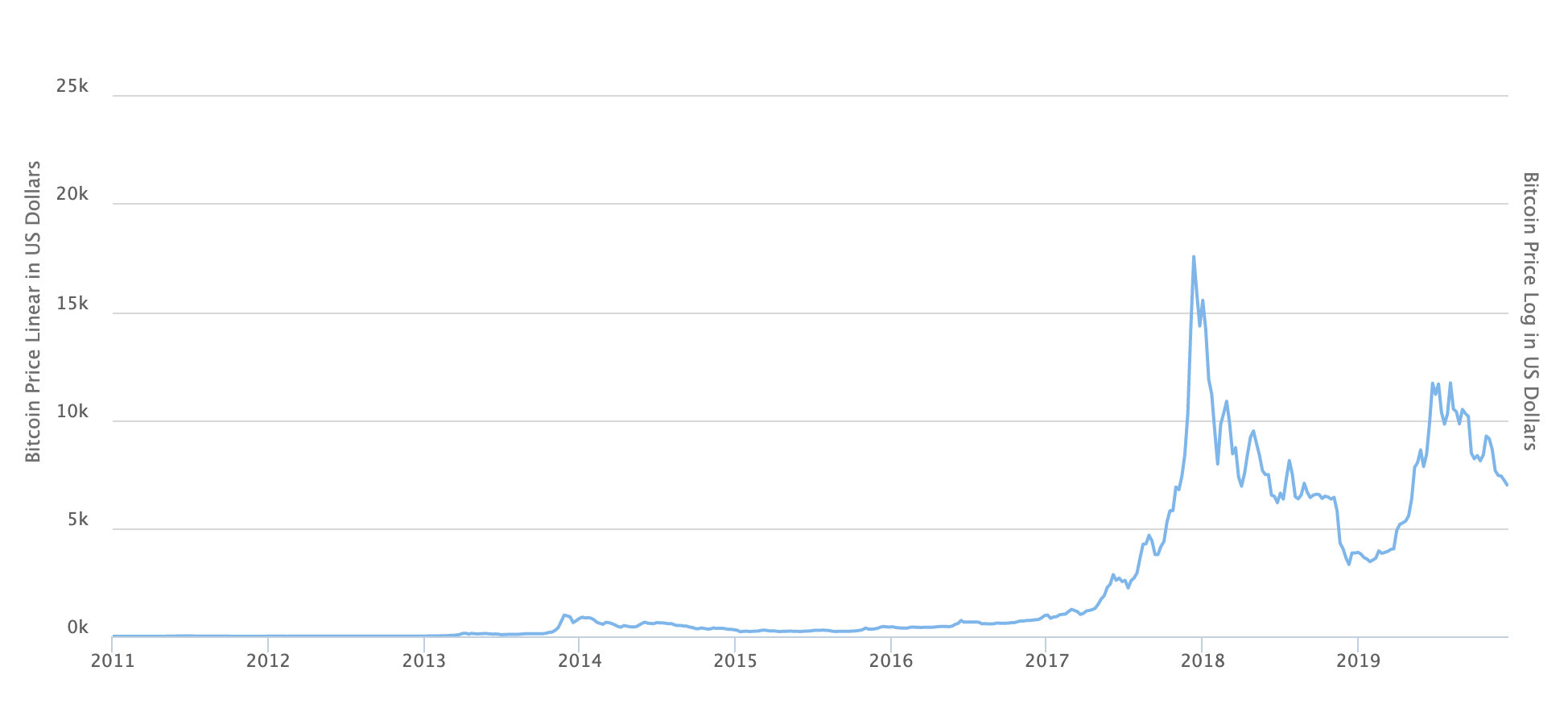

Source: https://www.cryptocoinsnews.com/bitcoin-now-larger-fiat-currencies-europe-americas-market-cap/ The evolution of bitcoin’s price in U.S. dollars since 2011

Supplementary material: A fascinating discussion about the future of bitcoin and blockchain technology involving leading experts.

This ends the bitcoin crash course. Thanks for taking it! To keep an eye on bitcoin, consult the latest network statistics. And check this page every now and then as we’ll keep updating it with the latest developments.

To cite this bitcoin crash course:

JP Vergne, C Lomazzo, Y Hsieh, N Ahmed. 2019. Bitcoin crash course. Accessed XX/XX/202X, www.ivey.uwo.ca/scotiabank-digital-banking-lab/education/bitcoin-crash-course/