On January 24 and 25, nearly 80 students gathered for Ivey Fintech and Western Founders Network’s 12th annual Technology Consulting Competition (TCC), tackling one of the most timely topics in financial technology: consumer-directed banking. As Canada’s regulatory landscape continues to evolve around data portability—often referred to as open banking—students were challenged to explore how fintech companies can empower consumers through greater transparency, control, and insight into their financial data.

This year’s case focused on Wealthscope, an investment analytics platform operating within the open banking ecosystem. Previously positioned as a data aggregation and analytics provider for businesses, Wealthscope faced a strategic challenge: transitioning back to its original vision as a direct-to-consumer platform. Working under real-world constraints, teams developed solutions that balanced technological feasibility with regulatory considerations, while prioritizing user trust and long-term value. With participation from partners such as Scotiabank and EY, alongside Ivey faculty, the competition brought together students from Western University, the University of Waterloo, Huron University College, and Ivey Business School in a fast-paced consulting-style environment.

Day 1: Virtual Case Release and Client Introduction

The competition officially kicked off on the morning of Saturday, January 24th, as participants gathered virtually for opening ceremonies. To set the tone for the weekend, competitors attended a case competition workshop led by Evan Woo, a former TCC finalist. Woo shared valuable insights on structuring compelling analyses, crafting clear and actionable recommendations, and communicating effectively under tight time constraints. His session helped establish a common foundation for teams as they prepared to tackle the case.

Following the workshop, students were introduced to the client by Pauline Nolan, Co-Founder of Wealthscope. Nolan shared the company’s journey, mission, and the strategic inflection point that formed the basis of the case. Competitors were tasked with designing a plan to reposition Wealthscope as a consumer facing product capable of building trust, driving adoption, and delivering tangible value to Canadians navigating increasingly complex financial lives.

The interactive client session offered students valuable exposure to the realities of building within a regulated fintech environment. Nolan highlighted the practical difficulties of building consumer trust in a new data-sharing regime, alongside the opportunity to design products that could finally give users a consolidated and actionable view of their finances. For many teams, this marked a shift from feature-driven thinking to a deeper focus on data security, user trust, monetization strategies, responsible innovation, and long-term scalability.

Following the case release, teams began an intense 13-hour sprint to develop their solutions. Throughout the day, participants had access to bookable mentorship calls with subject matter experts across technology and consulting, including professionals and students from firms such as BCG, Accenture, Oliver Wyman, and Evercore. These mentors helped participants refine their thinking, challenge key assumptions, and navigate the complexities of the fintech landscape, offering practical guidance grounded in real-world consulting and industry experience.

Day 2: In-Person Competition

After submitting their deliverables late Saturday evening, competitors returned on Sunday to present their strategies in person. Teams delivered concise presentations to a panel of judges, who evaluated submissions and provided detailed feedback based on analytical rigour, creativity, feasibility, and clarity of communication.

Following the preliminary round, four finalist teams advanced to the finals. These teams earned the opportunity to present to a distinguished panel that included David Cruikshank from Scotiabank, alongside Ivey faculty members Julien Denis and Sergii Nevmerzhytskyi. Judges commended the finalists for their adaptability, strategic depth, and ability to integrate user centric design with regulatory and commercial considerations.

The winning solution stood out for its emphasis on user trust and engagement. The team correctly identified that the central challenge was not feature development, but adoption in a trust-sensitive environment, and designed a strategy around credibility and sequencing. Their proposal combined gamification to increase product stickiness with human-to-human touchpoints to build trust, supported by a phased go-to-market strategy aligned with Canada’s evolving open banking rollout.

Learning Impact

Beyond the case itself, the competition had a meaningful impact on how students approached teamwork, time management, and decision-making under pressure. For many participants, the weekend highlighted how important clear communication and coordination were to producing a strong final recommendation, especially in a fast-paced consulting-style environment.

Throughout the competition, feedback from judges and mentors played a central role in shaping this learning experience. Teams were challenged to refine their arguments, simplify complex ideas, and respond to questions in real time, often rethinking how they presented their work rather than changing the substance of their solution. For students newer to case competitions or fintech, TCC provided practical exposure to the realities of presenting ideas to external stakeholders, helping build confidence in both professional communication and adaptability.

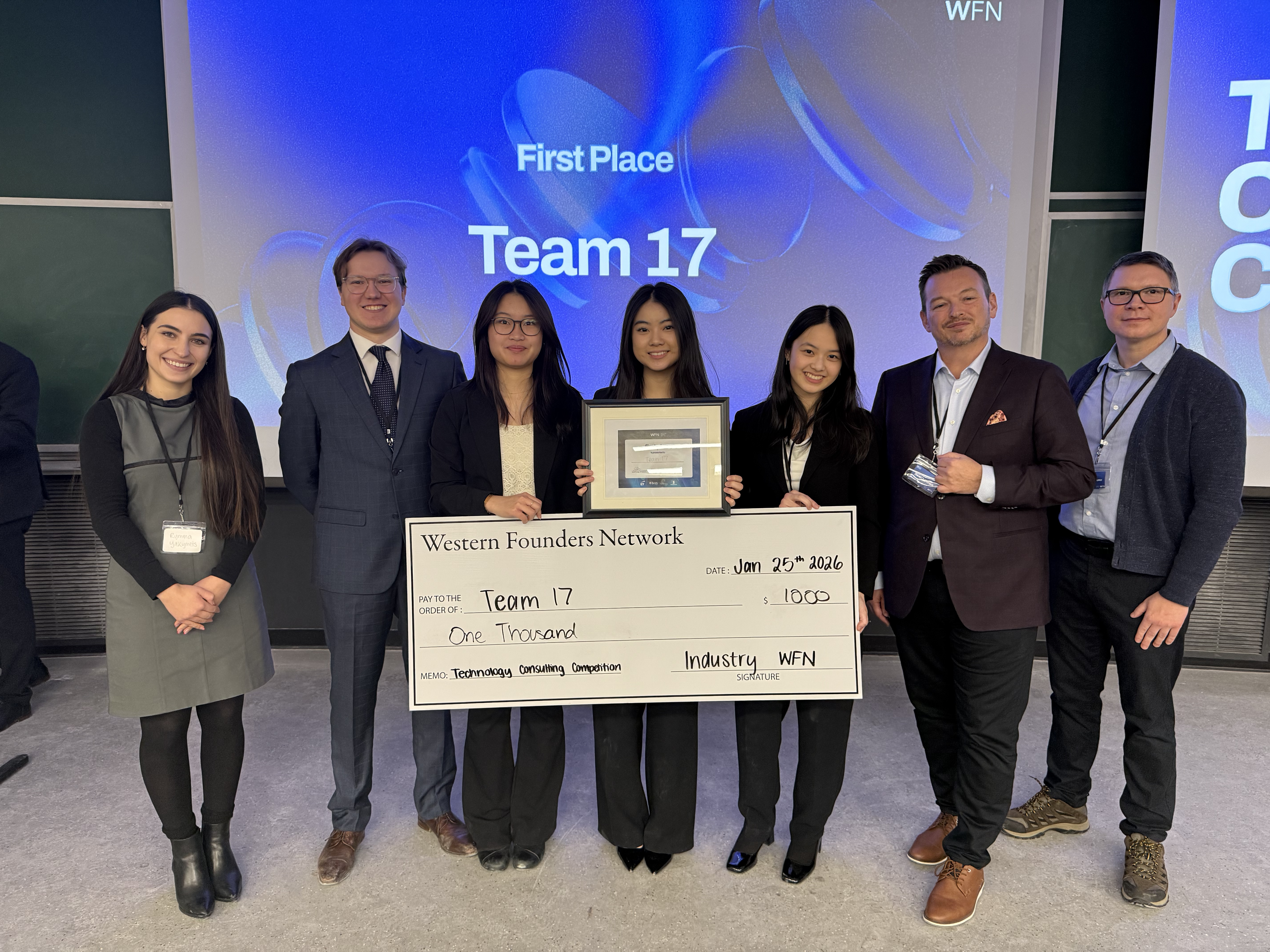

The weekend concluded with an award ceremony at the 3M Centre, celebrating the efforts of all competitors and recognizing standout teams. As consumer-directed banking continues to evolve in Canada, competitions like TCC play an important role in preparing the next generation of fintech and consulting leaders by connecting classroom learning with real-world problem-solving.

The Ivey Fintech Club and Western Founders Network gratefully acknowledges the generous support of the Scotiabank Digital Banking Lab, whose contributions made this competition possible. A sincere thank you is also extended to the judges from Scotiabank and Ivey faculty for their time, expertise, and valuable feedback.