This is my second blog in a four-part series on Regulating Ontario’s electricity sector. I’m writing the series because I’m participating in a panel discussion on regulation at the upcoming APPrO 2018 Canadian Power Conference. The material in these blogs will help shape my discussion at the panel.

My last post highlighted a basic challenge in the current regulatory framework with respect to Ontario’s electricity system planning process: weak oversight and governance. These have led to “uneconomic, unnecessary, or ineffective” expenditures and higher costs for consumers. The APPrO panel needs to address: What should change to remedy this issue?

In this blog series, I’ll address that over-arching question by exploring three foundational and related questions. In this post, I consider the meaning of regulation and ask the first question: Why regulate? My next post will explore the remaining two questions: When should governments delegate regulatory decision-making authority to an arms-length regulatory agency?; and, How should the authority be prescribed to the regulator when it is delegated?

My final post will appear after the APPrO conference and provide my views on how we should regulate the Ontario electricity sector.

The meaning of regulation

Regulation, broadly defined, is a form of government intervention designed to influence the decisions and activities of individuals and businesses relating to social or economic matters.

All business activity is subject to a basic level of regulation, often called framework policies. For example, tax policy and competition policy define certain “rules of the game” within which all businesses must function. For example, how much in tax a business must pay, or what types of competitive business strategies are permitted and which are not (i.e., collusion or price fixing)? However, framework policies rarely provide prescription to basic business decisions:

- How to produce it;

- How much to produce; or,

- How much to charge.

Examples of framework-type regulations in the Ontario electricity sector include the Independent Electricity System Operator’s (IESO) wholesale market rules and the Ontario Energy Board’s (OEB) licensing requirements.

In some sectors, regulation is more prescriptive. Sectors that produce or provide important infrastructure, such as the electricity sector, have historically been subject to more direct regulation of product and price decisions. Firms in these industries are often called public utilities and the regulation of these firms is called public utility regulation. Consider the controls in Ontario’s electricity sector, for example:

- Direct price controls (i.e., regulation of distribution and Ontario Power Generation (OPG) rates);

- Controls on how the product is produced (i.e., no to coal but yes to renewables);

- Output controls (i.e., central planning of the amount of capacity to be built); and,

- Direct government ownership or control of productive assets (i.e., the government is the sole shareholder of OPG).

Start with the Why?

To assess the appropriateness of a sector’s regulatory framework, we need to understand why governments choose to regulate in the first place. What is the objective behind the government intervention? The economic literature is instructive on this issue. It offers two explanations:

- A normative one that describes what government should do. It argues regulation should seek to promote the public interest. For this reason, it is called the public interest theory of regulation; and,

- A positive one that uses a testable hypothesis to prove or explain why governments do what they do. This is called the public choice theory of regulation. [1]

Public interest theory

The public interest theory of regulation states governments should intervene in markets when needed to promote the public interest. But what does it mean to promote the public interest?

A major theme in economics dates back to 1776 and Adam Smith. It states competitive markets, which harness the self-interest of individuals through the “invisible hand,” lead to the best use of society’s scarce resources (i.e., economic efficiency). In doing so, they promote the public interest at large. Economists eventually brought more rigour to Smith’s idea. They showed that a perfectly competitive market leads to an ideal outcome where society’s scarce resources are fully allocated to the point where no individual can be made better off without making someone worse off. This concept is called Pareto efficiency.

The Wealth of Nations, regarded as one of the most important books in the world. A rare first edition was auctioned off in 2013 for £55,000.

However, perfect competition is rare. And under certain conditions, markets may fail to achieve the most efficient ideal outcomes. When markets fail, there is a rationale for government intervention to correct the market inefficiency and raise the overall per-capita living standards.

Markets may fail for several reasons. Consider the electricity sector. Electricity transmission is a natural monopoly. It is more cost-effective to have one firm provide transmission services than to have two or more firms provide the service as it avoids the wasteful duplication of large sunk investments in wires. However, a single firm, if unregulated, would have an incentive to raise the price of service above the marginal cost of providing the service (i.e., exercise monopoly power). If so, some consumers that value the service more than the marginal cost would go unserved, an economic inefficiency. In this case, price regulation is justified as a means to promote the efficient use of the transmission wires. There are other reasons why markets fail: incomplete property rights leading to externalities (i.e., pollution), asymmetric information, and poorly designed government policies (i.e., government failures).

I offer a few observations on the public interest rationale. First, under this theory, a market failure is necessary to justify intervention, but it does not follow that intervention is justified in all cases. For example, most markets or industries in our economy are not perfectly competitive. Firms have some, and often considerable control, over the market price and they set prices inefficiently above costs (the marginal cost of me watching a movie in a half-full theater is zero, but I still pay $14 to be there). But governments cannot improve on all departures from perfect competition. Instead, intervention is justified if, and only if:

- There is evidence of a market failure and inefficiencies;

- There is a feasible form of intervention that can correct the inefficiencies; and,

- The benefits of the regulatory intervention (increased efficiency) outweigh the cost of regulation. Regulation costs include the direct cost of implementing the regulation and any indirect cost, such as regulatory induced inefficiencies.

Second, rarely will a government intervention achieve the ideal outcome of Pareto efficiency. There will invariably be winners and losers of a government policy. In this case, the public interest may be evaluated relative to the concept of a potential Pareto improvement: the winners’ gains are large enough to potentially compensate the losers for their losses. The winners remain better off. Compensation does not need to actually occur; there only needs to be the potential that the gains are large enough. With potential Pareto improvements, governments and regulatory agencies must make a trade-off between the overall efficiency gains (i.e., higher per-capita living standards) and the negative effects on certain classes of individuals that are made worse off without actual compensation. This is an equity issue for which there is rarely an ideal solution.

Finally, most economists prescribe a particular meaning to public interest – economic efficiency. However, the public interest often has a broader interpretation within the policy and regulatory world. Other arguably legitimate goals that may be pursued relate to the concept of fairness and the equitable redistribution of wealth, market or price stability and macroeconomic growth, or broader social goals related to culture and the promotion of desirable social values. My next blog will address more on the public interest concept.

Public choice theory

The public choice theory of regulation starts with the premise that the same basic force that motivates private individuals and firms in the economy also motivates politicians and public servants: self-interest. This theory focuses on the incentives facing politicians and public servants to explain why governments choose the regulatory policies they do.

Politicians and public servants have many self-interests that may influence the regulatory policy-making process. Politicians typically want to be re-elected and often aspire to higher levels of office. Public servants want to advance their careers. Both are often subject to lobbying by influential interest groups that have a lot at stake in a particular policy and thus an incentive to get involved in the policy-making process more than diffuse groups in society. This can lead to a disproportionate representation of views on the benefits of the policy and a bias towards the group’s views in the policy-making process.

One of the more cynical views of regulation is the “capture hypothesis” first put forth by Nobel Prize winner George Stigler. Its premise: politicians are self-interested, and when they form government, they are granted monopoly control over the ability to implement regulation toward a desired outcome. Large industry that recognizes certain polices can be used to increase profits will seek to influence or “buy” regulations from government officials (often referred to as ‘rent-seeking’). The politicians and public servants, motived by self-interest, will provide this service to large industry in exchange for votes, financial support, or other political favours. Under this theory, government becomes captured by the industry it is regulating and serves the interest of the industry (and government) rather than the public.

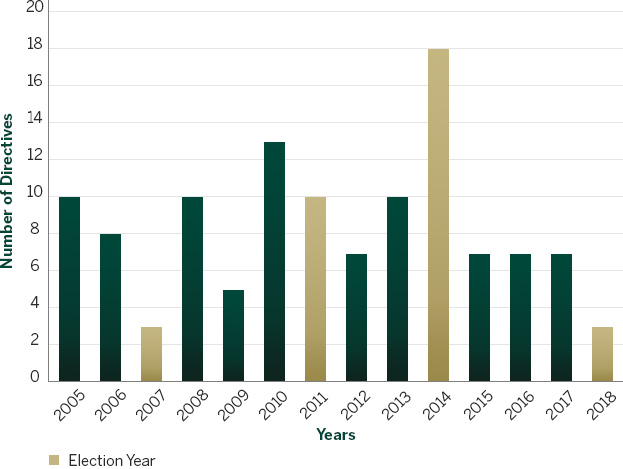

Figure 1: Ministerial Directives to the IESO (formally OPA) by Year

Source: IESO. Figure 1 shows the number of Ministerial Directives issued to the IESO and former OPA each year since the enactment of the Electricity Restructuring Act in 2004. The Act expanded the role of the government granting legislative authority to issue directives to the former OPA and eventually the IESO, creating a mechanism through which it could directly intervene in the generation and transmission planning processes.

Richard Posner extended the theory. He observed the existence of regulation cannot be explained by the interest of industry alone. Sometimes politicians use regulation to reallocate wealth in the economy as a means to gain the support of large voting groups – often consumer groups (i.e., ratepayers) – that are key to re-election success. This reallocation of wealth does not create new wealth in society. Instead, it generally means a shifting of scarce resources from their most valued use to a less valued use. This reduces the efficiency in the sector. And while it may advantage one group (often temporarily), it disadvantages the economy as a whole and reduces per-capita living standards over time. The inefficiency of wealth redistribution policies can be exacerbated in industries like the electricity sector where the life of the assets is long (much longer than the election cycle), and the upfront investment costs are large and sunk in such that they cannot be recovered later if a newly elected government decides the investments are no longer desirable.

Regulatory objectives in Ontario’s electricity sector

So what is the justification behind the various regulations in the Ontario electricity sector? Have they been guided by the public interest theory? Or, are they better explained by the public choice theory? I will offer my personal thoughts on the motivation in my final post when I list my recommendations for change to the current regulatory framework (spoiler alert – the justifications are mixed, but the trend has been toward the public choice theory). Be sure to read the blog!

[1] Readers interested in learning more on the economic theories of regulation may want refer to James A. Brander, Government Policies Towards Business, Fifth Edition (Toronto: Wiley 2013).