In April of this year, an Ontario Crown corporation closed a massive financial deal for a series of natural gas power plants. The $2.8-billion acquisition by the newly formed Atura Power, a subsidiary of Ontario Power Generation (OPG), of three combined-cycle natural gas plants from TC Energy has garnered little public attention despite its size and the fact that it gives the government-owned company a larger share of Ontario’s electricity generation market. As a point of comparison, when the federal government announced its intention to buy the Trans Mountain pipeline (TMX) from Kinder Morgan for $4.5 billion in May 2018, there was sustained media and public discussion about the move.

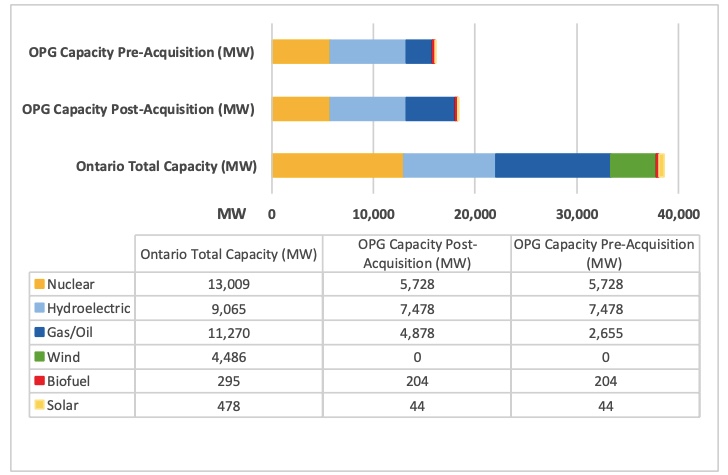

This deal involves OPG acquiring 100-per-cent ownership of Napanee Generating Station (985 MW), 100-per-cent ownership of Halton Hills Generating Station (683 MW), and the remaining 50-per-cent ownership of Toronto’s Portlands Energy Centre (50 per cent of 550 MW). In August 2019, OPG also acquired the remaining 50-per-cent interest in the 560 MW combined-cycle natural gas-fired Brighton Beach Generating Station. With these transactions, OPG has increased its share of Ontario’s natural gas-fired installed capacity to 43 per cent from 24 per cent [1] and its share of total Ontario capacity to 48 per cent from 42 per cent. Figure 1 highlights OPG’s generating capacity following the deal.

Figure 1: Ontario Power Generation Installed Generating Capacity,

Pre- and Post- Acquisitions

Source: Ontario Power Generation Inc. Annual Information Form. 2019 and IESO’s Reliability Outlook Report. OPG’s Gas/Oil capacity in 2019 includes 100 per cent of Lennox Generating Station, 50 per cent of Portlands Energy Centre, and 50 per cent of Brighton Beach Generating Station

As both the statements from OPG and the public commentary of this deal have been limited, we consider possible motivations for the acquisition from both a financial and public interest perspective.

Is the acquisition a good deal for OPG and its shareholder?

The most basic explanation for an acquisition of assets is that it increases a company’s expected future profits and the dividends payable to its shareholders. OPG’s sole shareholder is the Ontario government, and the benefactors of higher future dividends are Ontario’s taxpayers. So, under what conditions might it be financially attractive for a company to acquire a competitor’s assets? Business economics offers a few theories:

i. Superior production techniques and know-how

A textbook explanation for an acquisition is that an acquiring firm believes it could do more with an asset and generate more value than the current owner or another prospective owner. This may be due to superior production techniques or operational know-how that allows the new owner to achieve cost-savings that may not be realized under alternative ownership. This would lead such an acquirer to out-bid others for the assets and still realize a competitive return on its investment.

Does OPG possess superior production techniques or know-how in the operation of natural gas plants in Ontario? OPG CEO Ken Hartwick alludes to this possibility in his brief remarks on the deal where he asserted: “OPG has decades of energy generating expertise in Ontario,” although its experience operating natural gas plants is arguably limited; prior to the acquisition, OPG owned and operated the oil-and-gas-fueled Lennox Generation Station, and shared ownership and operation of two other stations, Portlands and Brighton Beach. Alternatively, OPG’s specialized know-how could stem from a unique ability as a publicly-owned generator to manage what some have called the “heightened level of policy or regulatory risk”[2] in Ontario, caused by a history of extensive government intervention in the Ontario electricity sector. In this view, OPG would be able to squeeze more value out of these plants than others.

ii. Market growth

A company may acquire a competitor’s assets as a relatively quick way to increase its share of a market and its operating cash flow. This may be a particular challenge in this setting as, not only did OPG acquire the natural gas plants, but it also obtained the rights to the associated power purchase contracts with the Independent Electricity System Operator (IESO). These contracts establish the revenues to be paid for the gas plants’ output over the next nine to 18 years. Of course, if the terms are lucrative, the selling company, TC Energy, would want to be compensated equivalently for the lost future profits. Furthermore, the steady cash flow would be attractive to other firms, including private equity and hedge fund investors, which means OPG would have to pay at least as much as what other competing bidders would pay for the assets.

iii. Economies of scale

Adding new productive assets can lower a company’s overall average unit costs by spreading fixed costs over a larger amount of output. OPG operates more than 70 generation facilities in Ontario, so adding a few more could potentially allow for further spreading of fixed costs. In addition, OPG is set to shutter the Pickering nuclear facility in 2024. Pickering currently accounts for eight per cent of the province’s generation capacity – slightly more than the amount of new natural gas generation capacity that OPG now owns. Assuming OPG continues to operate with the same level of fixed costs following the Pickering closure, the addition of the natural gas plants should help to at least maintain OPG’s overall average cost from what it would otherwise have been after the closure. But this assumes that the shutdown of Pickering would not lead to a material reduction in OPG’s fixed operating costs.

iv. Eliminate a competitor

Another motive for a company to acquire a competitor’s assets is to eliminate the competitor from the market. If the acquirer already owns a significant amount of the productive assets in the market, it may be able to command a higher price from consumers for all its output after the acquisition if the additional capacity makes it more profitable to withhold supply from the market (i.e. exercise market power).[3] OPG owned 42 per cent of the province’s generation capacity prior to the acquisition of the natural gas assets and, with the acquisition, it has increased its share by an additional six per cent. Furthermore, OPG now owns 61 per cent of the province’s combined hydroelectric and natural gas capacity, which in competitive electricity markets are the generators that largely set the market price.

This level of concentrated ownership would ordinarily raise concern with regulators such as the Canadian Competition Bureau and the Ontario Energy Board (OEB)[4] about OPG’s ability to increase the wholesale market prices above competitive levels. But does OPG have the incentive to do so? The payments to OPG for its existing assets are regulated by the OEB, and the revenues OPG receives for the electricity generated from the acquired gas plants are largely set by contract. As a result, OPG may have little incentive to use its dominant position in the market to increase the wholesale market price as this is not the price that defines its revenues. Furthermore, OPG’s 2015 Memorandum of Agreement(MOA) with its sole shareholder, the Province of Ontario, requires OPG to serve the public interest and operate in a way that moderates overall prices and supports the efficient operation of the electricity market. This may limit the likelihood for OPG to exercise market power.

The Competition Bureau did not contest the transaction, although it did not provide reasons for its decision. The OEB, in its Decision and Order[5] to grant an amendment to OPG’s license reflecting the change in ownership concluded that, while factors such as OEB regulation, contracts, and the MOA “may reduce the risk of anti-competitive behaviour, they do not eliminate it.” In the OEB’s view, “the acquisition of additional generation assets by OPG raises concerns about the competitiveness of Ontario’s wholesale electricity market and the potential implications for electricity consumers.” For this reason, the OEB considered it “necessary to include safeguards (in the license) to protect the integrity of the market.”These include the requirement of OPG to offer all its generating resources into the IESO markets, and ring-fencing requirements for OPG and its subsidiary Atura to make decisions on bidding and supply into the Ontario market independently of each other. These safeguards, however, may not be sufficient, as recognized by the OEB in its Order, and it is possible that further mitigation measures may be required to limit the risks related to concentrated market power.

Does the acquisition serve a public interest objective?

As a Crown corporation, the typical commercial motivations for OPG’s acquisition may be blurred by public interest objectives. The company operates with a unique governance structure that allows the shareholder, the Province of Ontario, to provide OPG with written declarations directing the organization to operate in a manner consistent with the shareholder’s preferences. OPG’s public interest mandate is explicit in the MOA. This leads to a more complicated set of potential explanations for the deal, including:

i. Repatriation of profits

A motivation for the acquisition could be the potential for profits to remain in the province instead of flowing to Alberta with TC Energy. This is not only cited in the press release from April 29, 2020, which recognizes the benefits for Ontarians, but it is also a stipulation of the MOA, which states how OPG should generate “financial benefits that remain in the Province of Ontario.” If this is the case, then the question needs to be asked as to whether the Ontario shareholder (i.e. taxpayers) is better off with the future cashflows generated by these assets as opposed to the outgoing $2.8-billion purchase price that was paid to Alberta-based TC Energy.

ii. Control of strategic assets

Governments sometimes prefer state ownership of key industries over private ownership for political and social reasons. For example, governments may choose to have a significant presence in an industry to achieve a better distribution of wealth, to promote industrial or environmental policy and economic growth, or to control strategic resources or assets for national security reasons. Governments can instruct the state-owned company to reduce prices to protect lower- income earners, invest in favoured technologies that are not privately profitable (i.e. technology subsidies), operate the assets to reduce greenhouse gas emissions, or locate production in more costly communities to promote local area job creation. State ownership may be preferred over the implementation of legislation that incentivizes or coerces privately-owned profit maximizing firms to make these decisions if direct ownership is perceived as a more effective and expedient way to achieve social outcomes.[6]

This argument is not uncommon in the electricity sector where public ownership is seen as an imperative for some jurisdictions. The MOA between OPG and the Ontario government offers insights on OPG’s public interest mandate as a Crown corporation. The MOA states that OPG shall:

- Serve the public interest and operate in a way that achieves a commercial rate of return and moderates overall electricity prices;

- Undertake generation-development projects in support of the province’s electricity planning initiatives; and,

- Operate its assets efficiently and cost-effectively, and deliver value both to Ontario’s ratepayers and taxpayers.

The acquisition press release notes that OPG recognizes these newly acquired plants as being “strategically important to the current and future electricity system,” although it does not elaborate on the reasons why. CEO Ken Hartwick, in an interview with Steve Paikin on The Agenda, provided further explanation. When asked “Why get into the gas plant business?,” Hartwick stated:

“Our view on this is relatively simple, that again, as we look across, how do you take assets in Ontario and operate them in the best interest of customers in Ontario and in the best interest of the environmental aspects that are important and we think we can utilize these gas plants in a way that meets both of those criteria.”

Operating natural gas generation assets in the best interest of both customers and the environment can be challenging, especially in a jurisdiction such as Ontario with no other fossil-fuel-generating assets, such as coal, to displace. It would also introduce an objective to the plants’ operations that the prior private owner, TC Energy, had not considered as it would have been primarily focused on its commercial objectives. Furthermore, protecting the interest of consumers in electricity markets is generally the role of the independent regulators, and is often achieved by ensuring markets operate competitively and/or with the appropriate safeguards. Environmental protection can be managed through the government’s legislative powers and the imposition of environmental regulations, including statutory limits on emissions or market-based mechanisms (i.e., carbon tax). Arguably, in this case OPG and the Ontario government may believe public ownership offers an effective approach to balance customer and environmental objectives rather than private ownership, independent regulation, and environmental legislation.

iii. Renewable integration

Given the intermittency of wind and solar power, natural gas is often pointed to as the bridge fuel for the integration of renewable power given its ability to be rapidly dispatched. In fact, Hartwick highlighted this in OPG’s press release where he noted that “natural gas is the enabler of renewable energy and provides the flexibility required to ensure a reliable electricity system.” There is nothing controversial with this claim except for the fact that these plants were already providing flexibility when owned by TC Energy and the province has an independent agency in the IESO whose core mission is to ensure the reliable and efficient dispatch of generation assets. While OPG has participated in renewable energy development in the past, responsibility over the integration of these assets rests with the IESO and not OPG.

iv. Reducing consumer electricity bills

The regulated residential rate for electricity in Ontario has approximately doubled over the past decade, which has brought successive governments to commit to bring prices down. The current government has committed to lower prices and, as recently as March 6, 2020, the Premier stated that he intends to keep his campaign promise to lower bills and rates by 12 per cent.[7] OPG has been a tool for such efforts to lower rates in the past, such as when their balance sheet was used to float debt to finance the Fair Hydro Plan, which lowered bills by 25 per cent in 2017. While the contracts for the newly acquired plants differ in length and term, it is possible that public ownership may allow the government to change the terms in such a way that make them more favourable for ratepayers. Renegotiation may not have been feasible under private ownership. Should this be the case, the government may be able to use this to help realize its campaign promise but at a cost to taxpayers. This would again represent a transfer from taxpayers to ratepayers, as we have seen before in the case of the Fair Hydro Plan.

Looking ahead

We are surprised that there has not been more public discussion about OPG’s $2.8-billion acquisition of new gas generation capacity given the potential implications for ratepayers and taxpayers. We have offered a variety of potential rationales: the deal may be attractive on commercial terms, help achieve public interest objectives, or a mix of both. Many of the rationales result in a trade-off between the interest of ratepayers and taxpayers, the effects of which may not be understood until sometime in the future.

We are also surprised that we have not heard more discussion of what OPG’s increased share of the province’s generation assets means for the future of Ontario’s electricity market and the projected benefits of the IESO’s Market Renewal initiatives. The OEB has identified the potential for the abuse of market power and its effect on the integrity of the competitive market and has imposed safeguards. A larger question, however, is how the presence of a large Crown corporation, with public interest requirements, could affect the integrity and effectiveness of competition. Can a market in which a government-owned and directed company owns 50 per cent of total capacity achieve the outcomes of a workably competitive market, which is an objective of the IESO’s wholesale market and the Market Renewal initiatives? This is an issue worthy of further discussion.

[1] With these acquisitions, OPG now is the owner of the four largest natural gas generation stations in Ontario in terms of installed capacity.

[2] The Brattle Group, “The Future of Ontario’s Electricity Market: A Benefits Case Assessment of the Market Renewal Project”, Report to the IESO, at page 12 and page 70.

[3] In energy markets, market power is exercised through an act of withholding, either economic or physical. Physical withholding is a decision by a firm not to offer available capacity into the market when the short-run marginal cost of the capacity is less than the competitive market price. Economic withholding is a decision by a firm to offer capacity into the market, but at a price that exceeds the short-run marginal cost of the capacity and exceeds the market clearing price.

[4] The IESO also regulates the electricity market enforcing market rules enabled by the Electricity Act, whose objectives and purpose are efficiency and competition, and which contain prohibitions against anti-competitive conduct. The OEB’s Market Surveillance Panel also is responsible for the monitoring and reporting of anomalous conduct and abuses of market power.

[5] Ontario Energy Board DECISION AND ORDER EB-2019-0258 / EB-2020-0110.

[6] See OECD, Policy Roundtables: State Owned Enterprises and the Principle of Competitive Neutrality, 2009, page 27.

[7] Conservative Party of Ontario. For the People: A plan for Ontario. https://www.ontariopc.ca/plan_for_the_people. Accessed: June 6, 2020.