Of the top 20 US-based ESG (Environment, Social, Governance) ETFs, 16 have significant exposure to industries such as weapons (nuclear and conventional), tobacco, alcohol, and coal. For some ESG-focused investors, such an insight would be surprising, even upsetting; yet therein lies the issue. What are the expectations of ESG fund composition? How should these funds be labelled and marketed? Who will provide assurance of their reported performance? With the market for ESG-related equity funds currently exceeding USD 11 trillion in the US and over USD 17 trillion in Europe, identifying and addressing investors’ information needs are pressing issues for capital market participants of all stripes.

This article showcases the efforts of True Alpha, an impact-focused company led by Kai Chen (Ivey MSc ’17) working to democratize ESG investing through market- and portfolio-level insights of equity funds. The firm’s methodology uses science-based KPIs and is able to offer an objective, apples-to-apples comparison between any public equities portfolio, creating a common basis for which investors can make values-driven investment decisions.

Information Overload, Insufficient Regulation, and Greenwashing

Some investors seek out ESG equity funds as a medium by which to practice their values. By mobilizing capital flows to correcting environmental degradation, climate change, or social inequality, their investments are vehicles for the change they wish to see in the world. For these investors, greenwashing is not only a risk to their investment performance, but also to their investment purpose. As such, information on ESG performance is paramount.

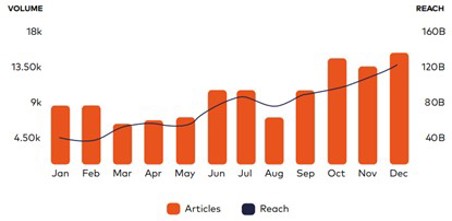

Yet, there is no shortage of data. A report by Cognito found that ESG investment coverage by global influential media publications increased by over 70% in 2020. In December 2020, there were over 13,500 articles related to ESG investing published by major media outlets; this averages to ~450 articles per day related to ESG investing.

2020 ESG Investment Coverage

The problem is not a lack of information, but a lack of helpful information- simple, accessible, comparable, trustworthy information. Investors have expressed frustration over the poor standardization of ESG classification, unreliable marketing materials, and doubts concerning the veracity of ESG disclosures. Where sunlight remains the best disinfectant in governing our markets, the information gap is secondary to a more pressing issue: What is the information that investors need and want with respect to ESG funds?

TrueAlpha’s Solution

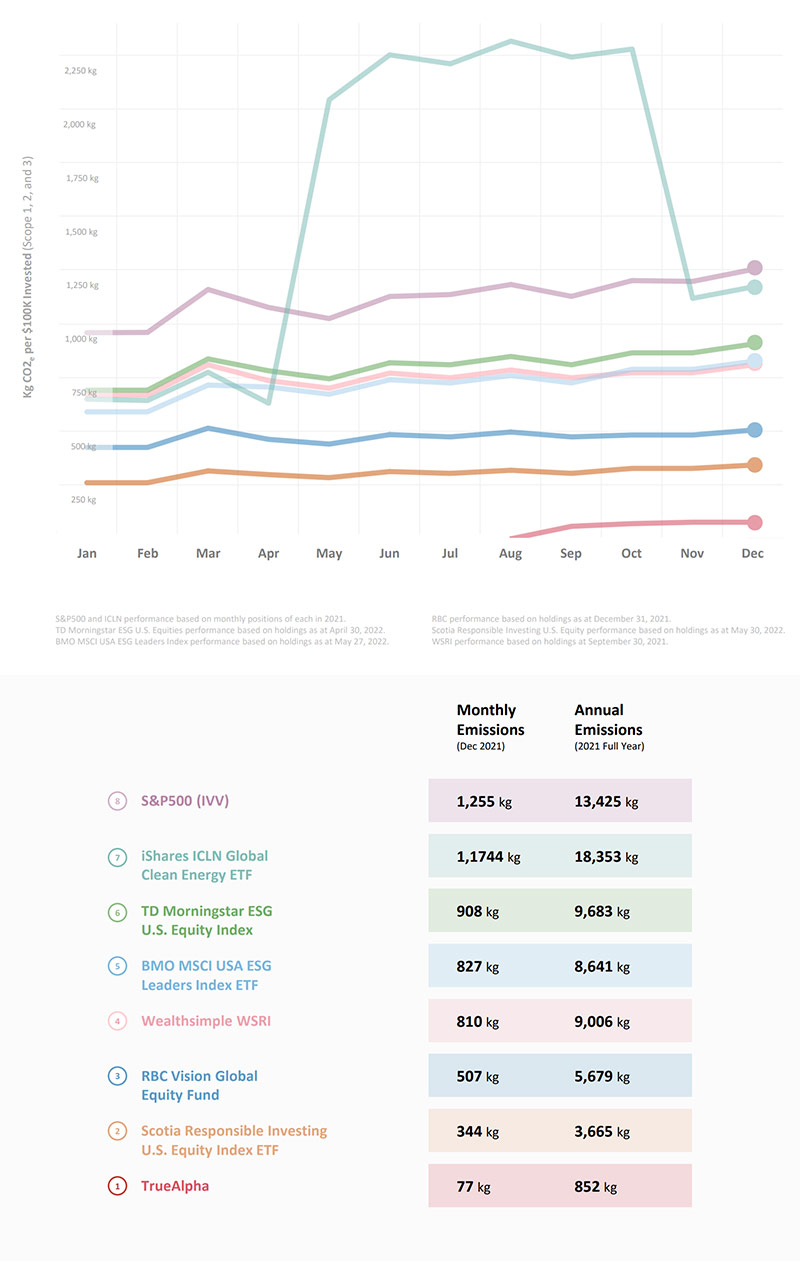

True Alpha, led by Kai, attempts to solve these problems and gain investors’ trust by distilling data into simple, accessible, comparable insights. The firm analyzes data rigorously, generates comparable KPIs such as carbon-per-invested-dollar, then communicates the information using digestible visualizations.

Carbon Emissions of S&P500, TrueAlpha, and Top ESG Equity Funds

True Alpha goes against what is easy and cuts through the murky gray area of regulation (or lack thereof) with conviction to get to its mission; Kai has made clear choices to organize data and define impact for asset managers, investors, and companies. Soon, True Alpha will offer a new, free data-analytics tool and new metrics per invested dollar such as generated renewable electricity, water usage, restored or reforested land, and waste diverted.

Other financial services firms can follow suit by not only analyzing data rigorously but also being clear and concise about their information values and product impacts. Doing so will address information overload and uncertainty and give investors confidence in their decisions.

Looking Forward

Kai’s True Alpha is no magic bullet. It does not claim – or seek – to address an entire system of ESG greenwashing. The firm is just providing a tool for investors to redirect the flow of capital towards investments that are reasonably and unsurprisingly categorized as ESG. The next step is building trust- how can True Alpha build investors’ trust? What does trust look like in the ESG space? For us, policy is an important component; regulation must improve quickly to ensure ESG metrics, labelling, and disclosure are relevant and consistent. This will force all firms to do better and refine tools provided by firms such as True Alpha by enhancing the quality of publicly available information. Overall, this will improve trust in True Alpha’s capabilities and the systems of ESG.

Written by: Brian Chang

Supervised by: Nadine de Gannes

Sources: OECD ESG Investing Report; Cognito ESG Coverage Report; TrueAlpha internal reports referencing S&P Trucost, CDP, and company self-reported sustainability reports