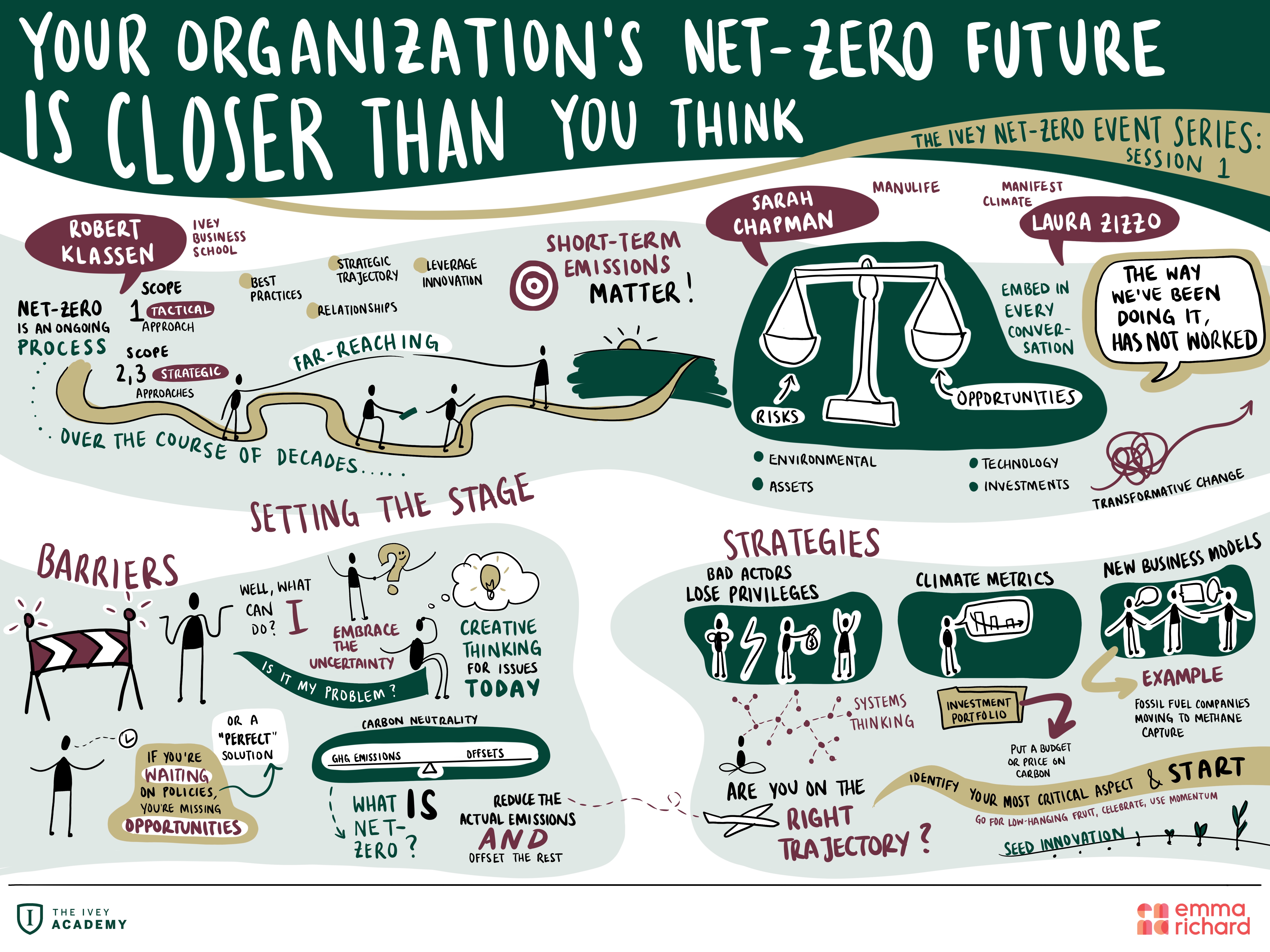

The Ivey Net-Zero Series: Your organization's net-zero future is closer than you think

Artwork by Emma Richard (IG: @itsemmarichard)

In this episode:

The transition to a “net-zero” climate emissions economy will have profound implications for all organizations, not just those in heavy-emitting sectors. Many leaders are making long-term commitments to climate action and the forces driving this transition are already building compelling momentum: investors are changing perspectives on future value; technologies are maturing; policies are shifting; and consumer pressure is on the rise. Consequently, marginal efforts by organizations and delayed leadership action are becoming increasingly risky strategies.

But just as important, transformative opportunities could shift or fundamentally restructure key aspects of a firm’s business model, value chain, and competitive positioning. In the first episode of the Ivey Net-Zero series, our panelists explore key topics, including:

- What are the strategic implications of the net-zero agenda for business?

- How are the growing expectations of key stakeholders impacting or disrupting existing business models?

- How can firms develop and navigate a successful path forward, effectively balancing transformative long-term climate targets against short-term imperatives for action and investment?

For this episode hosted by Ivey Professor Mazi Raz, we were joined by two of corporate Canada’s leading voices on strategic climate action – Sarah Chapman, Global Chief Sustainability Officer, Manulife and Laura Zizzo, Founder & CEO, Manifest Climate – along with Robert Klassen, Director, Centre for Building Sustainable Value, Ivey Business School.

This episode was originally recorded as a livestream, and you can read an Ivey News Recap of the event here: Net-zero future for business may be closer than you think.

Other ways to listen:

Note: the views, thoughts, and opinions expressed in this multimedia content do not necessarily represent those of Western University or Ivey Business School and its affiliates. This content has been made available for informational and educational purposes, and its appearance on the Site does not constitute an endorsement.

About the Ivey Net-Zero Series

Hundreds of businesses are making commitments to achieve net-zero greenhouse gas (GHG) emissions by 2050 (or earlier) in line with the goal of the Paris Climate Agreement. These commitments are being driven by a range of factors including investor pressure, the risk of stranded assets, evolving national policy frameworks and ratcheting societal expectations. The urgency for action has been accelerated with the dire warnings of the most recent IPCC Report and the forthcoming Climate COP in Glasgow in November 2021.

Establishing a credible path to net-zero presents major challenges, uncertain risks and transformative opportunities for firms to shift or completely alter key aspects of their business model, value chain and competitive positioning. Firms can capitalize on strategic opportunities, such as the possibilities of new products, services and markets, and novel ways of interacting with or serving customers.

However, much of the discourse ‘lumps together’ these strategic considerations with the technical complexities of pathways, technologies, solutions and measurement, which impede clear strategic thinking on the net-zero transition. As we enter a decade of unprecedented transformation and disruption, the leaders will likely be the firms that take a strategic approach to net-zero – aligning ambitious emissions reductions with long-term business strategy, innovation and value creation.

Created in collaboration with the Centre for Building Sustainable Value, the Ivey Net-Zero Event Series will focus on the strategic implications and opportunities for business in pursuing a net-zero strategy for climate emissions.

The series is informed by Ivey’s new research initiative, Canadian Corporate Strategies for Net-Zero: Planning for the Long Term, which is engaging and convening a unique cross-sector group of leading Canadian businesses taking bold climate action. Through exchange, dialogue and research, the initiative is identifying the opportunities and decision points to build ambitious and actionable net-zero strategies that position firms to thrive in a net-zero future.

The series will also tackle the new agenda for public-private collaboration to achieve ambitious climate goals, and will foster engagement with key climate solutions through an interactive application of the En-ROADS simulation.

Additional Resources:

Ivey Business Journal — Why Directors Must Own Sustainability

Manifest Climate Whitepaper — Closing the gap: Using the TCFD Data and Insights to Accelerate Change, and Five Keys to Success

Ivey Centre for Building Sustainable Value — The transition to net-zero: what are Canadian companies committing to?

Ivey Centre for Building Sustainable Value — Corporate Strategies for Net-Zero

Episode Transcript

MAZI RAZ: Hello, everyone. Welcome to the Ivey Academy podcast where we discuss current topics in leadership and organizations, unpack the latest research in the field, and look at trends across different settings for insights to share with our audience. My name is Mazi Raz and I'm the director of Learning, Design, and Strategy at the Ivey Academy.

Before we begin, I'd like to encourage everyone to reflect on the long-standing history that has brought you to reside on the land and the traditional territories of the Indigenous peoples where you live, work, and play. We invite you to seek to understand your place within that history. We have the Ivey Academy acknowledge the Anishinabek, Haudenosaunee, Lūnaapéewak, and Attawandaron, and other peoples as the original caretakers and the storytellers of the land on which we are situated. We commit to honoring their past, present and future. We also to commit to working towards creating a just, vibrant, and inclusive community for everyone.

This episode is about your organization's strategy toward a net zero future. We bring this to you in co-production by the Center for Building Sustainable Value at Ivey Business School. This is one of the few sessions we are dedicating to this important topic. I hope you make plans to attend to the whole series on the transition to a net zero climate and emissions economy. As you can imagine, this is a vast, highly critical, and fast evolving topic.

Many businesses, small or large, in many sectors are making commitments to achieving net zero greenhouse gas emissions by 2050 or hopefully earlier. These commitments are being driven by a range of factors, including investor pressure, risks to assets, evolving national policy frameworks, and of course societal expectations. The urgency for action has accelerated with the dire warnings of the most recent IPCC report as well as the dialogues coming out of COP26 in Glasgow.

Business leaders must develop and invest in a credible path to net zero for the firm. This presents major challenges and opportunities, which can fundamentally transform a firm's business model. Firms must begin now to identify and capitalize on these opportunities. However, much of the work ahead is crowded with complexities of measurement, emerging technologies, and untested solutions. These would likely cloud strategic thinking on the net zero transition.

In our live streams we will begin to explore what all these means to businesses, to strategy, to innovation, and to the function of today's leaders. To set the stage for us I will be soon asking Dr. Rob Klassen to share his thoughts and provide the necessary backdrop to these dialogues. Rob is a professor at Ivey and the director of Centre for Building Sustainable Value.

In addition to Rob, we're also joined by Laura Zizzo and Sarah Chapman as our guests and panelists. Laura is the founder and CEO of Manifest Climate and Dr. Sarah Chapman is the global chief sustainability officer at Manulife. As I mentioned, to get us started I'm going to ask my colleague and a professor of mine, Dr. Rob Klassen, to help us get started.

Rob, the center for building sustainable value is pursuing research and advancing in research initiative on the strategic implications of net zero, so it would be great if you could help us set the stage for today's discussion.

ROBERT KLASSEN: Thanks very much, Mazi. Happy to do so and thank you very much for the invitation to join today's panel. I think net zero as a conversation has begun, I think, for many companies, but in many respects it still is an ongoing process that's going to unfold over the next number of decades. It's really this time frame that makes it such a difficult area to address at this point.

It's very hard for managers to think that far, to be fair, but when we think about the range of impacts that businesses have on the climate and the way climate change sort of feeds into strategizing within organizations I think it's important just to set some language here. First of all, if we just think about carbon and carbon emissions it's actually a little more complex than that. It usually includes a range of six or seven different basic classes of gases and for the most part carbon dioxide is the one we focus on most.

So the others do have various factors and some of them are actually quite potent in terms of ramping up the greenhouse gas effect that we see going on now. With methane being significantly stronger than carbon dioxide, we see less of it entering the atmosphere.

Now if I bring the focus to your organization or organizations that you might work with, we usually think about climate impact happening at three different levels of scope here. The first really being relative to your organization direct activities that are going on within your firm, the second scope now incorporating the sources of energy that you would use again within your direct operations, and then the third scope, which is the most difficult for many organizations, first of all to assess and then to start to plan around reductions, is really the scope three.

You'll notice that it extends both upstream in your value chain, capturing things around capital equipment, around supplier interactions, around movement of goods and services and so on getting to your organization. Then on the downstream side we again have similar sorts of interactions with customers. What does the customer do with your product? How does the customer relate to your service? Even in the financial industry there's also the implications in terms of the investment portfolio for different firms, whether it's equities or debt obligations, as well ultimately playing through to what we consider scope three.

So if we think about from an action-based perspective and how we might translate all of these different scopes into what a firm might consider, for purposes of an oversimplification of conversation, I think it's fair to sort of look at your scope one, what happens internally in your organization as being for many organizations. Not all, but for many organizations a bit more tactical in nature in the sense that it's something that you can understand in a very real way today.

It's also something that you can plan around where you're going as an organization because you have a huge amount of control over that. As you start to move towards scope two and three, the complexity and the strategic nature of that also expands dramatically. This is where rightfully many organizations are struggling with how best to move forward. So it becomes a process of unpacking this and starting to think strategically about beyond your boundary within your firm and often where you have very indirect control what changes are needed, what changes might you make.

Now we also can look here at what are some of the key challenges that we have to sort through as we work through this? Well, the first one that may have struck you as you sort of think through some of the implications of climate change and climate risk for your organization is that the natural gravitation is to look towards best practice. What works well and what should we then adopt in that sense?

The challenge when we talk about climate change and carbon reduction is that this is very forward-looking. It's not as simple as looking back at what other firms have done, identifying their best practice over the last two to three years, and say this is something we should adopt. So whether it's from a research perspective or whether from a corporate strategizing perspective, we're really moving into a lot of unknowns here, a lot of uncertainty.

In addition, the relationships that are required to change as we think about a net zero strategy also are much further reaching than many other business problems that we've dealt with in recent years. So we think about how that shapes our interactions with our customers, what we're doing in terms of working with suppliers, all of this is on the table when we talk about net zero.

In addition, because it's such a long-term time frame you hear the 2050 and some of you might be saying this isn't going to affect me, I'll be retired by that point in time. That might be fair, but the stage needs to be set at this point in time in terms of concrete action to move towards that long-term term strategy.

The fourth major challenge, at least from my perspective, is thinking about how to leverage innovation. Clearly there's some near-term improvements that can be made, particularly around scope one and tactical things to think about. But the more difficult area to really be in exploring and strategizing is what technologies and what gaps need to be filled in the intermediate to longer term?

Is it your firm that's going to do that innovation? Are you looking to acquire that? Are you looking to seed entrepreneurs and look at the entrepreneurial landscape as a source of innovation in this space? All of that ultimately feeding to thinking through different business models as you sort through what your strategic options are.

So if we think about the changes in the space here, we've begun a research project here at the Centre for Building Sustainable Value looking at how we can start to transfer some of these broad sectoral approaches that you see out there being developed now. All of those are important to have in place, or at least understandings around those in place, but managers then need to move the next step. What does it mean for my firm?

What does it mean for my customer base? What's it mean for my supply base as I think through net zero given the scope one, two, and three that I had on the initial slide? The other piece about this is really trying to understand and learn how to navigate this pathway forward. Where do you engage stakeholders in this? How do you pass the baton, so to speak, between what I'll term generations of managers, given that many managers will move up to organizational ranks but they'll often transfer or move to different organizations and you inherit goals and you pass on goals as you move through those particular different stages of your career?

The last piece that is really about how do we explore different options? How do we think through what it means for my business today and tomorrow? And much of the discussion, I understand why, has been really focused on what are the risks? What if we don't do this? What happens if we move to a different supplier?

But what I would like to suggest, and I think our panelists will also speak to that, is that there's also opportunities in this area as well. It's not just about risk. In fact, this is where new business models can emerge and new growth opportunities can emerge as well, and likely the new industry forms will emerge, too.

So in essence, what we're trying to do now is focus on this last piece as part of this ongoing research project where we're trying to understand what are some of the operational and market aspects that play into the risks. A lot of companies are focusing on this right now. At the same time, how are we thinking longer term? How are we looking beyond the two, three, five year time horizon to look at where the key opportunities are around maybe it's resource efficiency because certainly you can reduce carbon footprint that way, maybe it's around the energy sources, but just as importantly, the opportunities to develop new markets through innovative products and services, identify new customers, bring them into your portfolio, and so on.

As we've noted over the last year and a half with all the difficulties that many supply chains have experienced, these types of issues are going to continue forward in the context of carbon as well. How exactly can you make your supply chain more resilient given that there might be physical changes in the environment due to climate change and so on in place as well? Ultimately trying to move forward towards reducing the carbon footprint and the financial impact of the risks and ultimately grabbing or moving forward and achieving more on the opportunities side as well.

MAZI RAZ: I very much appreciate that, Rob, and thank you for not only setting the stage about what we're talking about, but also giving a sense of what your net zero research initiatives are about. As you mentioned, this is just an ongoing research, so these are great, excellent questions that you're raising. Answers to which hopefully will show up as we go forward with further research with collaboration of many involved parties.

I want to bring Sarah into the conversation. Sarah, from your perspective, someone who is in an industry, why is the transition to net zero such a strategic importance for firms across all sectors, not only those in the heavy polluting industries?

SARAH CHAPMAN: So a couple of things, and I think this set up well by Robert, there's both the risks and the opportunities side of climate change. For Manulife, we're both life and health insurance company with also a property casualty reinsurance business as well as a third party asset management side of the business with Manulife Investment management. So for us as we think about climate change and climate risk, there's the risk and opportunity side for our business, if you think about insurance, there is certainly the consideration of climate risk if you think about just both that we talk about physical risks and transition risks.

If we think about the physical risks of climate, floods, wildfires, these are considerations that we've been building into our actuarial models for a long time in terms of considering what the impact of climate change will be from an insurance perspective. On the asset management side of things, if you think about things like transition risks in these industries that actually transition, things like utilities, oil and gas, et cetera, there are both risks that those investments will not remain competitive, but also there's an opportunity side to climate change that's really, really important.

That's around the additional technologies that are going to be needed, the additional innovations that are sitting in labs right now that need investment that will be very compelling from a financial return perspective moving forward. A very tangible example of this in terms of the opportunities is renewable energy.

Manulife has been investing in renewable energy for 20 years and we've done that not because climate change was the hot topic at Davos back then, but in fact, because it was just good business and there were strong returns there. You know, and we are continually tracking what are the additional opportunities of climate change? How do we invest in the solution towards climate change?

In terms of net zero, and Manulife has made a commitment to transition our portfolio to net zero by 2050, frankly what's far more important than net zero right now is the focus on actual emission reductions. In some ways I always caution the discussion around net zero with the need to be focused on actual emissions reductions, too. In some ways I worry about all of our net zero by 2050 discussions because it certainly sets the time frame so far out that none of us will be in the roles we are by the time that comes.

What's more important is those shorter term targets. That's what the science-based target initiative is certainly advising companies around inviting companies to be setting shorter term targets to actually decarbonize their portfolios in the immediate term. So that's always my caution around net zero and having to dig in, but that's sort of setting the frame for where we're going.

[MUSIC PLAYING]

MAZI RAZ: Sarah, thank you. I don't know about you, but I do plan to be here in this role in 2050, but hopefully not talking and advocacy about net zero. I hope by then we have significantly overcome this challenge. So thank you very much for that.

Laura, both Sarah and Rob were talking about both the risks and opportunities that are present in this case. As one of the leaders and innovators and advocates in this practice as you are leading manifest climate, what do you think about this? What do you think about the opportunities that exist, and how do you go about advising firms in stepping into this journey?

LAURA ZIZZO: Yeah, thanks for that. That's one of the reasons I stopped practicing law, because as a lawyer it's all about the risk and I realized people are not asking the right questions about how we make transformational change. We are talking about transformational change and one of my partners at the law firm said to me, that's not our business model. We wait for questions.

They didn't have the questions because they didn't have the information because the professional service providers were not actually providing the information. It was this definition of insanity that we're talking about these targets and we're not actually doing anything. I want to point out we're in the middle of COP26 right now. 26. That means there's been 26 years since we had the UNFCCC signed and that said we have to avoid catastrophic climate change. So the exact amount of time between now and 2050.

Between 1992 and now, we have seen increasing global emissions. Something has to change. The way we've been doing it has not worked. So just to put that in perspective, in the early '90s would we have been able to have this Zoom call? We went through the digital transformation and many of us were not using emails, many of us didn't have access to the internet, there wasn't HTML.

So now 26 years later we've had a transformation. We don't have to leave our house to do our work. We are in the middle of a transformation. So we're talking about that. So what we need to do, the opportunity is in every single discussion, every single decision, we put a climate lens on it. That's what we have to do.

I love what you said, Sarah, about 2050, what's that mean? It means right now this decision, how does that contribute to that? So I think we need to reframe this and the opportunities are significant. So and I've been working on this topic for my whole career, and I said, you know what, we just need to inform decision makers with how to think about this.

So that's what Manifest Climate is doing. We're trying to help companies tell their climate story by understanding what's important. How do you embed this into the ethos of the organization so everyone feels like they can tell their story? The other thing I want to talk about is the opportunities around just thinking about it from a financial risk perspective.

So the TCFD, hopefully will get into more detail about this, but the Task Force for Climate Related Financial Disclosure is asking you not just to report your metrics and targets. It's asking you to think about how you govern, what your strategic approach is, how you're integrating this into a risk management perspective. If we unlock the power of decision makers to understand what we're doing with this transformation, there's a huge opportunity to not only have a sustainable future, but one that thrives.

So we talk about the movement from sustainability discussions to viability discussions. You just aren't going to survive unless you figure out a way to transform. So we're just kind of at the tip of the iceberg about all the opportunities that we have in front of us and it's a really exciting time.

MAZI RAZ: Laura, thank you. You mentioned that we have been at it for at least 26 years and something has to change. I get a sense that we are talking about what needs to change. Rob mentioned that it's not just about the risk, it's risk and opportunities. Both Rob and Sarah pointed to one thing that does need to change is the mindset about how to approach this.

And Rob mentioned, for instance, the time horizons. That we need to figure out a way of setting the strategies that are actually much more long term. We need to start doing them now. In your experience with the companies with whom you interact and you consult, where do you see some of the obstacles in terms of companies coming on to this journey with you?

LAURA ZIZZO: I think they just don't think it's their problem yet. Like, Sarah. I think once you realize it's not just Sarah's problem, it's everybody's problem, then you can understand the opportunities. We're in Canada, most of us, right? There's a little bit of a cognitive dissonance around where our wealth comes from and where our wealth will come from and how we make that transition.

The future is going to look a lot different than the past and just having the imagination about what it could look like, we know what we need to do and we know we need to change. I often say it's like the person who says I'm going to quit smoking by 2050, but just one more pack. We know that that's not good for us yet we still do it because we don't see a way out. We're addicted.

So we have to think about what is the thing I can do right now that moves us in that discussion. It's not my sustainability team's problem, we have to understand how it's everyone's problem and their decision. So I think it's mostly just an educational component and an empowerment of decision within an organization.

But I would love Sarah and Rob's thought on that, too.

MAZI RAZ: Let's go to Robert for a second, and then I'm going to flip the same story to Sarah. Rob, I understand that you mentioned that this is in the early stages of your research, but in your discussion and research can you point to any logical reasoning why we may experience some barriers in thinking about this process in a combination of risk and opportunities on the horizon and then a much bigger picture that you laid out for us?

ROBERT KLASSEN: Let me kind of point to just a couple of things, and certainly I 100% agree with Laura's comments about some of the rationale and some of the reasons why we're kind of at sometimes a bit frozen like the deer in the headlights. I think part of it is the definition of, is it my problem? And that's still, unfortunately, is a bit of an ongoing debate for some.

Part of the rationale being I'm going to wait for public policy to sort this out, I'm going to wait for 100% unanimity on the science, and I'm going to wait for, wait for, wait for. It's human nature, you know, I'm at fault as much as anyone else, but it's this tendency to wait for absolute certainty before we can act that I think is actually a real barrier. So it's that willingness not to make a step of faith, because I don't actually think you need to have faith to move forward on this, but it's a willingness to embrace some of the uncertainty and ambiguity.

In the process of doing that, think creatively with your team about what that would mean for our company. How would it look if we could even cast for 10 years and then bridge to something beyond that in terms of what it might do for us to move to a low carbon type of operation, value chain, customer base business model as we think forward?

The other point that I'll suggest is that the conflicting signals that we sometimes see from public policy, from a variety of other environmental, and I don't mean natural environment, but business environmental factors, I think also sort of cede some of the tendency to kind of say, well, should we just wait to acquire the perfect solution? Where is the silver bullet that we're looking for?

Again I think this is very much something that we're sort of in the tyranny of the urgent. How do we solve today's supply chain problems, not how do we solve tomorrow's clear urgency around climate change? So I'll stop there, but I think there are real challenges that many organizations and managers face.

MAZI RAZ: Thank you. Sarah, both Laura and Robert are suggesting that part of this conversation that's happening is that the state level, at a policy level. It's at a level that many organizations are simply or businesses are just simply waiting for the solutions to come from policies, the solutions come from the state. In your experience, how do you help characterize the impact of climate change and sustainability even when we're talking about investments?

SARAH CHAPMAN: Yeah, so from where I sit there's certainly an acknowledgment that we can't wait for policy to come. And again, as a global organization, even just monitoring policies and frankly, more importantly for us the regulations coming in this space is a very sort of reactive approach. So if you're just waiting for those policies, you're actually missing out on the opportunities. So that's my first point.

The second point is we are setting our own, things like an internal carbon budget and real price on carbon, knowing that those things are coming. We sort of need to start thinking about those now. Manulife, just given the nature of our business, is an extremely long-term framer in everything we do. From insurance perspective and investment management perspective we're thinking about the long term.

So regardless of when some of these policies and regulations are coming, we're looking 30, 40, 50 years in the future and we know they'll be there. Our framing is really that long-term nature and therefore not waiting for the policies. You know, I would say that maybe a couple of years ago the reason that companies were kind of getting into this space and setting these targets was kind of looking around going everybody else is, we should probably be doing this, too.

I think we're at the financial services level, we're far past that. We're on that journey and not just because others are, but actually realizing both the risks and the opportunities as it relates to climate and starting to see those like really tangibly come to bear.

MAZI RAZ: All right. Appreciate! I appreciate that very much. Sarah, a major focus of your work with companies is supporting their climate reporting and disclosure obligations to the investors. How important are investor's perspective in driving some of these ambitions and maybe changing the results that we see on the screen?

SARAH CHAPMAN: So I'll come back to the question in a second. One of the things I did just want to pick up on, what is carbon neutral? What does it really mean to be net zero? I'm going to give a perspective, there's probably competing perspectives, but I'll hope to be as general as I can and maybe give us some examples.

So when we think about carbon neutrality this means balancing the GHG emissions by offsetting, or removing from the atmosphere, an equivalent amount of carbon or the amount produced. So it's about that balance. If you get there, you achieve that often by purchasing climate credits.

So when people think about carbon neutral and a company's commitment to carbon neutral versus net zero, or a statement that they are already carbon neutral, it is this balance and getting there by offsetting, by purchasing carbon credits, or supporting things like renewable energy products.

But a commitment to carbon neutrality doesn't necessarily require a commitment to reduce overall GHG emissions. So a company can be carbon neutral. It doesn't mean they're actually committed to reducing their emissions. It just means that they're offsetting them.

In my personal point of view here, carbon neutrality frankly, is not as admirable because it often is relying on offsets. Now offsets are actually a really important thing and we can talk about those, but I want to then sort of try and explain the difference between net zero and carbon neutral. So if I take a simple example of air travel.

So let's say there are people within a given business that take 20 flights a year. Organization can achieve carbon neutrality for those 20 flights by just buying carbon credits to offset those emissions. They are therefore carbon neutral. But a net zero carbon company would need to actually reduce the number of flights per year as much as possible. As much as possible and then also be investing in those projects that would remove from the atmosphere the carbon dioxide that's produced by the emissions from those other flights.

So that's one way to explain the difference, but frankly this whole concept of net zero and what does it really mean and can we use offsets is still something that we're all figuring out. Which comes back to my point about the importance of the actual emissions reductions conversation here versus just thinking about the balancing of net zero.

But Laura, I would be very interested in how you explain to clients.

LAURA ZIZZO: For me it's so frustrating. Like I'm a lawyer right by training, but we get so bogged down on these definitions. Did you do better than last year? Did you make a decision that was better? I mean, I'm just so sick of all the targets and all of that when we don't see action now. So I think that it's becoming very less credible to have ambitions without an action plan for what we're doing right now.

So I'm less concerned. Like, if we get to net zero, great. I'm going to be super happy. Let's talk about that like 2040 to 2050 what the end result actually looks like, but right now it's like are we just on that right trajectory? So I don't really care about the difference between carbon neutrality and net zero to be honest, I just want people to reduce their emissions.

So if they're saying they're carbon neutral and there's no emissions reductions, we're going to call them out on that. We're going to say green-washing alert. But as far as how we're explaining it to our clients, this is so-- One of my PR guys actually said, how do you deal with your kids when they don't listen to you? The amounts of frustration coming from you is palpable. So like let's talk about how do we actually take away their privileges.

We are at the time right now where your privileges and your access to capital-- And you're going to see this with like decision makers not funding things-- your privileges and your access to capital will be reduced. If we don't start doing that, we're starting to see decision makers, we're starting to see capital markets moving. So the access to capital is a huge one.

There is a balance. It's not just the reduction, it's also the amount of capital going to solutions. And we know we're going to have to try a lot of things and we know we're going to have to take risks. We're going to have to change the way that we think of something as investable.

Things that are investable are going to be more investable even if we don't have the traditional economic metrics, but there's a climate metric involved. So it's up to us to say how do we talk about those climate metrics to attract access to capital for the solutions? There's a huge opportunity in every sector.

MAZI RAZ: Fascinating. Rob, I have a question to you based on the fact that you are a professor at a business school. The suggestions that Sarah and Laura are sharing with us in terms of an invitation to a reduction of emission, you mentioned at the beginning that this has huge strategic implications. Specifically, it impacts the way that a firm thinks about its business models.

In your research in your position as a professor in a business school, how do you help people disentangle this idea that moving forward for emission reduction requires a complete transformation of [INAUDIBLE] or transformation of business models?

ROBERT KLASSEN: Well I think this is part of the significant challenge that, whether I'm speaking with students in the classroom or MBA students or MSC students or undergraduates, part of the challenge is they can see potential. They can see the opportunity. In fact, a number of them go into entrepreneurial ventures that explore how we can formulate new business models.

But those also need to be really wrestled with at the most senior levels in Canadian and global corporations as well. How do we think through what a new business model might be? I came across a recent example, its public example so I can readily point people to it with Nutrien, trying to think through what a relationship with a customer might look like. In this case, a farmer, Nutrien obviously producing fertilizers, how might that look like in a new environment where I have to think strategically about this broader business model?

I'm not just selling a product into the marketplace, I'm actually now trying to rethink what it would look like. It may be in terms of facilitation with the farmer, carbon sequestration in the soil, and so on. So the whole range of different practices that once you open up the box and say, well, what would it look like if I actually see carbon as central to my strategy, combined with obviously customer service and all of the traditional metrics that we think about, there's new opportunities that really emerge in that type of environment.

Trying to work through that, I think the panel, because I just wanted to echo the observation about the diversity of where organizations are at, speaks to some of the uncertainty about how best to do this. It really requires ongoing conversations like we're having today, but more importantly within companies and within their value chains, not just the company itself but all of the suppliers and customers they interact with, to think about what does the new business model could look like.

Where do we need to focus most quickly to make some action now, to set the stage for where we need to be?

MAZI RAZ: Thank you. Anyone on the panel, Laura, Sarah, or Rob, have you encountered good examples of how businesses might have approached their business model from a fresh perspective and have reevaluated it based on the conversations we're having?

LAURA ZIZZO: I'll give an example that comes to mind. There's a lot of different ones, but we've seen some fossil fuel producers understand that there's a market for methane capture. We said, let's just stop doing the fossil fuel part and only do the methane capture part for other fossil fuel extracting companies. So I mean, transition, you're still sort of like not the best example but showing let's get out of the thing that we know is a super risky and help those people who are still doing that do less bad.

And they totally got out and divested from coal, in this case, and moved to methane capture. So that's starting to happen. We're seeing diversification across energy classes.

The one example that we use a lot is the difference of the market cap between GM and Tesla. So if you look at the difference in market cap, I don't have the numbers in front of me, but like one of them makes a lot more cars and one of them makes a lot more money. But why is that? The market's sort of going crazy. There's like a different example and now GM is moving out of regular cars to fully electric vehicles and has a plan for that.

So we can see sort of early leaders and then incumbents coming on and saying we have to have a transformational change within our own stock and our own business models to catch up to where the market's going both from a regulatory threat, because we know the inevitable policy response coming, but if they wait until those laws are on the books, as Sarah said, it will be too late. They have to capture the market and understand to move faster than the regulations probably will impose them to.

MAZI RAZ: Sarah, do you have good examples that you can share with us as you've seen organizations or businesses, they don't have to be large organizations like Tesla or GM, in changing or reevaluating their business models?

SARAH CHAPMAN: Yeah. This maybe isn't a business model, but at least mechanisms within an organization to actually be thinking about how you achieve some of your targets on this. Even within our own organization, as we set science based targets for our general account, which is our $401 billion of investments as a result of our insurance liabilities, again very long term, as we set shorter term targets to 2035, 2030, 2025 in terms of the decarbonization pathway, there are things that we need to figure out.

We need to figure out, OK, across certain sectors where are our investments are actually going to decarbonize just naturally? Where we're investing in utilities and they're just going to naturally be there decarbonizing? So how do we sort of figure out what the value of that decarbonization is?

We then are also looking at, OK, what are some low hanging fruit within the so the where we might have a holding that is overweight in terms of its carbon emissions intensity? Perhaps not performing from a financial return perspective, is that low hanging fruit that we can just divest from?

Then we're left with the rest of the portfolio where it's like, OK, we can assume this much decarbonization in the industry, we're going to take these low hanging fruit, but what do we do with the rest? Implementing an internal either carbon budget or price on carbon is a way for our portfolio managers to evaluate a deal. So when they're looking at making an investment, how do they weigh the balance of, well, here's a potential investment that maybe is a utility, but we believe they're going to be on a trajectory versus an investment that's just renewable energy, that's [? carbonation ?] time already.

So setting an internal price on a carbon budget allows the portfolio managers to give them a tangible mechanism to be able to make those trade off decisions and work towards those targets in a tangible way. So it's not a business model, per se, but it's a mechanism for the way that financial institutions can be thinking about how they shift their portfolio to net zero.

MAZI RAZ: That makes a lot of sense. Thank you to you both. We talked about business models, we talked about mechanisms and practices, and earlier we did also mention about that businesses could also have opportunities. So it's not just about investments, but you can actually think about new opportunities.

So Rob, back to your opinion, how can you imagine firms structuring their innovation approaches?

ROBERT KLASSEN: I think part of the challenge is that, because we have such a diverse audience, the lens that you choose to look at climate change, carbon reduction, net zero more narrowly, I think is different. If you're certainly in the financial services sector, it's about the types of investments you're making, about the risks you're taking, about how you're trying to move some of your portfolio in a more climate neutral direction.

For many firms and I look at much of this through an operations supply chain perspective, because that's my personal background, I start to think about what is a company doing? How much of the innovation to move towards net zero is supposed to happen internally versus how much do you want to lean on your suppliers or customers to enable that innovation?

So for example, if a consumer packaged goods company is trying to reduce their carbon footprint, their own production may have very little carbon in and of itself, it's in fact their customers using hot water for shampooing and so on that ultimately may matter much more to their climate footprint than it does just their internal operations.

So one of the questions that I think really has to be asked is if you look at your organization, to what degree are your investments in innovation, meaning internal or through acquisition or through customer interactions, is it actually focused on climate change? Is it something an add on or well maybe we'll get to that eventually or is it central to what we're trying to think about and move the business forward?

By doing that you may not have the perfect solution in the short term. I think short term action absolutely is necessary because of the reduction points that the Sarah raised earlier, but you also have to be seeding those innovations to happen longer term. So I think this is where talking to a broader set of stakeholders can provide the input that enables some thinking along those directions. So tangibly, can we look at how much is invested with a climate tone to it? How much of it focuses on suppliers? How much of it focuses on customers? And how much it focuses on internal operations?

MAZI RAZ: So instead of keeping it tangential or afterthought, how do we make it essential to our decision making and essential to all our innovation efforts?

[MUSIC PLAYING]

LAURA ZIZZO: Just to add to that, one of the things we always think about is, what do you actually do? Because it's not keeping the lights on, right? So what is your business actually do? When you think about a lot of the early work was with banks, thinking about how do we reduce the emissions coming from our branches, that's not what a bank actually does, having people in branches.

So I think scope three is just trying to help us understand. How do we interact and what do we actually do? But I actually think if you think about it from-- and I'm going to go talk about the TCFD framework here a little bit more, what do we actually do? How do we understand that our business model is going to be part of the transformation?

We haven't touched on it in the last couple of minutes, I just wanted to say the word scenario analysis because, Mazi, you said innovation. I think that is why there is that one recommendation in the TCFD for thinking about scenario analysis. It's asking us to stretch our thinking to what the world would look like if we stayed within two degrees both from a transition and physical risk perspective, and how does your business fit in?

Then once you've been stretched into that thinking then you better strategize around it. So this is the way to unlock innovation within the organization. Then once you have an understanding of that, who's in charge? So they ask you, how is the board keeping on top of this? How is your management actually tracking?

So it's not just about counting your scope 1, 2, and 3 emissions, it's thinking about how your business thrives through the transformation and scope 1, 2, and 3 is just a guide to think about that universe.

MAZI RAZ: I very much appreciate that. This whole idea of asking these questions, these very profound questions Laura that you're raising, they may appear as simplistic but they are really critical. They are some big questions that possibly we shouldn't rush into answering them right away and stay engaged and entangled, but question really to see the big system that Laura's suggesting as a way forward.

I want to ask Sarah one last question. Sarah, at the beginning, I mentioned that this is one of the series of conversations we're going to be having about this highly critical but also messy topic. If we were to give advice to our audience members and if the question that they're asking is that what can I do differently, especially within my sphere of influence? What advice would you provide to our members of the audience?

SARAH CHAPMAN: Great question. We talk about this in the broader context of ESG. Where do I begin? In the context of climate and net zero, my advice is identify where your most material or your most critical significant impact is and focus there. Don't try to tackle everything right now, just start with your most material emissions if we're talking about operationally.

Start there, get a few wins under your belt, get some confidence with management that this isn't such a scary place, and especially where you can demonstrate the value. Start there, start small, but start meaningfully. Then grow from there once you have confidence and a better understanding as, frankly, this whole space matures. But don't try and think that you'll understand it all or that you need to tackle every aspect of this space.

MAZI RAZ: Thank you. Thank you for sharing your wisdom with us. Thanks to everyone here on the panel for this really interesting and engaging thought provoking conversation that we have.

[MUSIC PLAYING]

Thank you for tuning in and listening to this episode. We'd like to extend further thanks to our guests Rob, Sarah, and Laura for taking the time to share their insights and expertise with us. Currents in Leadership is produced by Melissa Walsh, Sean Acklin-Grant and Joanna Shepherd.

Editing and audio mix by Carol Eugene-Park. If you liked this episode, make sure to subscribe to similar content in the future. This episode is the first of four in the Ivey net zero series, so keep an eye out for future discussions on climate action.

If you want to learn more about net zero as it relates to Canadian businesses, we've provided resources and links in a blog post on our website. You can also visit Iveyacademy.com or follow us on LinkedIn, Twitter, or Instagram using the handle @iveyacademy to view our upcoming events, services, and programs. Thanks again for listening. We look forward to having you with us for the next episode.

Note: This article was originally published under our former name, The Ivey Academy. We are now known as Ivey Executive Education.

About Ivey Executive Education

Ivey Executive Education is the home for executive Learning and Development (L&D) in Canada. It is Canada’s only full-service L&D house, blending Financial Times top-ranked university-based executive education with talent assessment, instructional design and strategy, and behaviour change sustainment.

Rooted in Ivey Business School’s real-world leadership approach, Ivey Executive Education is a place where professionals come to get better, to break old habits and establish new ones, to practice, to change, to obtain coaching and support, and to join a powerful peer network. For more learning insights and updates on our events and programming, follow us on LinkedIn.

Give us a call 1.800.948.8548

Give us a call 1.800.948.8548